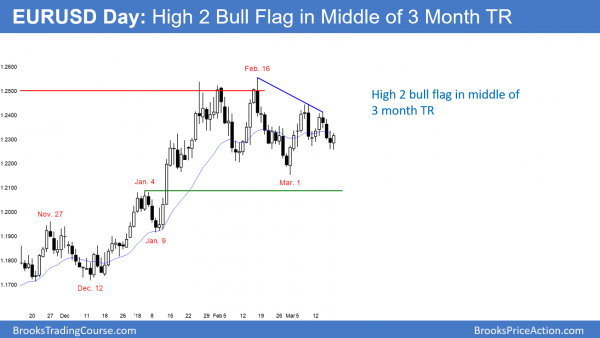

The EUR/USD daily Forex chart has a High 2 bull flag in the middle of a 3 month trading range.

The EUR/USD daily Forex chart has been sideways for 3 months. Like all trading ranges, the bulls look like they are about to take control, but then there is a reversal down. Once the bears look strong, the chart reverses back up.

The chart has pulled back over the past 2 weeks and has a bull bar so far today. If today closes above its midpoint, it will be a buy signal bar for tomorrow.

The past 3 months formed a trading range on the daily. Once a pullback grows to 20 or more bars, the bulls have largely lost control. I then use the term “trading range” instead of “pullback.” This is a neutral pattern. Since the trend leading to the range was up, there is only a slightly higher probability of a successful bull breakout.

However, these same few months on the daily chart created a bull flag on the weekly chart. The weekly chart is therefore bullish. The odds favor a successful upside breakout within the next month or two. If the pullback grows to 20 or more weeks, it too will become neutral, like the pattern on the daily chart. I will then call it a trading range instead of a pullback (bull flag).

If the bears get a successful bear breakout on the daily chart, they could get a Leg 1 = Leg 2 measured move down on to around 1.20. While bearish on the daily chart, it would still be a bull flag on the weekly chart. But, a weaker one.

Overnight EUR/USD Forex trading

The EUR/USD 5 minute Forex chart rallied 60 pips overnight up from below Friday’s low. In addition, there was a 15 minute bull breakout over the past hour. If the bulls can prevent this breakout from reversing, the day will close near its high. It would therefore be a good buy signal bar for a lower low double bottom with the March 9 low. The odds would favor a break above today’s high tomorrow.

The big problem for all traders is that 11 a.m. Wednesday’s FOMC announcement if a major catalyst. It could lead to a big move up or down. Consequently, what takes place before the report is minor.

Yes, the odds of a rally to above 1.25 will be higher if today closes on its high and tomorrow is a big bull day. Wednesday’s report could then lead to a huge rally to back above 1.25.

However, it is almost equally likely that the report will lead to a big reversal down to below 1.20. Consequently, day traders will mostly scalp until the report.