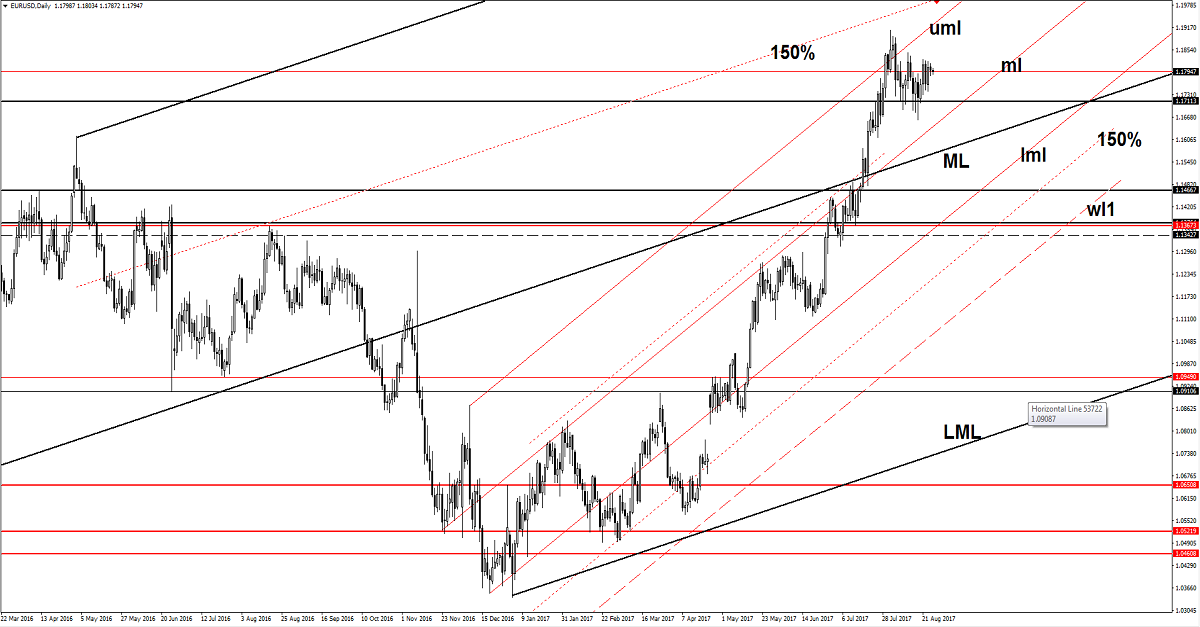

EUR/USD Bloodless

Price changed little today and waiting on the afternoon’s fundamental events to bring some volatility. It's still located in the buyer’s territory, but needs a bullish spark to be able to resume the upside movement. Continues to move sideways right now, is consolidating the latest gains, so we have to wait for a fresh trading signal.

Has shown some exhaustion signs in the last weeks, but maintains a bullish perspective as is located above some important support levels. We may have a high volatility in the afternoon as the economic calendar is filled with high impact data. The fundamental factors will take the lead, so you should be careful not to suffer a heavy loss.

The German Ifo Business Climate is expected to drop from 116.0 to 115.0 points, while the German Final GDP could increase by 0.6%, matching the 0.6% growth in the former reading period.

The Yellen and Draghi speeches will shake the markets, remains to see how the EUR/USD will react, that’s why it will be better to stay away tonight.

Price hovers above the 1.1712 major static support, but failed to retest the upper median line (uml), signaling that could come down to retest the median line (ml) of the ascending pitchfork. The perspective remains bullish despite the minor retreat, should climb toward new peaks as long as the median line (ml) and the ML are intact.

