- The economic calendar for the Eurozone is relatively quiet until next week, leaving US developments to drive EUR/USD.

- Next week brings PMI and IFO surveys, as well as the European Central Bank meeting.

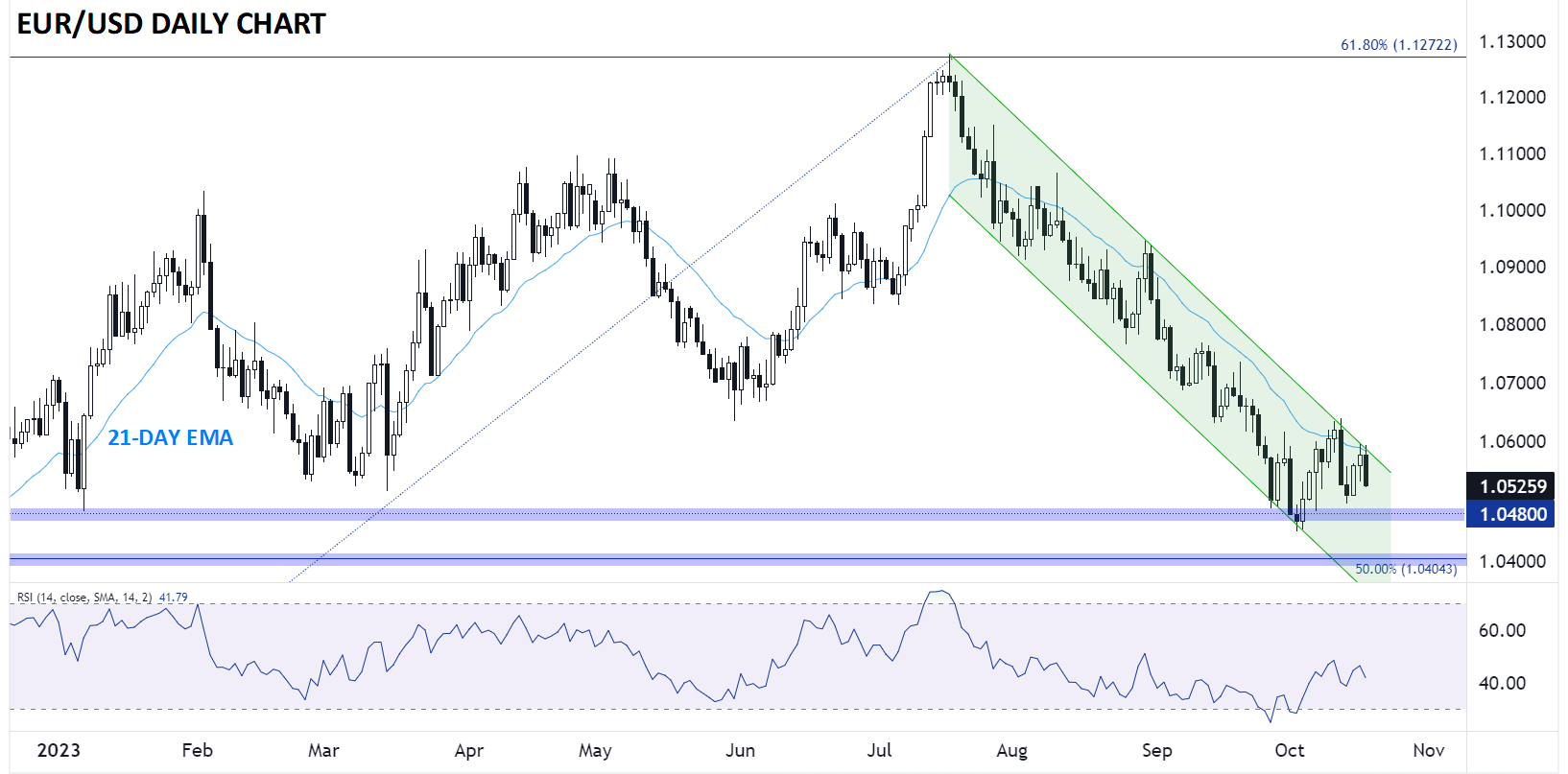

- EUR/USD’s early week rally is reversing, keeping the downward bias intact within a bearish channel.

Broadly speaking, the Eurozone’s economic calendar is relatively quiet heading into next week’s European Central Bank meeting, and even there, Christine Lagarde and company are highly unlikely to make any meaningful changes to monetary policy. The only data on the calendar today was Construction Output for August, which slipped -1.1% vs. 0.8% last month, but traders have mostly shrugged off the release as insignificant in the grand scheme.

Looking out a bit further, next week should bring some more meaningful economic data even beyond the ECB meeting. In particular, Tuesday brings the release of Flash PMI surveys, which provide one of the best measures of current, on-the-ground economic activity among all data releases. We’ll also get a look at the IFO survey of business conditions in the Eurozone’s largest and most important economy, Germany, which could influence the outlook for the currency bloc heading into the winter months.

EUR/USD Technical Analysis

Source: TradingView, StoneX

The world’s most widely traded currency pair got off to a solid start this week, but its gains from the first two days of the week are mostly reversing in today’s trade. As the chart above shows, EUR/USD again rallied into resistance at the top of its bearish channel before reversing back to the downside today (a surge to 16-year highs in 10-year US Treasury yields no doubt contributed to today’s broad-based strength in the dollar).

Looking ahead, the technical bias in EUR/USD remains on the downside as long as the bearish channel holds. The next support area to watch is around the year-to-date lows at 1.0480, with additional support possible from the 50% Fibonacci retracement of the 2022-2023 rally near 1.0400. Only a break above this week’s high and the 21-day EMA near 1.0585 would erase the current bearish bias.