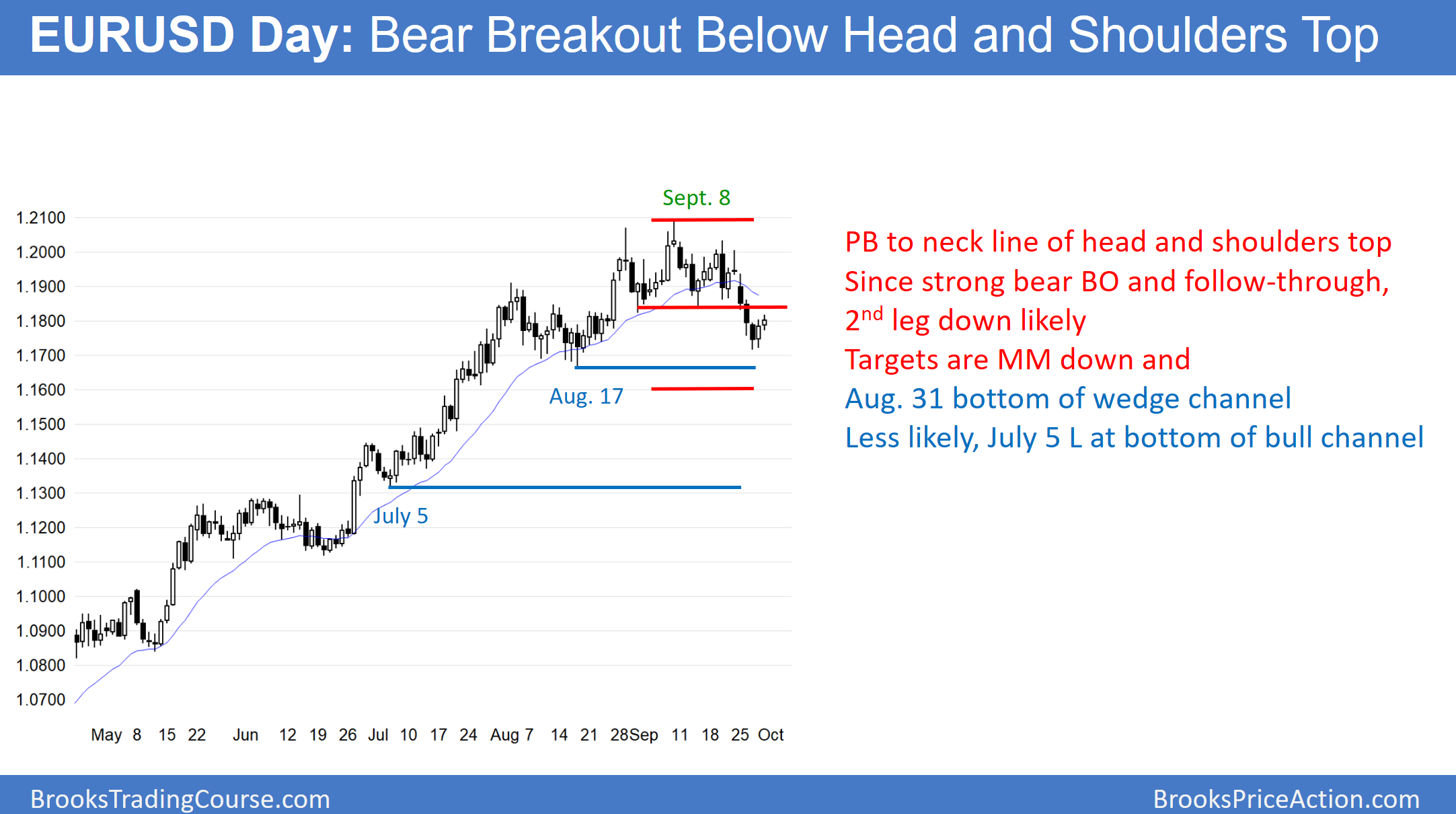

The EUR/USD daily Forex chart had 3 strong bear days breaking below the neck line of a head and shoulders top. The bulls are buying just above the August 17 major higher low. They therefore want a double bottom higher low and a resumption of the bull trend. Yet, the breakout was strong. Therefore, the odds favor a 2nd leg down, even if the pullback goes above the September 14 low and is over 100 pips tall.

The 3-day break below the neck line of the head and shoulders top was strong. Therefore the 2-day reversal up from a higher low double bottom with the August 17 low will probably fail. This is true even if it continues up for a few more days, goes above the September 14 breakout point, and is over 100 pips tall.

Unless the bulls break strongly above the September 20 major lower high, the odds favor at least one more leg sideways to down. At the moment, the odds favor a break below the August 17 major higher low. Yet, a head and shoulders topi s a trading range. A continued trading range is more likely than a bear trend. This is especially true when the top is small. It is therefore likely minor. This means that a trading range is more likely than a bear trend.

Weekly chart in strong bull trend

The weekly chart is in a tight bull channel, which means a strong bull trend. Consequently, the odds are that the current selloff is simply a sideways to down pullback to the 20 week exponential moving average. If the selloff continues down to the August 17 low, it will be at the average. It will also be a test of the May 3, 2016 top of a 2-year trading range. That support is around 1.1600.

It will therefore create a 20-bar moving average gap bar buy setup. There is a gap below this week’s low and the EMA. There have been gaps below bars for over 20 weeks. This means that the bulls have been so eager to buy that they have been buying above an average price. When that happens, they are usually very happy to finally buy at the average price. As a result, the current selloff will probably end around that support.

This does not mean that the bull trend will resume at that point. However, the weekly chart will probably rally for at least several weeks. The result will then either be a trading range or a resumption of the bull trend. Less likely, the selloff will continue down to the July 5 start of the bull channel. That is around 1.1300.

Overnight EUR/USD Forex trading

Yesterday’s bull reversal continued up overnight. The minimum target is the September 15 low of 1.1837, which is within 10 pips of the current price. While the 2-day rally might fail below that point, the odds are that it will continue at least a little above. This is because the daily chart has been in a trading range for 2 months. Trading ranges constantly disappoint bulls and bears. The easiest way to disappoint the bears is to rally back above the neck line of the head and shoulders top.

The next resistance above that is the 50% pullback. That is around the September 20 low of 1.1860. The final resistance is the top of the right shoulder of the head and shoulders top. That is the September high of 1.2033.

Most likely, the rally will last a few more days and go just above the September 20 low. Therefore, day traders will look to buy pullbacks until the rally is above resistance. The bears want the rally to stall for many hours before they will sell for a swing down. Until then, they will only scalp.