- US interest rate hikes still remain on the table despite Fed members' tones that signal otherwise

- Meanwhile, is the ECB about to end its monetary tightening cycle?

- Consequently, the EUR/USD pair could see further declines as a base case scenario

The recent rebound in the EUR/USD currency pair appears likely to be nothing more than a temporary correction within the ongoing downtrend that began in mid-July as, longer-term, the fundamental factors pushing the US dollar higher haven't changed, despite of all the recent noise.

Although a rate hike at the upcoming Fed meeting two weeks from today remains improbable, there is a slightly greater than 40% probability of one occurring in December. On the other hand, however, the European Central Bank's interest rate hike cycle seems to have plateaued, at least in terms of verbal commitments. The disparity in treasury yields helps reflect that panorama, putting even more pressure on the European currency.

As such, if the downward trend persists, sellers are likely to target levels below 1.04. Alongside economic considerations, the escalation of the Israel-Hamas conflict creates a climate of global risk aversion, theoretically driving capital inflows into the US dollar.

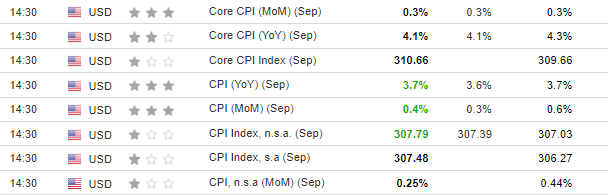

The latest US data further bolsters scenarios that are conducive to a stronger US dollar. The US inflation data released last Thursday closely aligns with forecasts, with year-on-year consumer inflation seeing only a marginal 0.1% increase.

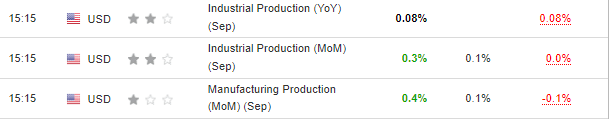

Aside from price dynamics, several other indicators may favor sellers in the EUR/USD market. For instance, data released on Tuesday for retail sales and industrial production surpassed expectations, diminishing the likelihood of an economic downturn and concurrently tempering inflation's ascent toward its target.

A series of statements from Fed officials Christopher Waller and Thomas Barkin, among others, indicate a lack of consensus on the monetary policy in the next few quarters, as the prevailing narrative is that we need to know more data. We may learn a bit more detail at today's speech by Jerome Powell at the Economic Club of New York.

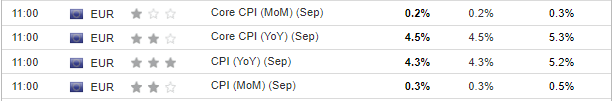

Eurozone Data Reflects a Disinflationary Trend

The Eurozone has maintained its status quo despite the release of key inflation data this week, which, although in line with forecasts, reflects a continuing disinflationary trend. A positive aspect is a clear decrease in core inflation, which had been a significant concern for European monetary policymakers earlier in the process of declining price growth.

This evolving scenario is now the primary rationale behind the European Central Bank's declarations about concluding the cycle of interest rate hikes at their current levels. The bank is scheduled to convene for its next meeting on October 26, and it's highly likely that the previously outlined scenario will be confirmed. It's too early at this stage to consider rate cuts.

Technical View

The beginning of October was marked by a corrective movement on the EUR/USD pair, which slowed down near the confluence of the resistance level of 1.0640 and the downward trend line. The local consolidation is currently forming a triangle pattern, the bottom breakout of which will confirm the continuation of the downward trend.

From the point of view of the broader picture, the most likely next area of trouble for sellers is the region of support falling slightly below the level of 1.04. Negating further southward movement will be the exit of demand above 1.0650, which opens the way for an extension of the rebound even near 1.0770.

**

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered investment advice.