The EUR/USD pair is holding steady at around 1.1134 as markets consolidate USD positions during a lull in significant news. Investors are now keenly awaiting the release of the Core PCE inflation data, a critical metric that the Federal Reserve uses to gauge inflationary pressures and shape its interest rate policy.

The anticipation surrounding this week's Core PCE release is particularly high due to the lack of impactful data from both the US and the eurozone earlier in the week.

While significant shifts in expectations regarding the Fed's monetary policy trajectory are unlikely, the upcoming report will still be crucial for fine-tuning investor forecasts.

The market has currently primarily priced in a rate cut by the Fed at its September meeting, with the baseline expectation being a 25 basis point reduction. However, a 34.5% probability of a more aggressive cut of 50 basis points remains.

This possibility is bolstered by recent comments from Fed Chair Jerome Powell indicating that the timing for a rate adjustment is appropriate now, echoing sentiments within the monetary policy community.

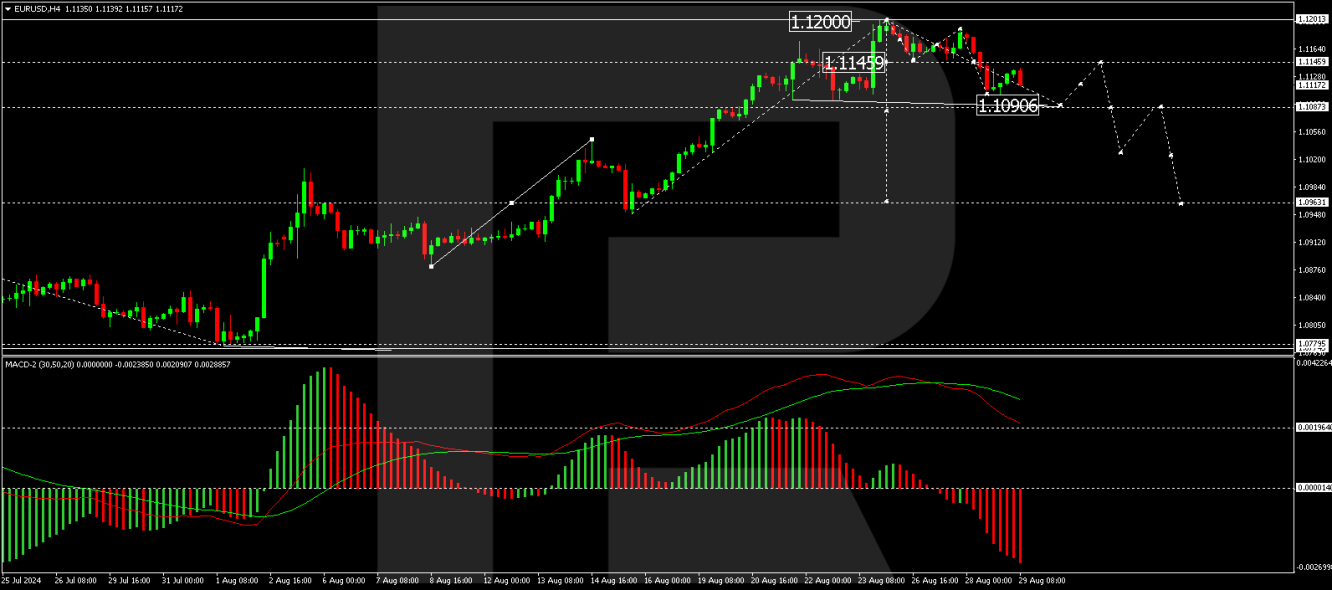

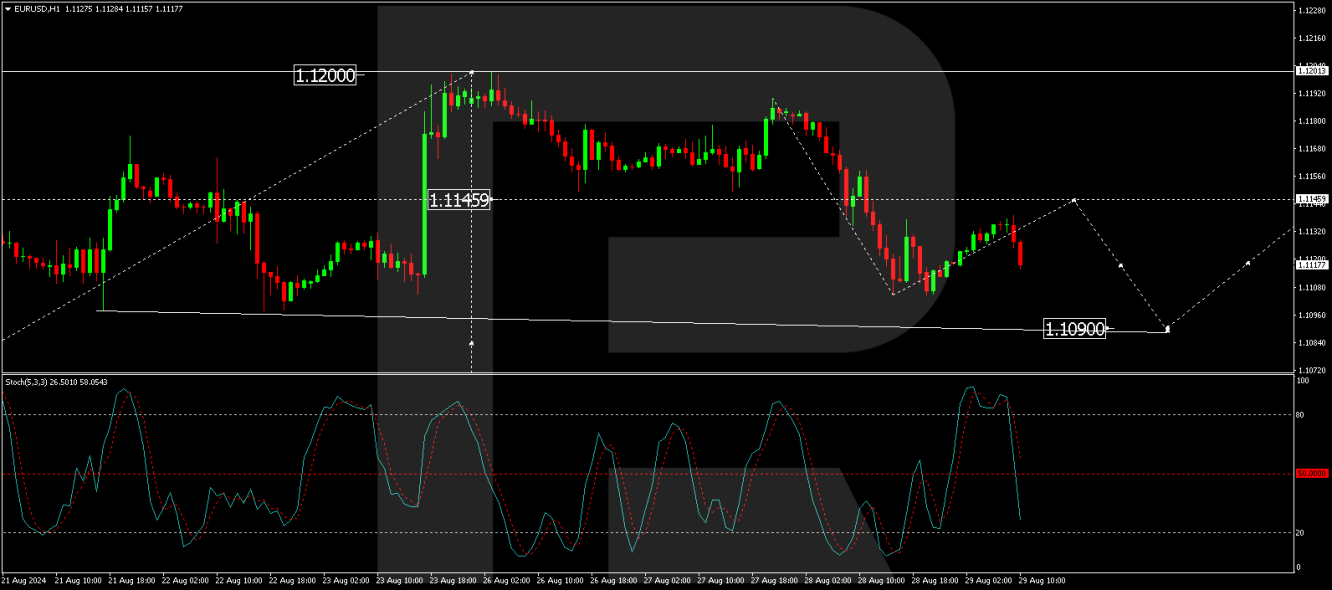

EUR/USD Technical Analysis

On the H4 chart of EUR/USD, the pair is forming a structure indicating an initial decline towards 1.1090. Following this decline, a corrective movement to 1.1150 is anticipated.

Once this correction concludes, a further decline to 1.1030 is expected, potentially continuing to 1.0960. This bearish outlook is supported by the MACD indicator, with its signal line positioned above zero but trending sharply downwards.

On the H1 chart, EUR/USD has already declined to 1.1104. A corrective phase towards 1.1150 may follow, testing it from below before resuming the downward trajectory towards 1.1090. The Stochastic oscillator, currently above 80, suggests an impending drop to 20, reinforcing the likelihood of continued downward movement.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.