EUR/USD: German ZEW weaker than expected, focus on Jackson Hole

Macroeconomic overview: The mood among German investors worsened for the third consecutive month in August, a survey showed on Tuesday, suggesting that markets expect Europe's biggest economy to lose some momentum in the coming months.

The Mannheim-based ZEW research institute said its monthly survey showed its Economic Sentiment Index fell to 10.0 from 17.5 in July. This undershot a consensus forecast for a fall to 15.0. A separate gauge measuring investors' assessment of the economy's current conditions edged up to 86.7 from 86.4 last month. This compared with the consensus forecast predicting a dip to 85.5.

ZEW President Achim Wambach said the significant decrease of the ZEW economic sentiment indicator reflected the high degree of nervousness over the future path of growth in Germany. In his opinion growth outlook for the German economy remains stable despite uncertainties linked to an emissions scandal in German automobile sector.

Markets are focused on Jackson Hole conference this week Friday's speech by European Central Bank President Mario Draghi is among the set-piece events at the Jackson Hole symposium, where remarks by his Federal Reserve counterpart Janet Yellen on the same day will be the main focus.

Draghi will refrain from delivering a new policy message, two sources familiar with the situation said last week, tempering any expectations for the ECB to start charting the course out of its quantitative easing stimulus programme. We think it is difficult to see President Draghi exceeding the QE taper expectations priced into the euro, while he could choose to repeat the Governing Council’s concerns over currency markets front-running ECB policy normalization. That is why we see a risk EUR/USD weakening in the coming days.

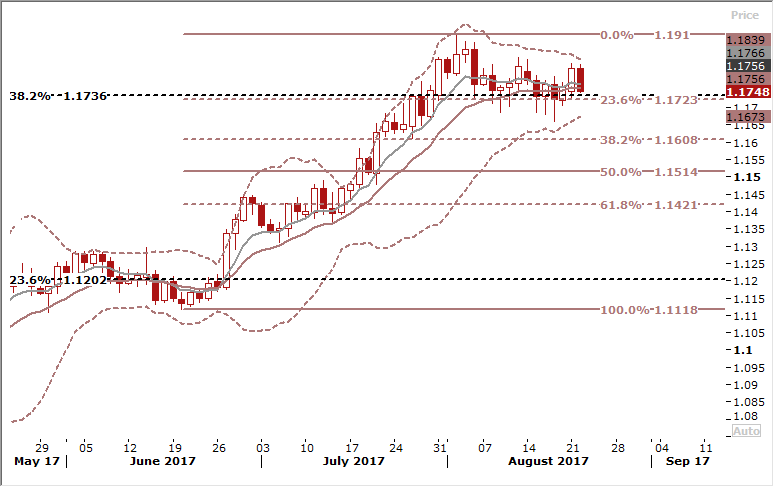

Technical analysis: Yesterday’s rise was not followed by a rise above August 11 high at 1.1848 to put the 1.1910 high back in play. Bears need a close below August 17 low of 1.1663.

Short-term signal: We opened EUR/USD short today at 1.1753. The target is 1.1575.

Long-term outlook: Bullish

USD/CAD: Loonie stays firm

Macroeconomic overview: The CAD held firm against the USD yesterday despite a sharp fall in oil prices, as the greenback stumbled on geopolitical fears over North Korea and investors girded themselves for the annual central bank conference in Jackson Hole later this week.

Last week, the CAD touched a two-week high against a greenback, after Canadian data showed an uptick in the rate of underlying inflation and oil prices jumped.

The traditional correlation between the Canadian dollar and prices of oil, a major Canadian export, has been more tenuous recently as focus shifted toward monetary policy decisions. There are some expectations Federal Reserve Chair Janet Yellen could highlight the need to keep a watchful eye on risks to inflation goals and financial stability at the Jackson Hole meeting. But if Yellen is less dovish than expected we can see a recovery in USD.

Markets were also jittery after the start of annual military exercises by South Korean and U.S. forces angered North Korea, which denounced the joint drills as a step toward nuclear war.

In Canada, investors will be also focused on retail sales data today. Domestic data on Monday showed wholesale trade slipping by 0.5% in June following eight consecutive monthly increases, greater than the 0.2% forecast.

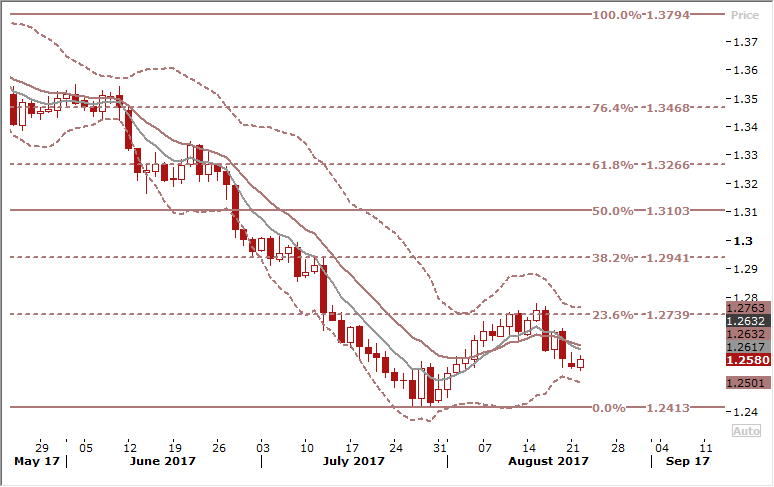

Technical analysis: The USD/CAD bounced from 23.6% fibo of May-July drop and remains below short-term moving averages now. The pair is on the way to July’s lows at 1.2416. Technical analysis suggests downward USD/CAD move will be continued.

