- All eyes on FOMC – expect a 75bp rate hike with a hawkish tone

- Russian aggression will keep euro under pressure

- Acceptance below parity is another sign of weakness for EUR/USD

There is no end in sight to the downtrend for the EUR/USD, which remains on course to break to a new low on the year as investors await the Federal Reserve’s much-anticipated latest interest rate hike today and keep a wary eye on the energy crisis.

All major foreign currencies have been weakening against the US dollar for much of this year and the euro has been no different. The Fed has been tightening its monetary policy aggressively to bring inflation under control and this has seen bond yields and the dollar rise sharply, especially compared to countries where the central bank is comparatively less hawkish.

The Federal Open Market Committee (FOMC) will conclude its meeting today and most analysts think the decision will be a 75 basis point (bp) rate hike. With some economists calling for a 100 bp hike, we might see an initial upward spike in the EUR/USD in the event it is indeed a 0.75% hike.

But after any potential spike higher, the EUR/USD will likely resume lower—and quickly. For one thing, the Fed is likely to maintain a hawkish tone either in the rate statement, the dot plots and/or in the press conference. Inflation is nowhere near low enough for the Fed to ease its aggressive stance. For another, the euro itself is facing continued headwinds.

The single currency has already endured a rough ride and has been unable to benefit from an increasingly hawkish European Central Bank this year—well, not against the dollar anyway. This is because investors have been far more concerned about a weakening Eurozone economy than a small rise in interest rates. Surging inflation combined with anemic growth—in other words, stagflation—means the ECB’s hands have been tied somewhat more than the Fed with the latter happy to cause a soft landing in the stronger-performing US economy.

The Eurozone economy has been crippled because of an energy crisis, due in part to Russia’s war in Ukraine. Russian President Putin has today said that military reservists are to be sent to Ukraine as part of a "partial mobilisation" of his forces to ensure Russian territorial integrity. The latest move is a step up in Russian aggression which doesn’t bode well for Europe given the situation regarding gas supplies. With Russia reinforcing its military operation in Ukraine, the war looks like it will drag on, unfortunately, which may mean a long cold winter for the rest of Europe dependent on Russian energy.

For the EUR/USD, this means continued downward pressure until something changes fundamentally.

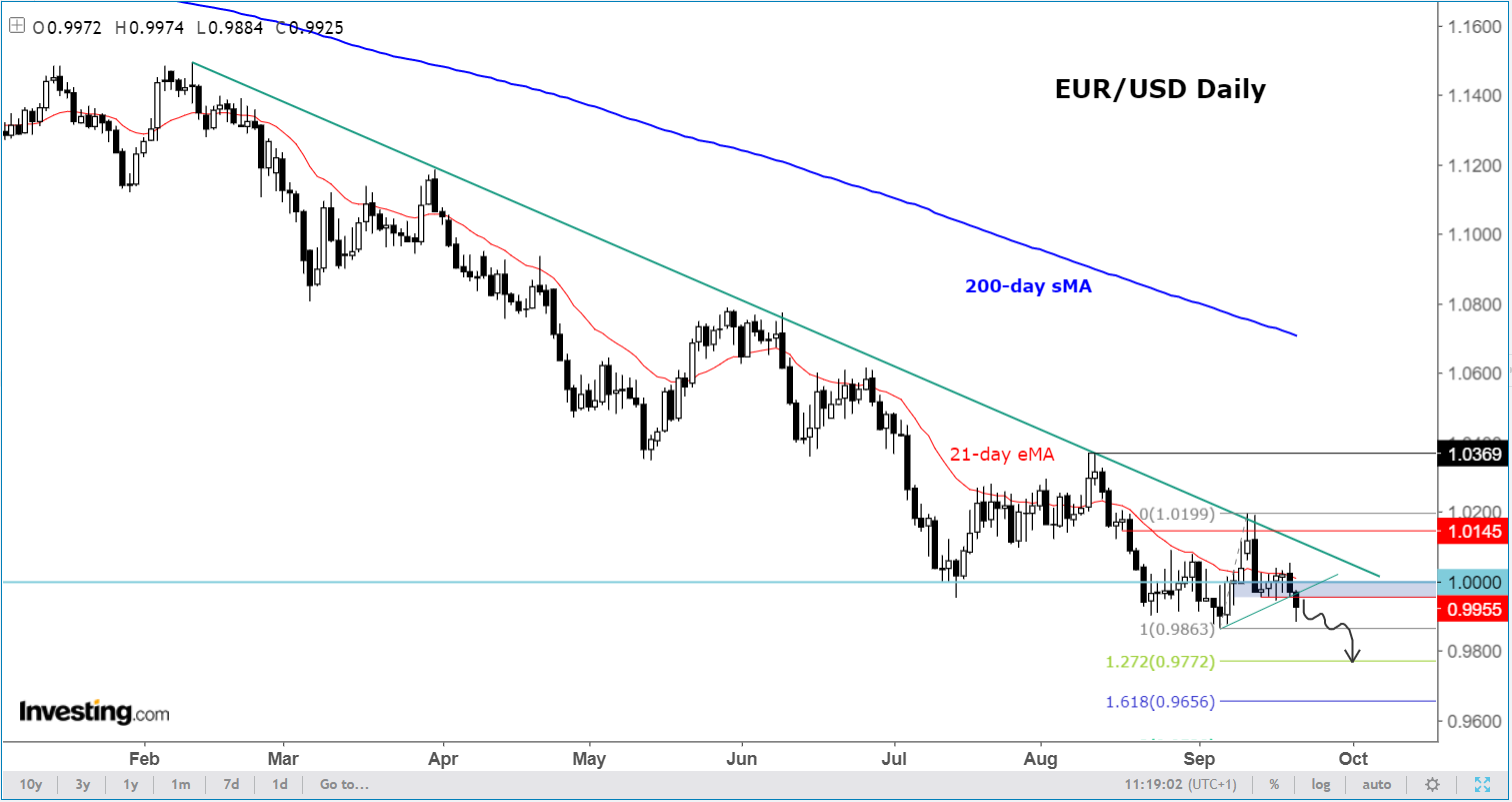

Technically, there’s nothing to excite the bulls looking to take advantage of a downbeat exchange rate. The sellers are happy to offer the EUR/USD at every key resistance level given a weak macro picture. The path of least resistance thus remains to the downside until we see a strong technical sign of a bottom in the exchange rate. With the previous support at 0.9955 to 1.0000 having broken down, this area is now the most important short-term resistance that the bears must defend. Otherwise, a short-squeeze bounce could be the outcome.

If the downtrend continues as we suspect, a new low on the year below this month’s low at 0.9863 is the minimum target. Thereafter, the Fibonacci extension levels at 0.9772 (127.2%) and 0.9656 (161.8%) will be among the downside levels to watch.

Disclaimer: The author currently does not own any of the instruments mentioned in this article.