- Will EUR/USD break the double bottom to the upside?

- Strong support at 1.1100

- Stochastic and RSI look quite positive

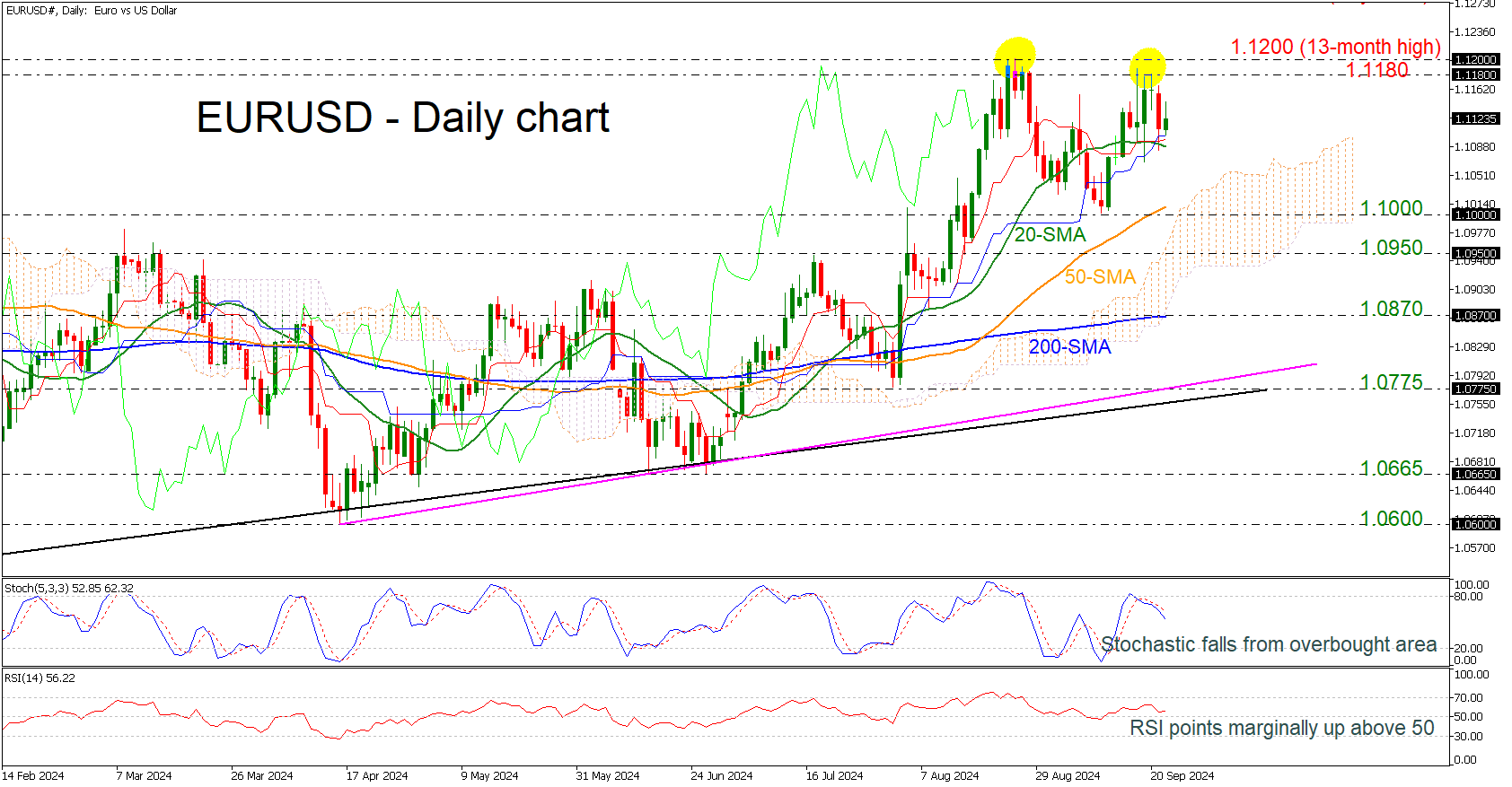

EUR/USD is continuing the upside rally near the 13-month high of 1.1200, remaining well above the 20-day simple moving average (SMA). A successful break to the upside of the double-top pattern could confirm the upside tendency.

Technically, the stochastic oscillator posted a bullish crossover within its %K and %D lines slightly beneath the 80 line, while the RSI is moving horizontally despite that it is still standing above the neutral threshold of 50.

If the market manages to pick up speed the July 2023 peak of 1.1275 could offer nearby resistance ahead of the 1.1390 barrier, taken from the high in February 2022.

Should prices decline, immediate support could be found from the 20-day SMA at 1.1100 before tumbling to the 50-day SMA at 1.1017. Slightly lower, the 1.1000 round number, which holds within the Ichimoku cloud may halt bearish actions.

In a nutshell, EUR/USD has been in a neutral phase over the last five weeks and needs a boost above 1.1200 to confirm the positive momentum.