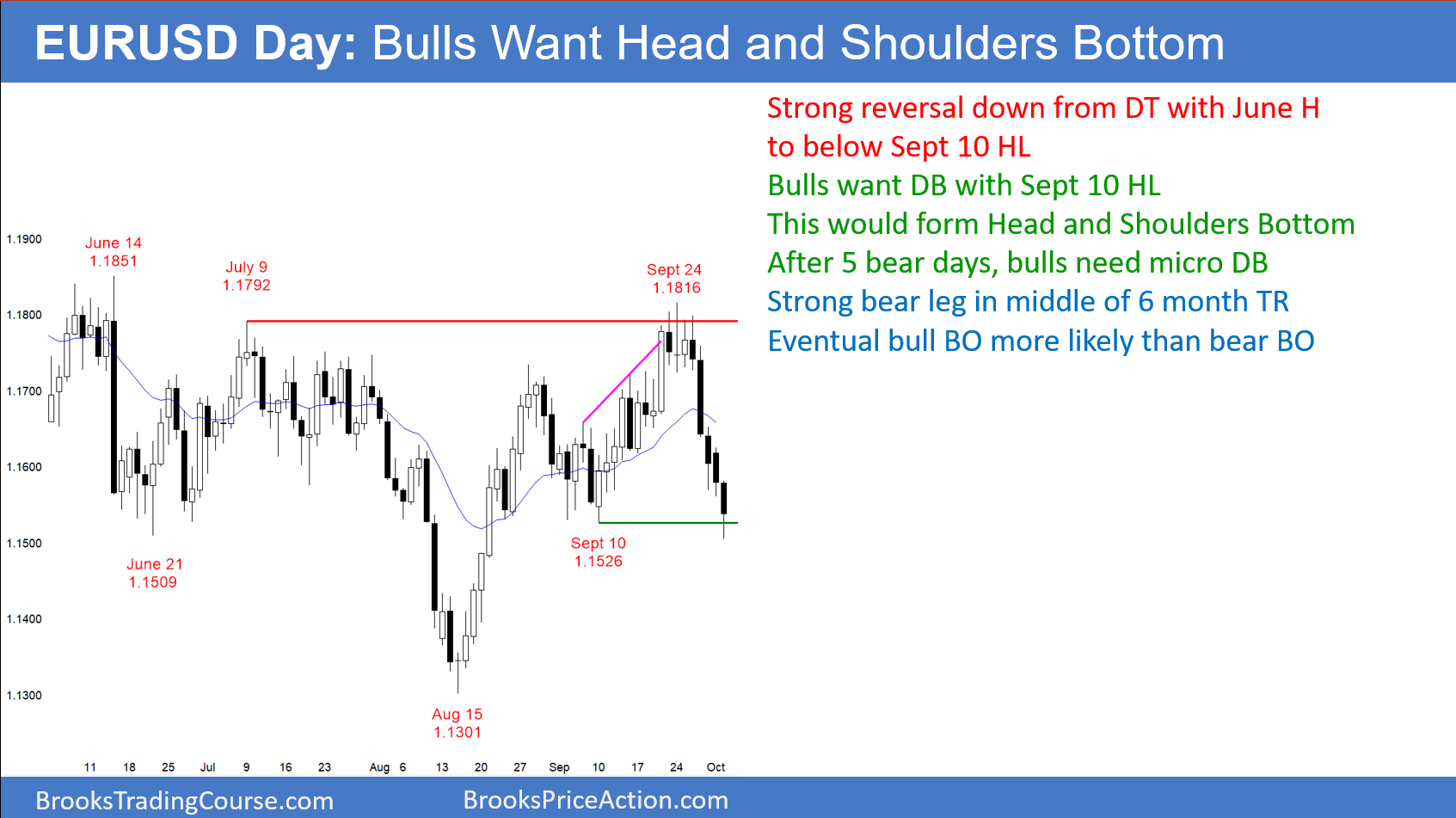

After 5 consecutive bear days, the bulls will need a micro double bottom. They want a double bottom with the September 10 higher low. This would also be the right shoulder of a head and shoulders bottom.

As strong as the 5 day selloff has been on the EUR/USD daily Forex chart, it is probably just a pullback to the middle of the 6 month trading range. It is about a 50% pullback, a test below the September 10 higher low, and a test of the 1.15 Big Round Number. If the bulls can stop the selling and create a small trading range over the next week or two, they will create a credible right shoulder of a Head and Shoulders Bottom.

Even though the odds favor an eventual successful breakout above the 6 month range, trading ranges resist breaking out. Consequently, the trading range could continue for several more months. Traders who bet on reversals after every 5 – 10 day move have been making money. Until there is a clear, strong breakout out of the range, traders will buy low, sell high, and take profits within a few days.

Overnight EUR/USD Forex trading

The EUR/USD 5 minute Forex chart sold off 70 pips overnight, but reversed up 40 pips after falling below the September 10 low. Since 1.15 is a Big Round Number, the bears will probably get a test below it within a week.

The daily chart is in the buy zone since it is at the support on the daily chart. Therefore, despite 5 bear days, the bulls will buy reversals up. The 1st reversals up will be minor. This means that the bulls will mostly scalp for 10 – 20 pips today.

But, the daily chart is oversold and now at support. Consequently, the bears will sell rallies, not at new lows. In addition, they will take profits after 10 – 30 pip selloffs.

Because the daily chart is at support, the odds are that it will begin to enter a trading range for a week or more. This will limit the size of the swings on the 5 minute chart.