- German consumer confidence projected to improve

- US consumer confidence slips, housing sales surge

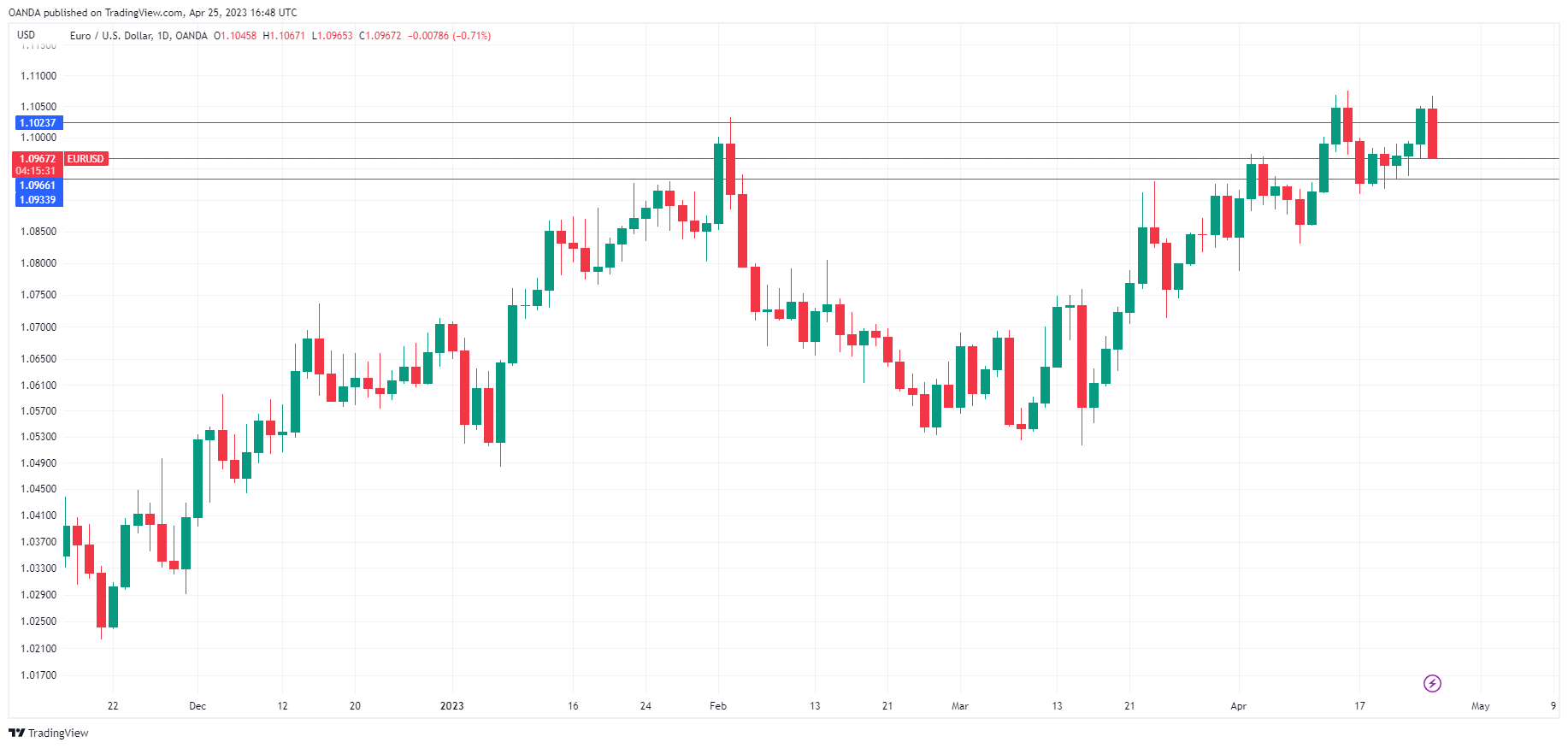

EUR/USD is trading at 1.0968, down 0.69% on the day.

German consumer confidence is expected to improve

Germany releases GfK Consumer Sentiment for April on Wednesday. The index is still deep in negative territory, but it has improved for six straight months and the upswing is expected to continue in the upcoming release. The market consensus stands at -27.5, following -29.5 in March.

Germany has emerged from the winter unscathed after major concerns over an energy crisis failed to materialize. Eurozone inflation remains high but fell to 6.9% in March, its lowest level in a year. This was mainly due to a drop in energy costs. Lower energy bills helped consumers and improved confidence, and the extended upswing in confidence shows that consumers may feel that the worst is behind them. The German economy is still in recovery mode, which won’t be easy while the ECB remains aggressive with its rate policy in a bid to bring inflation back down to the 2% target.

In the US, today’s data was a mix. UoM Consumer Sentiment for April, disappointed, falling from 104.0 to 101.3, missing the estimate of 104.0 points. There was better news from New Home Sales, which soared 9.6% in March, rebounding from -3.9% in February and crushing the estimate of 1.1%. There is a blackout on Fed speakers until the May 2nd meeting, so the markets will have to rely on economic releases in the search for hints ahead of the Fed rate decision. A 25-basis point is widely expected, with an 84% likelihood, according to the CME Group.

EUR/USD Technical

- EUR/USD has pushed below support at 1.1023 and 1.0966

- There is resistance at 1.1176