The EUR/USD pair is trading neutrally around 1.0510 as market participants adopt a cautious stance ahead of the Federal Reserve's upcoming decision on interest rates. With the December meeting set to begin tonight and conclude tomorrow, all eyes are on the potential rate adjustment.

The prevailing expectation is a 25 basis point cut, with a 94% probability factored by market consensus. Additionally, there's a 37% chance that this might be the only cut or that rates might not change at all in 2025, contributing to the current market apprehension.

As inflation concerns loom for 2025, influenced by uncertain policy decisions and economic stimulation measures, the Fed is expected to adopt a more cautious tone in its communications. This approach is aimed at providing the flexibility to respond effectively to economic indicators as they evolve.

Today, the market is also focused on the release of November's retail sales and industrial production data from the US. These indicators are crucial for assessing the current state of the US economy and could influence the Fed's policy direction.

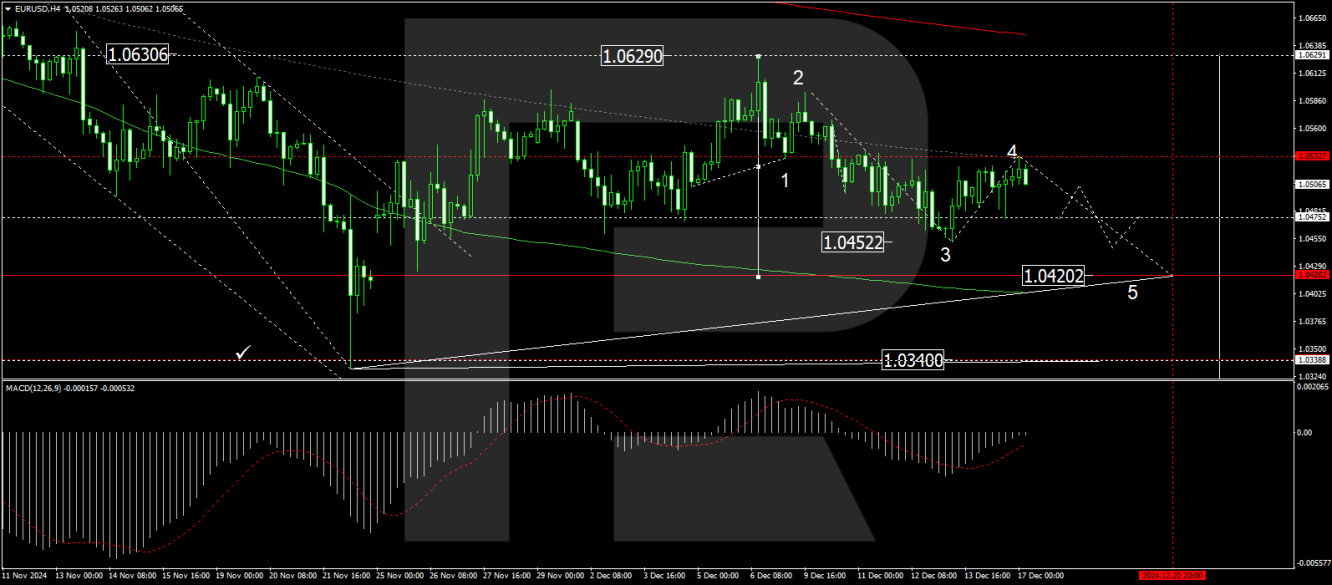

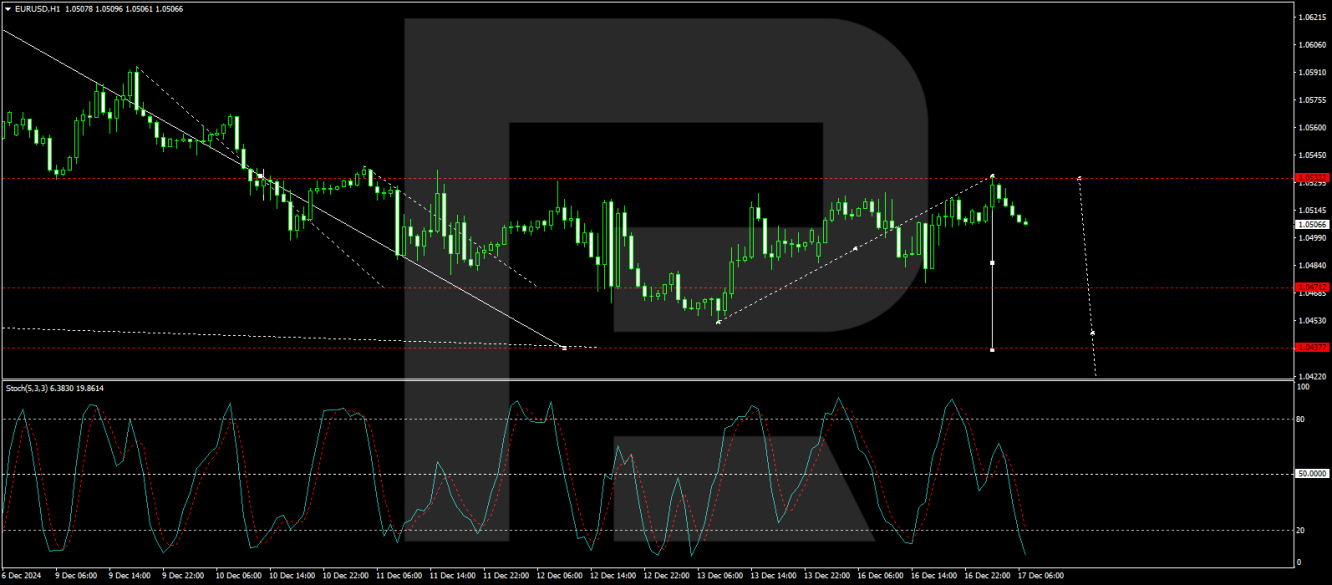

Technical analysis of EUR/USD

H4 chart: the EUR/USD has recently completed a correction wave at 1.0533 and appears poised for a downward movement towards 1.0420. Following the achievement of this target, a corrective move to 1.0475 is expected. Post-correction, another decline towards 1.0340 may commence. The MACD indicator supports this bearish outlook, with its signal line below zero and trending downwards, suggesting further declines.

H1 chart: on the H1 chart, the pair has retraced from 1.0533 and initiated a downward wave targeting 1.0485. Upon reaching this level, the formation of a consolidation range is anticipated. A breakout below this range could lead to a continued descent towards 1.0440 and potentially extend to 1.0420. The Stochastic oscillator corroborates this scenario, with its signal line currently below 50 and expected to drop further towards 20, indicating a continuation of the bearish momentum.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.