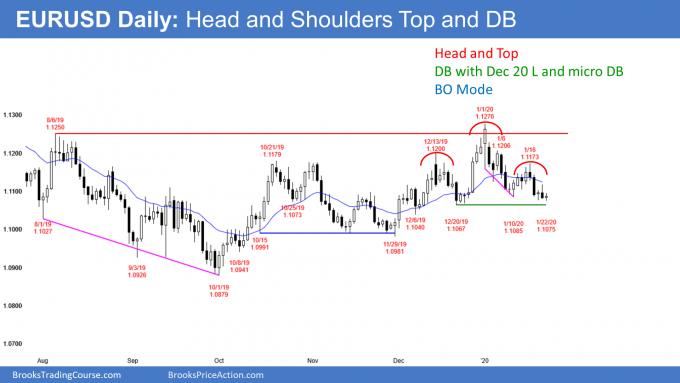

The daily chart of the EUR/USD Forex market has been in a trading range for 6 months. There is always going to be a reasonable buy setup and a reasonable sell setup in a trading range. The bears currently have a head and shoulders top while the bulls have a double bottom. They bulls now also have a 3 day micro double bottom.

Since trading ranges resist breaking out, these trend setups usually fail. At some point, there will be a successful breakout, but every breakout attempt up and down for the past 20 months has failed. Consequently, traders continue to look for reversals every few weeks.

After the current 3 week selloff, traders expect a 2 – 3 week rally soon. They are deciding if the current bottom attempt will be the start of the rally.

However, reversals usually come after breaking above some obvious support or resistance. The December 20 low is an example. Because this selloff has not quite reached that magnet, traders are hesitant to buy.

Has the 3 week bear leg ended?

The price action is not strongly bullish. The buy signal bar on Monday was a small bull doji. Today so far is another small bull bar. This does not represent a strong rejection of the current price. Many traders want to see a stronger reversal up, and one that preferably comes from below more major support.

However, if there is a Bull Surprise bar this week, they will conclude that a 2 – 3 week rally has begun. In the meantime, the buying is weak.

But so is the selling. Traders expect reversals every few weeks. This selloff has lasted more than 3 weeks. When a market is in a trading range, traders want to buy low and sell high. The EUR/USD is now low. Traders prefer to buy here and not sell. The bears want to sell rallies and not at the low. This is resulting in the lack of big bear bars down here.

Because the odds favor a reversal up soon, traders are looking for a strong buy signal bar or a big bull bar. Alternatively, they want a strong break below the December lows. That would then lead to at least a couple small legs down to the November 29 low or the October low. In the meantime, they are mostly day trading for small profits.

Overnight EUR/USD Forex trading

The 5 minute chart of the EUR/USD Forex market has been in a 20 pip range overnight. It sold off to below Monday’s low by 1 pip and reversed up. There is now a micro double bottom on the daily chart with that low.

The bulls want today to close on its high and have a big bull body on the daily chart. Today would then be a reasonable buy signal bar on the daily chart. That would increase the chance of a rally over the next week or two.

The bears want a break below the December lows. They, therefore, want today to break again below Monday’s low and for today to close far below that low.

With the range being only 20 pips so far, there is no strong sense that the price is wrong. Day traders are looking for 10 pip scalps from small reversals. Because of the possibility of a 2 week rally or a break below the December lows, day traders will switch to swing trading if there is a strong breakout up or down. But at the moment, that is not likely to happen today.