Does it make any sense to stand out of the crowd if it will result in an economic disaster? Growing risks of the global GDP soft landing made the central banks be extremely cautious. Many stopped considering monetary normalization at all, others are willing to make a long pause in the raising of interest rates. The ECB might need to admit at last that the risks for the euro-area economy are not balanced at all, they are rather weighed down. Based on the recent macroeconomic data in Eurozone, in 2019, the currency block may be challenged by a strong GDP growth decline, if not by a recession; in this environment, the central bank needs to think about a delay in the tightening of its monetary policy.

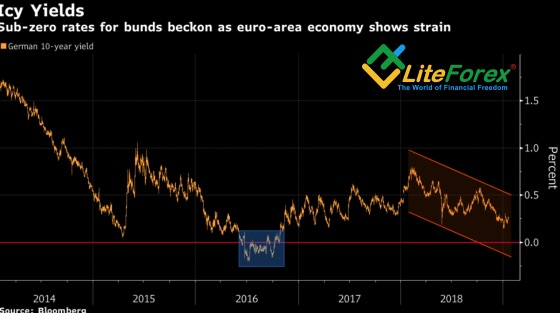

In late 2018, forex analysts suggested a bullish outlook for the EUR/USD, based on a long pause in the Fed monetary normalization and the ECB willingness to hike the interest rate in September, 2019. But currently, as the euro-area economic statistics is getting worse, they are changing their minds. The derivatives market, doesn’t expect a necessity to start normalizing the ECB monetary policy before Q2, 2020; weak data on industrial production, PMI and inflation rate sent German 10-year yield to a sub-zero level. The indicator is about to inverse for the first time since 2016. How could the euro be rising in such environment.

Dynamics Of German Bond Yields

Source: Bloomberg.

According to Societe General, if the US economic growth doesn’t decline, the EUR/USD rate may touch 1.1. Goldman Sachs (NYSE:GS), on the contrary, suggests that the euro will rise as high as $1.7, because the U.S. are likely to win in the race down. Based on the sharply falling PMI down from multi-year highs, the U.S. GDP rate should be sliding down. The situation is worsened by a record high government shutdown in the USA. According to the consensus forecast of over 100 Reuters experts, it should subtract 0.3% from the GDP growth rate in Q1 2019. Finally, the US growth pace on an annual basis will be at 2.1% in Q1, at -2.3% in Q2 and it will be down at 1.9 by the end of 2019.

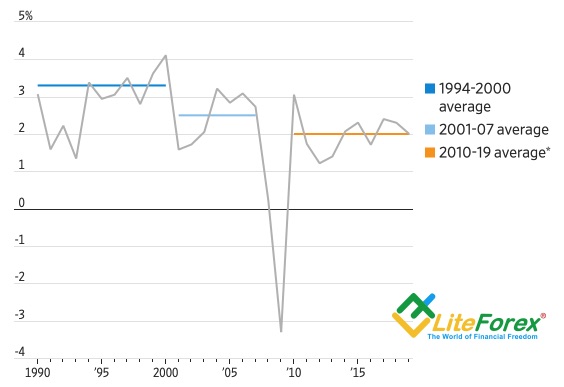

Although, it is generally though that the reasons for such a trend are the weakening effect of fiscal stimulus, higher political risks and weak foreign demand, hit by trade wars; but, in fact, the Fed has also made its contribution.

In the situation, when global GDP growth and a neutral interest rate are not that high by historical standards, even a slight monetary restriction can make a serious impact on global economy.

Source: Wall Street Journal

The same is also true for the euro-area. The ECB has ended QE, but it will still reinvest about €170-200 billion per year in purchasing bonds. The central bank may follow the Fed's example and determine its further policy depending on the incoming data. The EUR/USD has been falling down over five out seven trading days ahead the Governing Council’s meeting. It could suggest that investors have considered the risks of Mario Draghi’s dovish rhetoric. If he doesn’t sound dovish enough, the breakout of the resistance at 1.1415 will encourage the euro-bulls to go ahead.