EUR/USD FX forwards fall on Fed cut and expectations of more

OIS basis has widened in past months on turn repricing and debt ceiling suspension

EUR/USD FX forwards out to 5M are priced about fair-to-cheap in our view

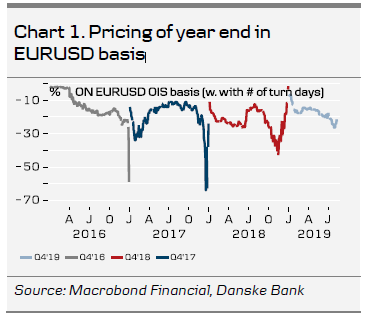

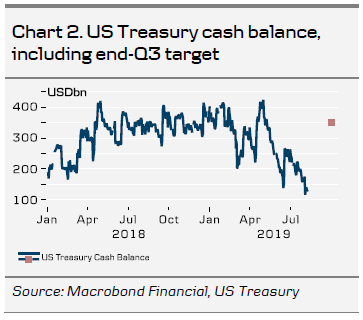

EUR/USD FX forwards continue to fall as the Fed cuts rates with the market expecting more to come. EURUSD OIS basis has been on a widening trend over the summer. Hedging USD over upcoming quarter turns has become more expensive. The market is now pricing the Q3 turn in line with where Q1 and Q2 turns traded (taking into account length of the turns) and the year-end premium has gradually increased over the summer, but cheapened a bit over the past week (see chart 1). The US Congress agreed in July to suspend the debt ceiling, which will give rise to a rebuild in the US Treasury cash balance following mid-September's corporate tax payments. The US Treasury targets a cash balance of USD350bn at the end of September up from USD133bn at present (see chart 2). That will lead to USD220bn of liquidity tightening, which may explain repricing of the Q3 turn.

Although, we have been alert to periods of USD liquidity tightening during the past couple of years, we stress that the upcoming bout of liquidity tightening should be viewed in the context of the Fed cutting rates. The July rate cut will likely be followed by further cuts in H2 (more on that below). Rate cuts and tighter USD liquidity do not go hand in hand, which is also why the Fed decided to put an early end to quantitative tightening (QT). The early end to QT will leave about USD60bn more liquidity in the market. If the rebuild of the US Treasury cash balance gives rise to tighter liquidity conditions and upwards pressure on short-term USD rates, the Fed has room to mitigate this, e.g. through temporary open market operations. Finally, the surprise widening of the EURUSD OIS basis over the July month-end was probably due to the July FOMC meeting coinciding with month-end. It is a rare thing, but the last time it happened in January 2018, the basis also widened sharply.

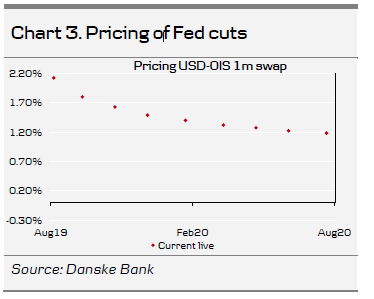

The rates market is pricing about 2½ cuts of 25bp for the rest of the year and a little over one 25bp cut in H1 next year (see chart 3). We read the Fed as more data dependent and less forward looking at the current stage and we thus expect two more 25bp cuts this year, but the risk is clearly that Fed will need to do more. In this respect, the front end of the USD money market curve looks too aggressively priced currently with 32bp priced for the September meeting, while October looks about fair with a 50bp cut priced in. Beyond October, the risk in our view is that the market will need to price more. There is still no strong consensus in the market on what the Fed will do over the coming meetings and there is room for the pricing to move in either direction. Key market movers over the coming weeks are US CPI on 13 August, US retail sales on 15 th , FOMC minutes on 21 st , flash PMIs on 22 nd and Jackson Hole on 23-24 th . In terms of the ECB, the market is pricing a 13bp cut in September and a total of 23bp cuts in December. That is about fair in our view.

All in all, EUR/USD FX forwards out to 5M are priced about fair-to-cheap in our view. There is room for the market to price more Fed cuts this year, but also potential for the year-end basis to widen further. Unless the Fed starts cutting in 50bp increments, the risk of the latter outweighs the former. Beyond 5M, the risk is for a further drop in FX forwards.