EUR/USD Key Points

- Europe has been put in the passenger seat when it comes to peace negotiations in Ukraine, an underappreciated geopolitical risk to EUR/USD.

- Traders will get their first look at Eurozone PMIs for February tomorrow, providing a timely update on the current economic situation on the continent.

- EUR/USD is poised for a potential breakout if PMIs come in better-than-expected; in that scenario, a quick continuation toward the key 1.0600 level is likely.

If you want to sound smart as a trader or market analyst, you can always cite “geopolitical flare-ups” as an underappreciated risk and you’ll sound smart. In the current environment however, some of Europe’s biggest geopolitical fears are coming to the fore.

In addition to US President Trump’s threat of “reciprocal tariffs” on the continent and the associated risk of a trade war with the US, Europe has been put in the passenger seat when it comes to peace negotiations in Ukraine. The Trump Administration appears to be moving forward with bilateral negotiations directly with Russia, cutting Ukraine and other European stakeholders out of the equation entirely.

The situation in Ukraine will ultimately play out over the next several weeks, if not longer, but with key European stakeholders not even invited to the proverbial “room where it happens,” the situation is clearly trending against a particularly euro-favorable outcome.

Back to more traditional market drivers, traders will get their first look at Eurozone PMIs for February. Last month’s readings showed a continued divergence between manufacturing (contracting at 46.6) and services (growing slightly at 51.3). An extension of that ongoing trend is expected again this month with traders anticipating the headline PMIs coming in at 48.5 and 51.5 for the manufacturing and service readings respectively.

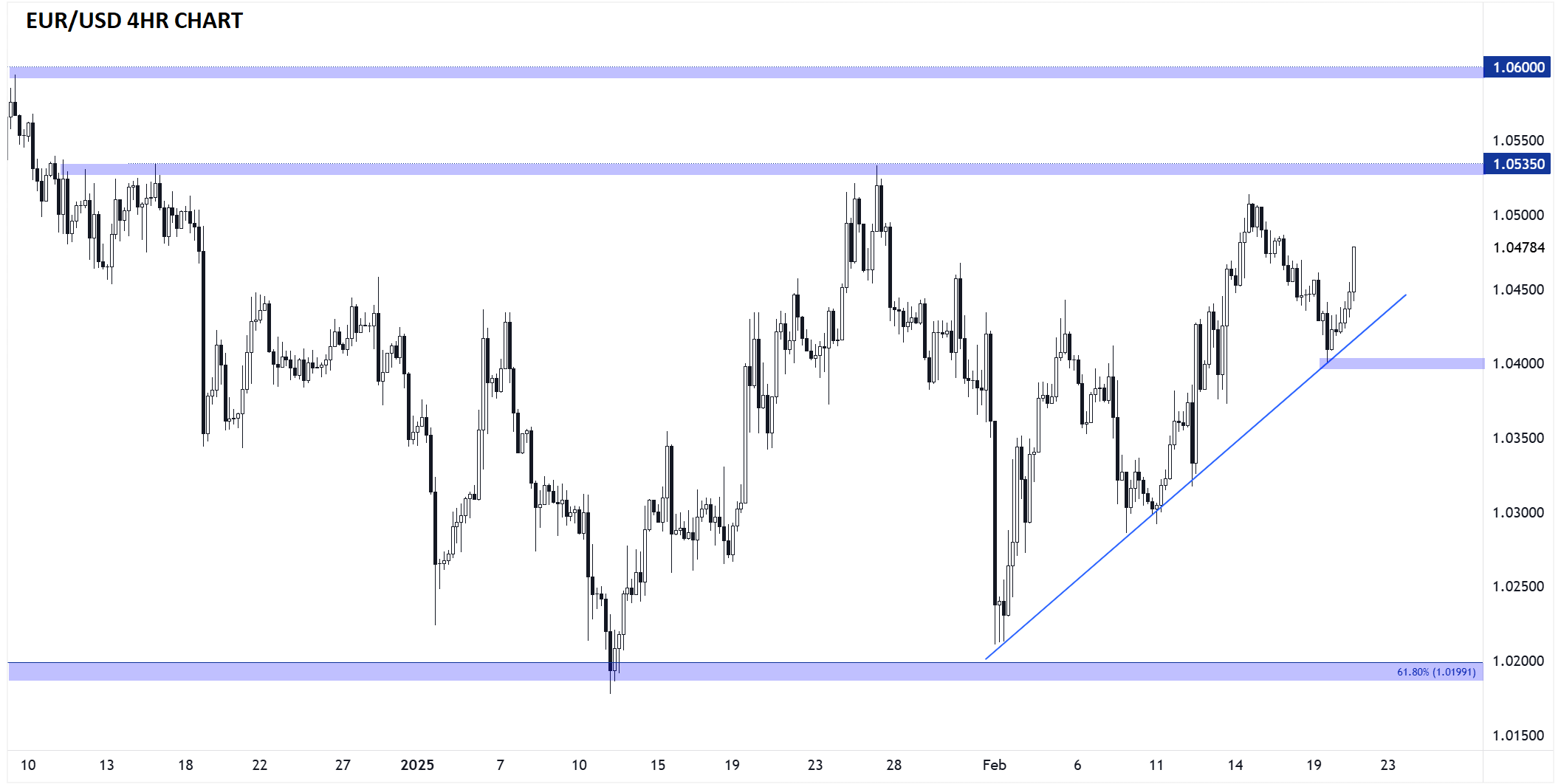

Euro Technical Analysis – EUR/USD 4-Hour Chart

Source: StoneX, TradingView

As the chart above shows, EUR/USD has formed a near-term uptrend since the start of February, more on the back of broad-based US Dollar weakness than any particular strength in the euro.

From a technical perspective, the pair is still consolidating within the 2+ month range between 1.0200 and 1.0530, but with the bullish momentum seemingly building, EUR/USD is poised for a potential breakout if PMIs come in better-than-expected; in that scenario, a quick continuation toward the key 1.0600 level is likely.

Meanwhile, if the situation in Ukraine continues to move in a Euro-negative (or even Euro-ambivalent) direction, EUR/USD may reverse lower to break its near-term bullish trend line and test the weekly low at 1.0400 next.