EUR/USD climbed to 1.0504 on Wednesday, nearing its monthly high of 1.0528. The pair gained momentum following positive news from Germany, fuelling market optimism.

Key Factors Driving EUR/USD

Reports have emerged suggesting that Germany is considering the creation of a 200-billion-euro emergency fund, boosting expectations for increased local fiscal spending.

Additionally, Friedrich Merz, a leading candidate for the next German Chancellor, has proposed reforming the country’s debt brake to allow for more flexible financing of key expenditures. This could include tax cuts, lower energy prices, and a significant increase in defence spending – all of which could stimulate the German economy and support the euro.

Meanwhile, market participants are closely analyzing recent comments from the European Central Bank (ECB) comments ahead of next week’s policy meeting. The ECB is widely expected to cut interest rates for the fifth consecutive time. However, some policymakers, including Isabel Schnabel, suggest that the central bank may soon need to pause or halt rate cuts altogether. The euro could find additional support if the ECB signals a more cautious stance on further easing.

Technical Analysis of EUR/USD

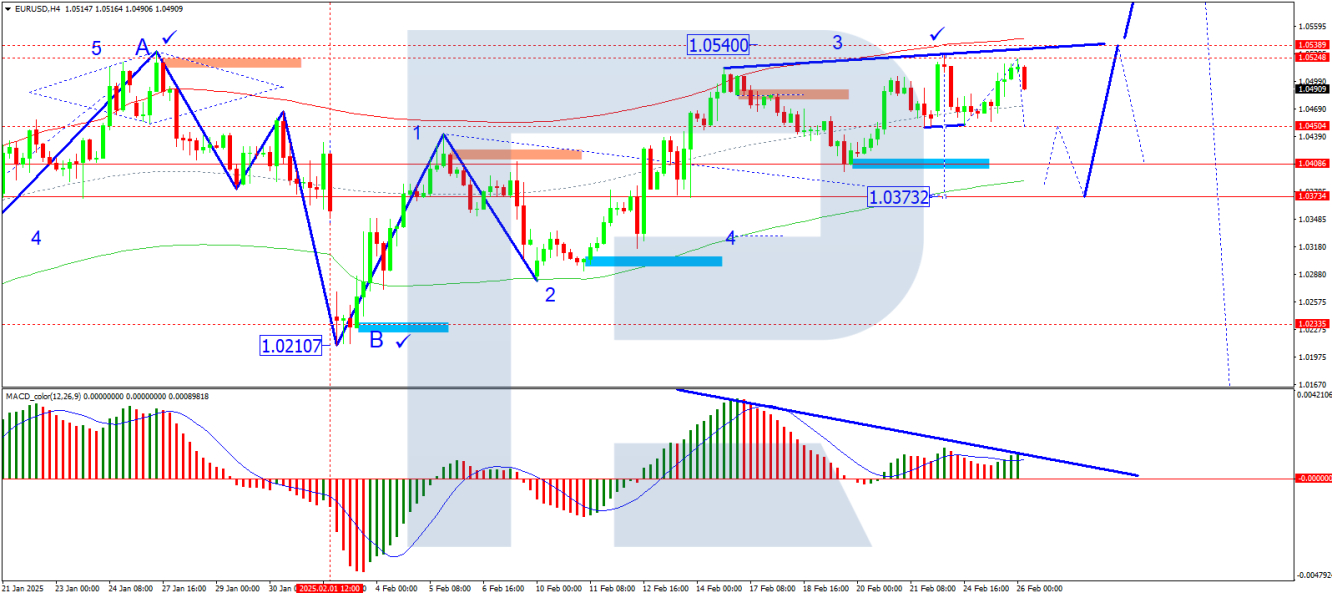

On the H4 chart, EUR/USD completed a growth wave to 1.0524 and is now developing a downward wave towards 1.0450. A breakout below this level would open the potential for a further decline towards 1.0380. After reaching this target, a corrective rebound towards 1.0450 is likely. The MACD indicator confirms this scenario, with its signal line positioned above zero but pointing sharply downward.

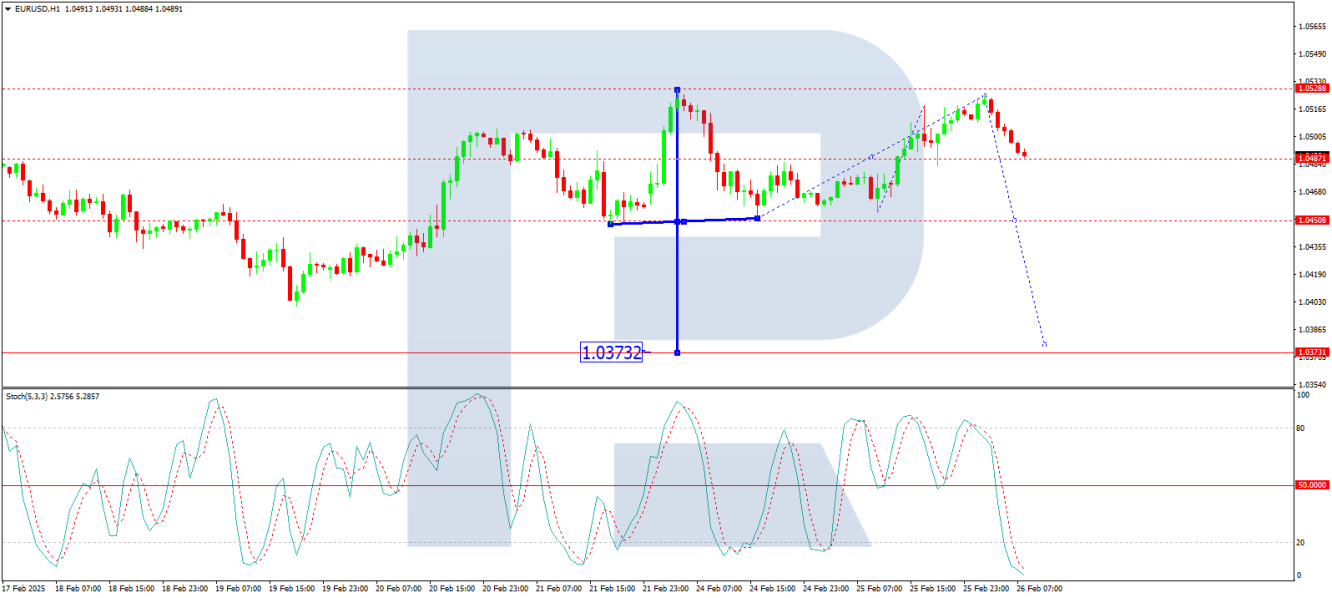

On the H1 chart, the market declined to 1.0453, followed by a correction to 1.0524. The likelihood of the downward wave continuing towards 1.0450 remains high. If this level is breached, the correction could extend towards 1.0380, with the broader trend potentially targeting 1.0373. The Stochastic oscillator supports this outlook, with its signal line above 50 and pointing decisively downward.

Conclusion

EUR/USD benefits from renewed optimism surrounding Germany’s potential fiscal expansion, but downside risks persist due to the uncertainty surrounding ECB policy. While technical indicators suggest an ongoing downward wave, the pair’s movement will depend on key support levels around 1.0450 and 1.0380. The upcoming ECB meeting remains a critical event that could shape the euro’s near-term direction.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.