EUR/USD: Long for 1.2400, stop-loss at 1.1585

Macroeconomic overview: A measure of U.S. manufacturing activity surged to a near 13-and-a-half-year high in September as disruptions to the supply chains caused by Hurricanes Harvey and Irma resulted in factories taking longer to deliver goods and boosted raw material prices.

Still, details of the Institute for Supply Management's survey underscored the economy's underlying momentum, with factories reporting stronger order growth last month. A measure of factory employment hit its highest level since 2011.

ISM said its index of national factory activity surged to a reading of 60.8 last month, the highest reading since May 2004, from 58.8 in August.

The ISM said Harvey and Irma had caused supply chain and pricing issues in the chemical products sector. There were also concerns about the disruptive impact of the storms on the food, beverage and tobacco products industries. Manufacturers of nonmetallic mineral products said while the storms were boosting sales, they were also causing significant price increases on input raw materials.

As a result, the ISM's supplier deliveries sub-index soared 7.3 points to 64.4 last month. A lengthening in suppliers' delivery time is normally associated with increased activity, which is a positive contribution to the ISM index. The survey's prices paid sub-index vaulted 9.5 points to 71.5, the highest reading since May 2011.

Discounting the hurricanes' impact, the outlook for manufacturing remains bullish. Seventeen out of the 18 manufacturing industries reported growth last month. The ISM survey's production sub-index rose 1.2 points to a reading of 62.2 in September and a gauge of new orders jumped to 64.6 in September from 60.3 in August. A strong reading for U.S. manufacturing activity pushed bond yields higher. Expectations of a U.S. rate increase hardened to more than 71% by December from 42% a month earlier.

Dallas Fed President Robert Kaplan, a voting member this year on the Fed's policy committee, said the Federal Reserve will need to "look hard" at whether it should raise rates in December, but there is no need to wait for inflation to actually get to, or even begin to rise back to, the Fed's 2% target before doing so. He said "I need to see some evidence that I think the cyclical forces are picking up enough that eventually it’s likely that inflation will start to build in the future, even if I can’t see it yet."

That is a different bar than some at the Fed are setting, including Minneapolis Fed President Neel Kashkari, who said he would want to wait on rate hikes until core inflation reaches the Fed's 2% target. But it may reflect the view of the majority at the Fed who anticipate raising rates again in December. We keep our forecast of December hike unchanged.

European Central Bank chief economist Peter Praet said relatively calm market conditions could encourage the ECB to extend its asset purchase scheme for a relatively longer period but with reduced monthly spending. With the ECB's asset purchases due to end in December, policymakers will discuss the future of its quantitative easing programme on October 26. They are likely to debate the merits of extending the scheme for a relatively long period but with smaller monthly purchases or keeping bigger monthly buys for a shorter extension period.

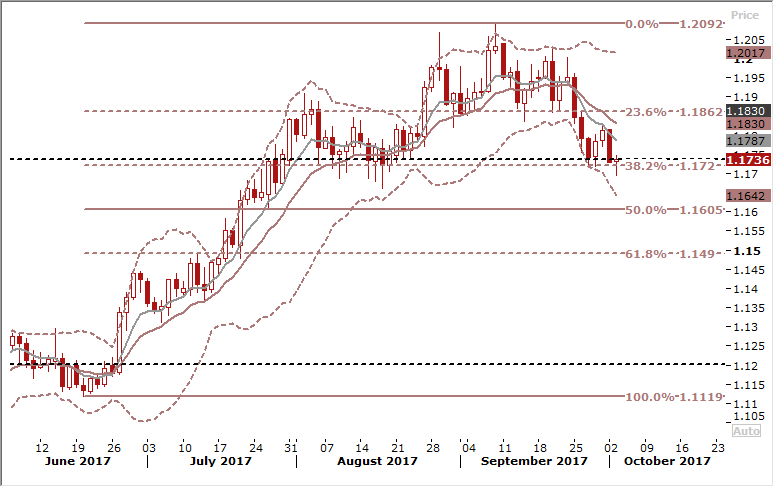

Technical analysis: EUR/USD continues to push through the daily cloud and broke below 38.2% fibo of the June-September 1.1119-1.2092 rise at 1.1720 today. The bears objective is 1.1605, 50% fibo of the above-mentioned move now. This is close to 1.1584, which is the head and shoulders projection following the September 25 neckline break. We do not expect this level to be broken.

Short-term signal: Long for 1.2400, stop-loss at 1.1585

Long-term outlook: Bullish

Source: GrowthAces.com - your support in forex trading