- Latest economic data continues to favor the US dollar

- Meanwhile,Donald Trump continues aggressive tariff targeting rhetoric

- Fed in no to rush to raise interest rates, ECB to cut again in its next meeting

- Get the AI-powered monthly updated list of picks that smashed the S&P 500 in 2024 for less than $9 a month here.

At the end of last week, we observed a slight increase in volatility in the EUR/USD pair due to the release of US labor market data.The overall reception of the data was positive, mainly because of the drop in the unemployment rate, which temporarily strengthened the US dollar.

Meanwhile, US President Donald Trump announced plans to introduce 25% tariffs on aluminum and steel, along with retaliatory tariffs on countries that impose similar tariffs on the US.

Despite this announcement, the market's reaction was less intense than during previous similar news, likely because we are still far from the extreme scenarios suggested during the election campaign.

Rate Cycle Divergence Weighing on Pair

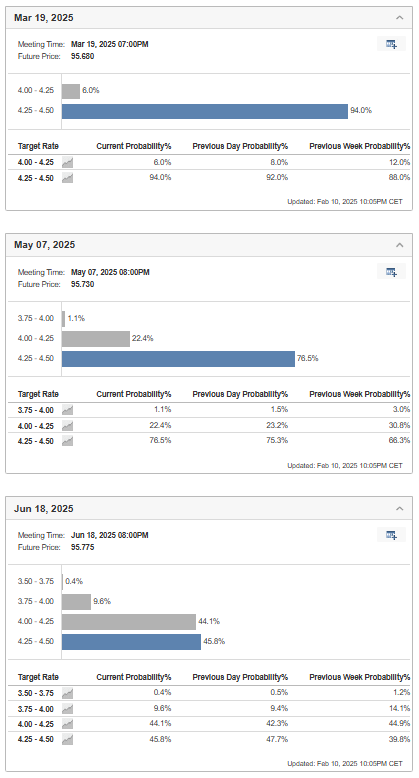

Currently, based on market valuations, the likelihood of the Fed maintaining current rate levels is higher for the upcoming three meetings from March to June.

Figure 1: Probability of interest rate levels in the U.S.

Figure 1: Probability of interest rate levels in the U.S.Recent labor market data reinforced the Federal Reserve's belief that there's no urgency for faster interest rate cuts, especially given the unpredictability of the current administration's actions.

Figure 2 US labor market data

On the Central Bank side, Jerome Powell has indicated that if the labor market weakens or inflation moves consistently toward the target, a return to more aggressive monetary easing will be necessary.

At the moment, neither of these conditions has been met.

In contrast, the ECB is not only cutting interest rates but is also expected to do so again in the coming months, creating a structural situation that favors the continuation of the downward trend in the main currency pair.

US CPI Data Could Slow the Rebound

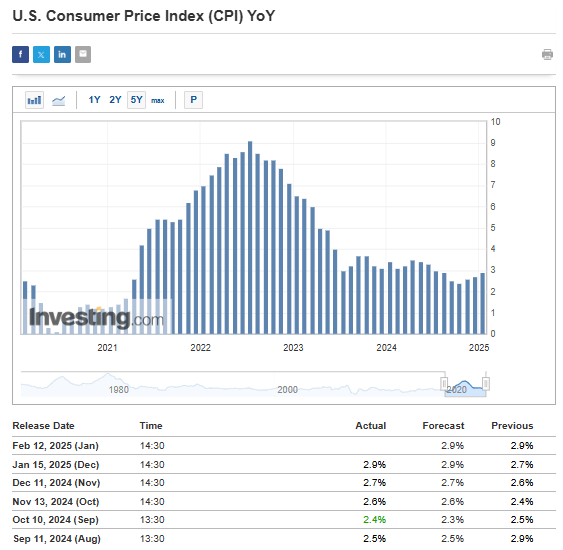

From a macroeconomic perspective, investors will be paying close attention to the US inflation data released on Wednesday.

Market consensus expects the year-over-year CPI growth to hold steady at 2.9%.

Figure 3: US Inflation data

If these forecasts materialize, they could lead to an interruption of the steady rebound that has persisted since last October.

However, one single bad reading would not be significant enough for the Federal Reserve to shift its stance at upcoming meetings, unless there is a surprising upside in the fight against inflation.

EUR/USD Technical View - Parity en Route?

The EUR/USD is currently confined within a local consolidation range of $1.02-1.05 per euro. At present, we can also identify a head-and-shoulders pattern, suggesting a continuation of the downward movement.

Figure 4 Technical analysis of EURUSD

The crucial level to watch is the lower boundary around the 1.02 price area, which also serves as the neckline for the identified formation.

A break through this area targets the round level of 1.01 and the significant psychological barrier of 1:1 parity. Exiting above the 1.06 resistance would negate the downward scenario.