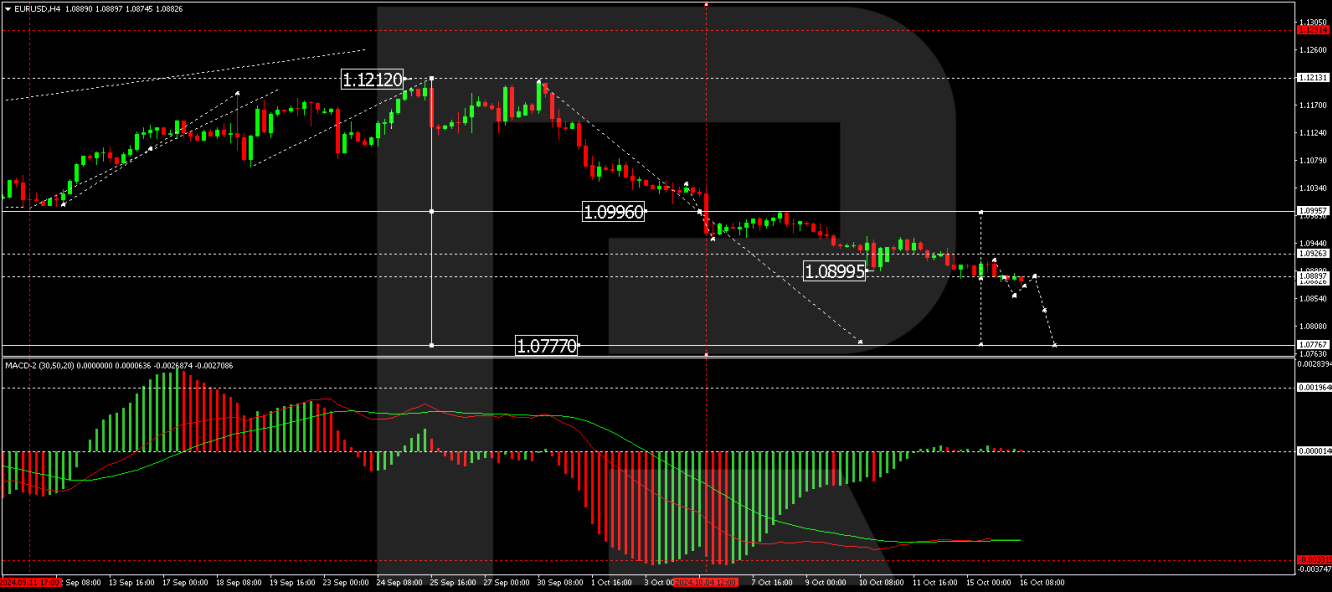

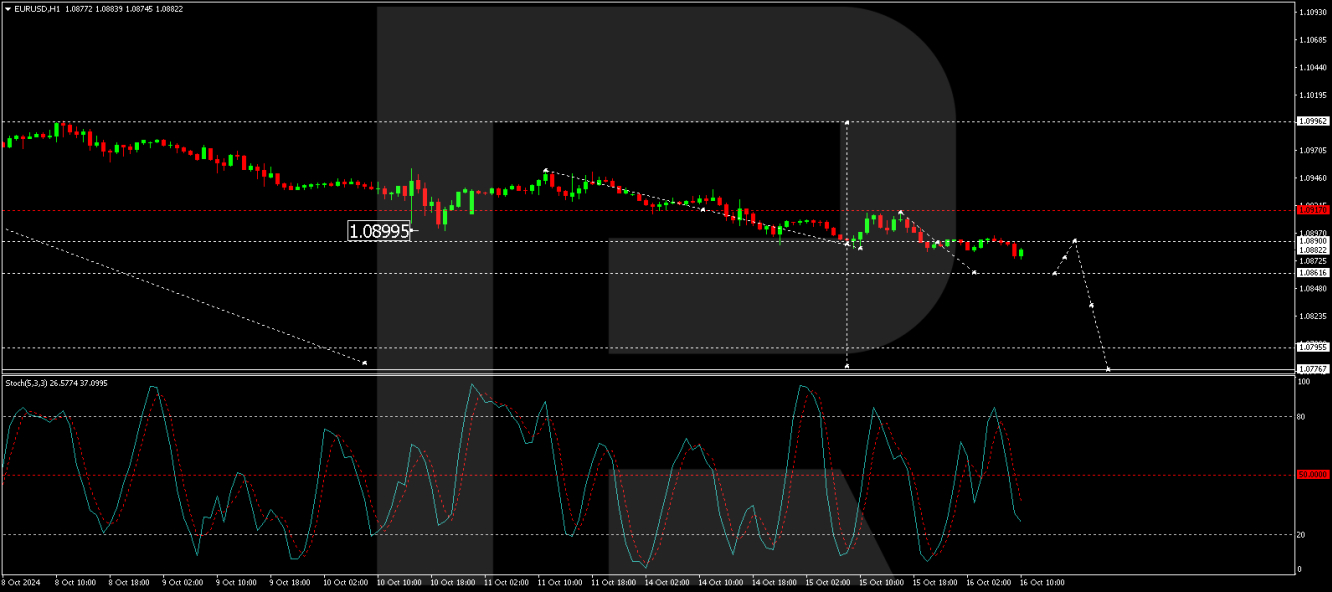

EUR/USD has sustained its position below the EMA-200 line, indicating a potential shift into a more defined downtrend. Recent comments from Raphael Bostic, head of the Atlanta Federal Reserve, have influenced this movement. Bostic suggests a modest 25-basis-point cut in interest rates this year – contrary to earlier predictions of a more aggressive 50-point reduction. Federal Reserve officials have underscored that any policy easing would be contingent on upcoming economic data.

The dollar's strength is further bolstered by the Empire Manufacturing Index for New York State, which sharply declined to -11.9 in October, a significant drop from 11.5 in September, marking the lowest level since May. This unexpected downturn, which contrasts with analyst expectations for a slight positive reading of 3.8, highlights a deterioration in regional manufacturing activity. While this data suggests potential headwinds for the US economy, it could paradoxically support the USD if it fuels speculation about a less aggressive rate-cutting strategy by the Fed.

Market participants eagerly anticipate further economic reports, including data on retail sales, industrial production, and the upcoming manufacturing data from FRB Philadelphia. These indicators will be crucial in painting a more comprehensive picture of the US consumer sector and overall industrial conditions, potentially guiding the next moves for EUR/USD.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/USD Set to Continue Downward Amid Economic Uncertainties

Published 10/16/2024, 04:45 AM

EUR/USD Set to Continue Downward Amid Economic Uncertainties

Technical analysis of EUR/USD

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.