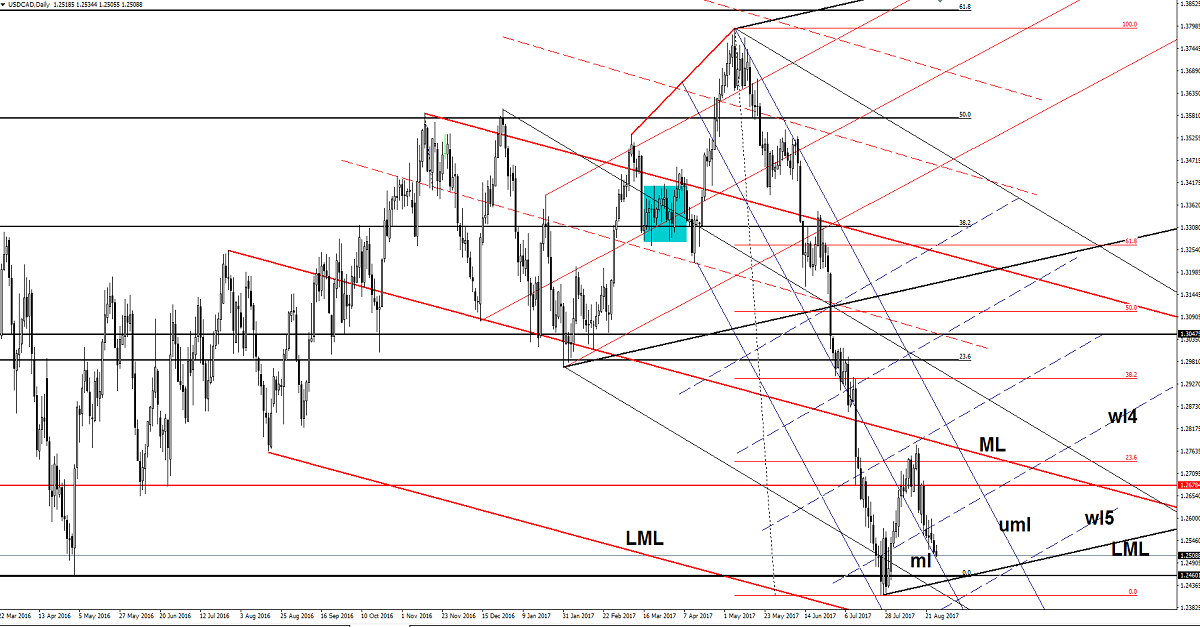

USD/CAD Losing Altitude

Price continues to drop and is expected to reach the major confluence area formed by the 1.2460 static support with the lower median line (LML) of the major black ascending pitchfork. It slips lower along the median line (ml) of the minor descending pitchfork, signaling that the bears are in full control.

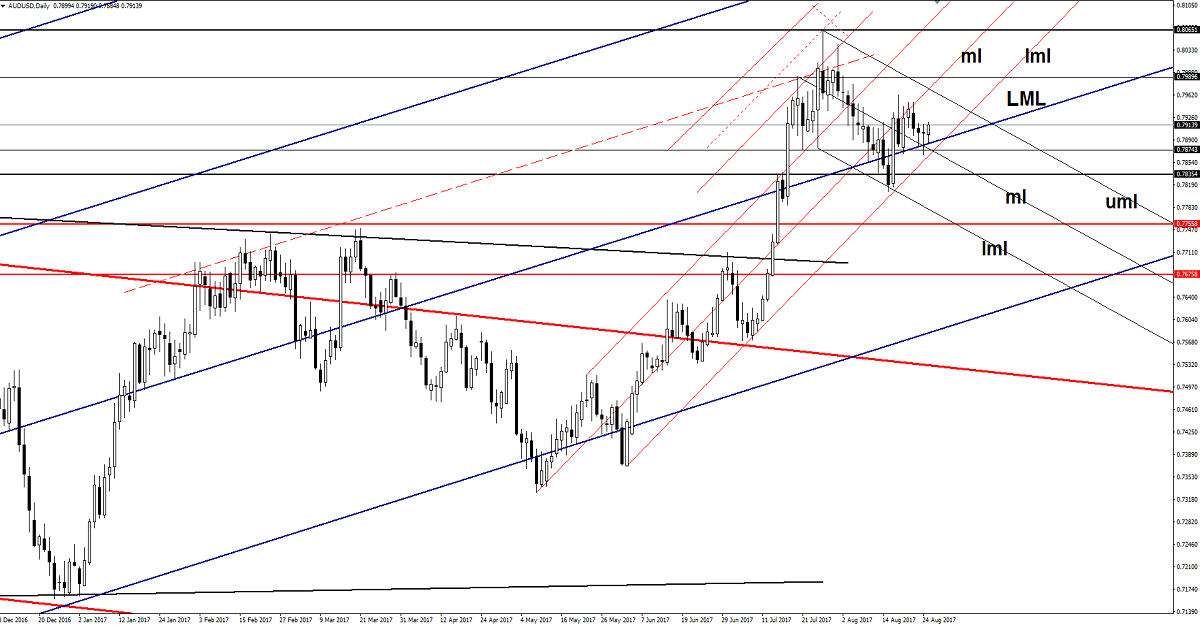

AUD/USD Throwback

AUD/USD climb higher after the retest of the lower median line (LML) of the major ascending pitchfork and now is targeting the upper median line (uml) of the minor descending pitchfork. Technically should jump much higher after the failure to close on the LML. Only the fundamental factors will send it below the dynamic support.

Risk Disclaimer: Trading, in genera,l is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can’t afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this web site.