- EUR/USD has surged at a fast pace in the past few days.

- Concerns about a US recession are rising.

- The US government's stance on tariffs remains unclear.

- Get the AI-powered list of stock picks that smashed the S&P 500 in 2024 by subscribing to InvestingPro today.

Since Donald Trump was elected US President, EUR/USD has not shown such a clear trend—this time in the opposite direction of November. The current outlook suggests further upward movement as concerns about a US recession grow, weakening the US Dollar.

Despite interest rate cuts by the European Central Bank and no action from the Fed, the euro is strengthening against the US dollar. This week, US inflation data on Wednesday will be important. If forecasts are correct, it will confirm a slowdown in the year-over-year rise in CPI since last October.

Market Focus Shifts to Possible US Recession

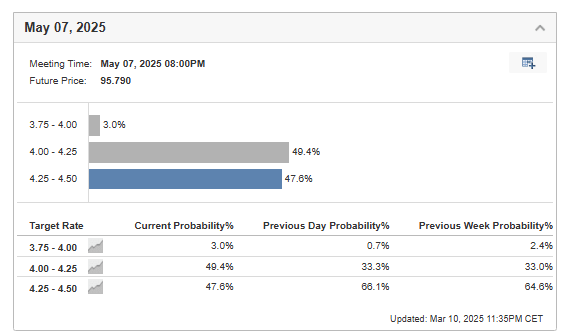

Recent weeks have highlighted the US economy's key role in global markets. Growing fears of a trade war are reviving recession concerns, reflected in the US dollar's decline last week. If the economy slows significantly, the Fed will likely speed up rate cuts—something investors are already factoring in. Market expectations now suggest the next Fed rate cut could happen in May instead of September.

Figure 1: Probability of the level of US interest rates in May

Therefore, we have an unusual situation in which the EUR/USD currency pair is rising despite the fact that the ECB is cutting interest rates and not the Fed. However, it should be remembered that the recent decision of the Governing Council was already discounted by the market, while the market is now pricing a possible change in the behavior of the Fed's leadership in the coming months.

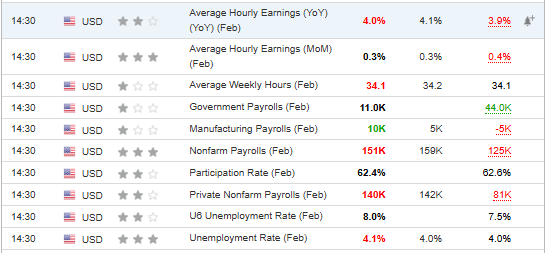

US Labor Market Data Falls Slightly Short of Expectations

As usual, the first Friday of the month brought US labor market data, which came in slightly below expectations.

Figure 2: US labor market data

Given the slight deviation from forecasts, the data had a limited impact on the market, but one must also keep in the back of one's mind the context of the tariff war and its impact on the US economy. If the next few months indicate the beginning of a broader negative trend then the pressure on the Fed will be increasing, which should continue to weaken the US dollar.

Is the EUR/USD Rally Coming to an End?

The strong rise in EUR/USD has slowed around $1.09, where a key resistance zone from last November is located. However, with minimal selling pressure and a strong bullish response in yesterday’s session, the outlook still favors further upward movement.

Figure 3: Technical analysis of EUR/USD

If the breakout occurs, the next target for buyers will be the resistance near the key 1.10 level. Those looking for a better entry point may watch for support levels below 1.07, around 1.0640 and 1.0530 per euro.

****

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.