-

Eurozone inflation remained stable at the end of Q2 2024, with core inflation for services and non-energy goods unchanged at 4.1% and 0.7% respectively.

-

EU services inflation remains persistently high and is unlikely to decrease significantly in the near future. A challenge for the ECB?

-

EUR/USD is approaching a key resistance zone around 1.0950 ahead of the ECB meeting, which could be pivotal for sustained bullish momentum.

EUR/USD continued its advance above the 1.0900 handle this morning as eurozone inflation matched the consensus and first estimates.

An accelerated selloff in the US Dollar Index (DXY) has also benefited EUR/USD, as traders increase their bets on rate cuts from the US Federal Reserve, putting pressure on the US dollar.

Inflation in the Eurozone remained mostly stable at the end of the second quarter. Energy inflation saw a slight decrease to 0.2% year-over-year from 0.3% in May. Inflation for food, alcohol, and tobacco dropped by 0.2 percentage points to 2.4%.

Core inflation for both services and non-energy goods stayed the same at 4.1% and 0.7%, respectively. The month-over-month increase in core inflation was revised up by 0.1 percentage points to a 0.4% rise. Year-over-year rates matched the advance estimates, except for a minor downward adjustment of 0.1 percentage points in the inflation of food, alcohol, and tobacco, which was initially reported at 2.5%.

In a similar vein to the UK, services inflation remains as sticky as ever and a concern for the European Central Bank (ECB). The inflation picture in the eurozone also faces some near-term challenges.

In France, energy inflation is expected to rise in July due to an increase in gas distribution costs. Additionally, the Taylor Swift tour across major European cities in July poses an additional upside risk to inflation in hotels and other accommodations.

Despite a summer of challenges on the inflation front, two more rate cuts from the ECB do appear on the cards, with markets currently pricing in 48 bps of cuts before the year end.

Market participants have been emboldened by the increase in US rate cut bets, but I expect that the majority of that has now been priced in.

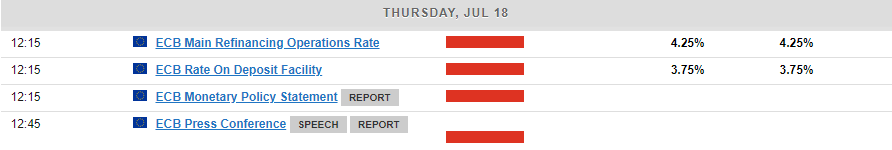

The Week Ahead: ECB Meeting Up Next

The Economic docket is light in the US this week, with Federal Reserve policymakers the main attraction. Comments from Fed policymakers could stoke volatility but are unlikely to sway growing rate-cut bets.

The ECB meeting tomorrow will now be the center of attention. EUR/USD is in a delicate position heading into the meeting as it rests just shy of a key confluence zone. The ECB are expected to hold rates steady tomorrow, with the press conference likely to hold more sway.

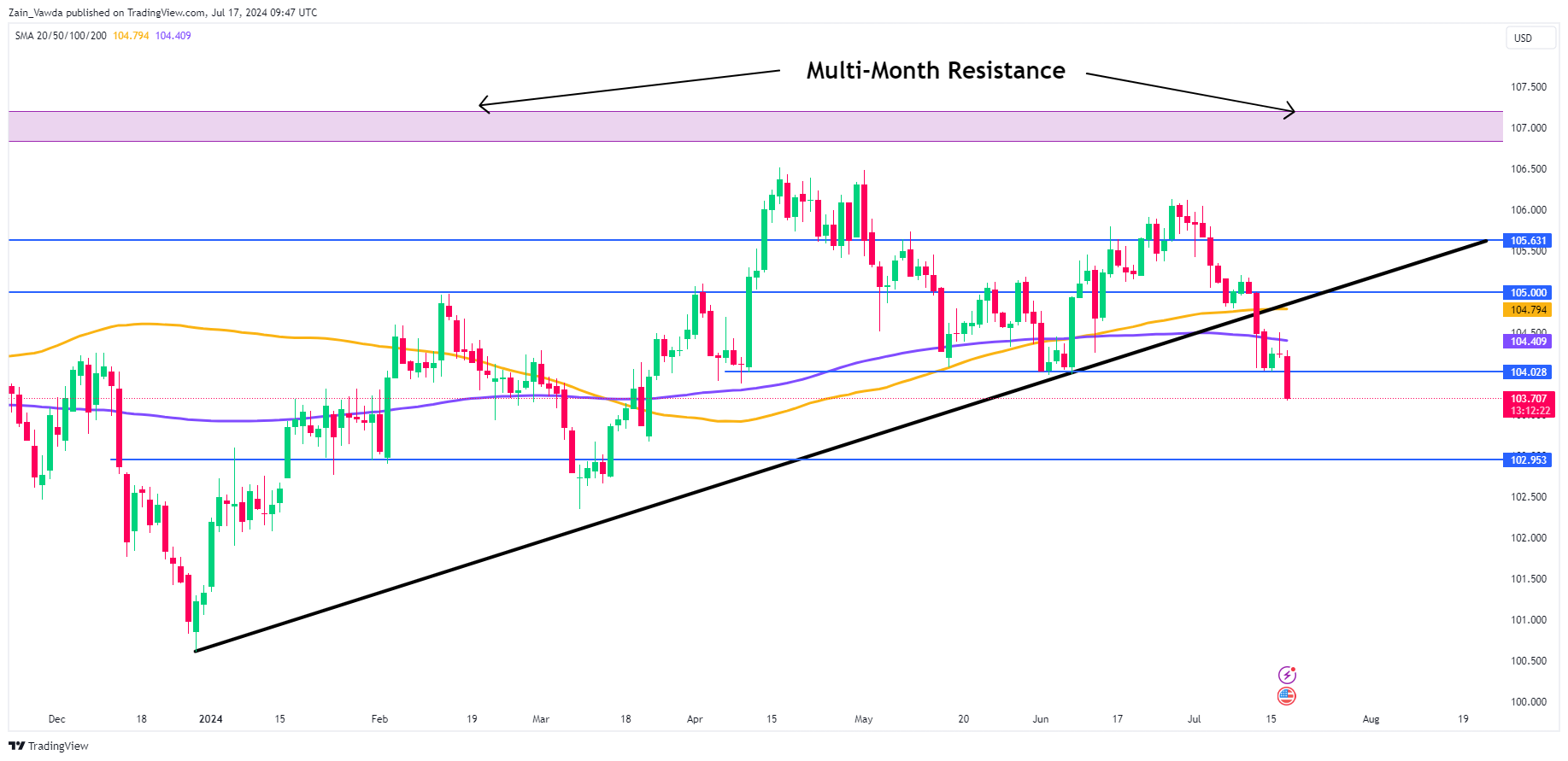

Technical Analysis

From a technical perspective, EUR/USD is currently trading at levels not seen since March 2024. Bulls might be concerned about the long-term descending trendline, which sits just above a crucial resistance zone around the 1.0950 mark.

This zone could be pivotal for sustained bullish momentum; however, a rejection at this trendline could push EUR/USD back towards support at the 1.0840 level in the coming weeks.

Source: TradingView

Support

-

1.0900

-

1.0840

-

1.0800

Resistance

-

1.0950

-

1.1000

-

1.1093