Q1 turn in EUR/USD FX forwards traded close to past quarter turns.

The remaining three quarter turns in 2019 look about fair-to-cheap priced.

We see value in hedging further out the FX forward curve, i.e. out to 6M-1Y.

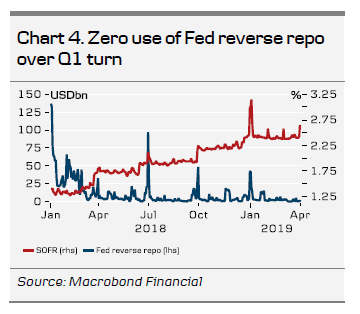

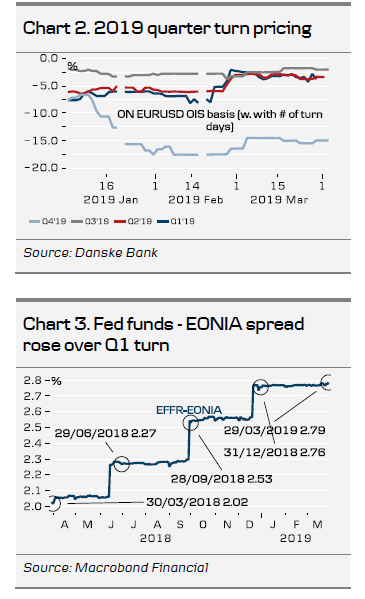

The Q1 turn in the USD money market is now behind us. On the surface, it did not stand out from the point of view of EUR/USD FX forwards. The overnight EUR/USD OIS basis was -3.8% (when adjusting for the length of the turn, which was three days), which is close to the median of non-year-end quarter turns since 2016. On some points, the turn was different. The spread between the effective Fed Funds rate (EFFR) and EONIA rose over the Q1 turn, whereas it normally narrows (see chart 3), due to a 2bp rise in EFFR to 2.43. Demand for repo funding has increased, which has led to repo rates rising over month ends (see chart 4). There is zero excess liquidity left in the repo market highlighted by the zero uptake on Fed's reverse repo facility over the Q1 turn - in 2018 money market funds placed around DKK50-100bn on the facility over quarter turns.

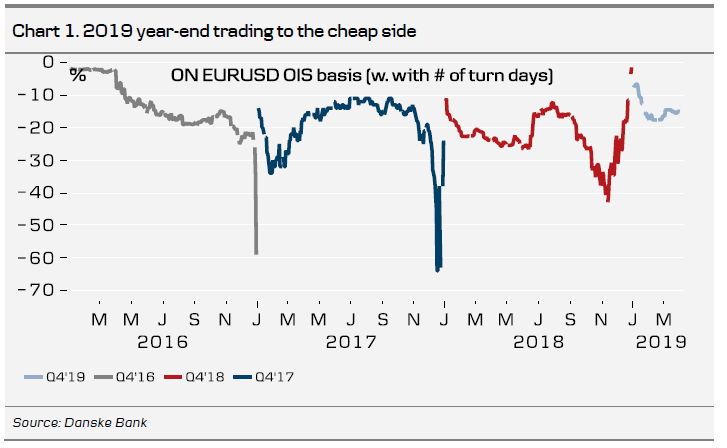

The remaining three quarter turns in 2019 look about fair-to-cheap priced. Q2 and Q3 are currently priced within the range non-year-end quarter turns have traded since 2016 (chart 2). At -15% (adjusted for the length of the turn) the outcome space for the year-end overnight EUR/USD OIS basis is skewed towards a wider basis, when compared to past year-turns (chart 1). Furthermore, we expect the Fed and the ECB to be on hold the coming year. Finally, the Fed is set to tighten USD liquidity at least another USD400bn before ending quantitative tightening in September, i.e. from current levels we see value for EUR- and DKK-denominated investors in hedging USD assets further out the FX forward curve. Out to 6M to gain the 14bp Fed cut priced at the September meeting and hedge the planned USD liquidity tightening. Alternatively out to 1Y to also hedge the year-end effect (it amounts to 8-14bp on a 1Y FX forward if year-end widens to past year's extremes) and gain from the additional 18bp Fed cuts priced on 1Y.