Short-term signal: Stay sideways. We see a risk of USD recovery after Jackson Hole meeting, that is why we prefer EUR/CAD short trade now.

Long-term outlook: Bearish

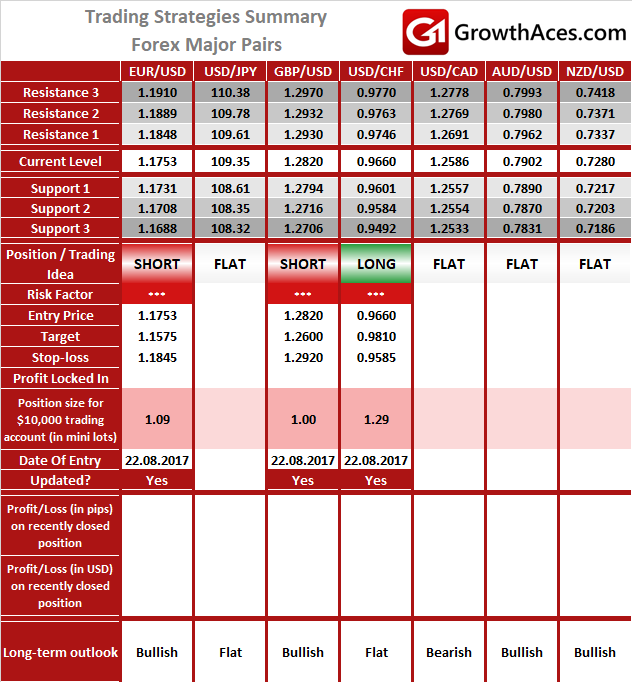

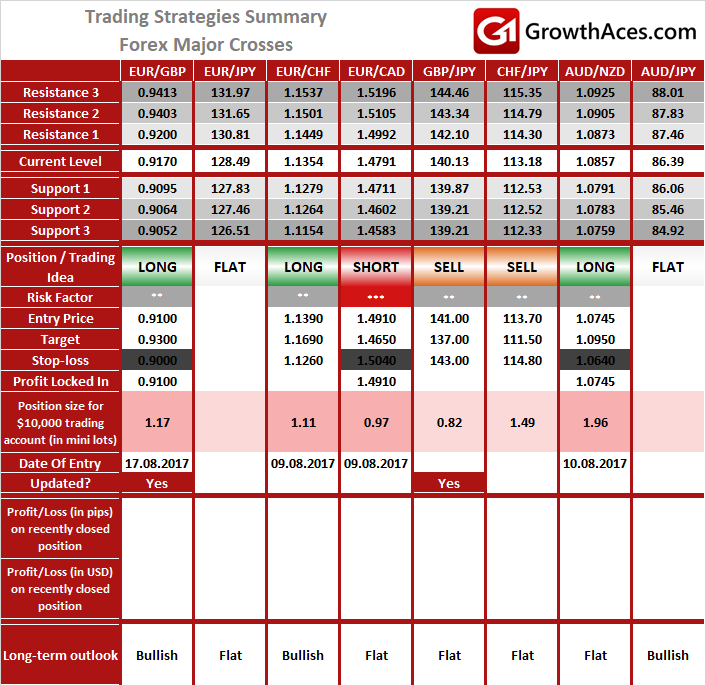

TRADING STRATEGIES SUMMARY:

Forex - Major Pairs:

Forex- Major Crosses:

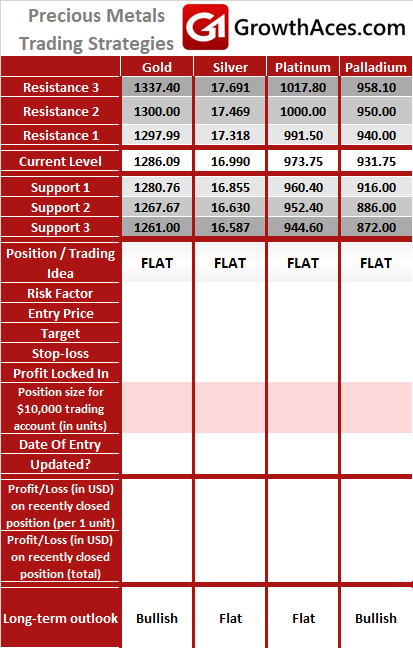

Precious Metals:

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size (forex)- position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Position size (precious metals) - position size suggested for a USD 10,000 trading account in units. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size).

6. Profit/Loss on recently closed position (forex) - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Profit/Loss on recently closed position (precious metals) - is profit/loss we have earned/lost per unit on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.