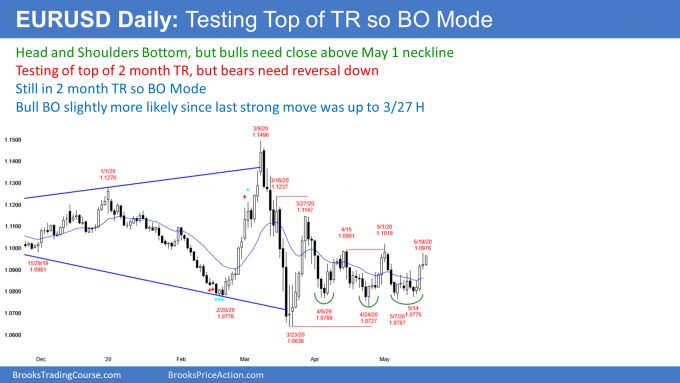

The EUR/USD Forex market on the daily chart has rallied to the top of its 2 month trading range. Since it is still in the trading range, it is still in Breakout Mode.

The last time one side was in control was during the rally to the March 27 high. That makes a bull breakout slightly more likely than a bear breakout. But it is important to remember that until there is a breakout, there is no breakout and reversals are still more likely.

At a minimum, the bulls need a close above the May 1 high. If the close is far above and the breakout bar is big and it closes on its high, that will increase the chance of a successful breakout. Consecutive bull bars and consecutive closes above that high would make traders expect a test of the March 27 buy climax high or even the March 9 high.

But if there is a bear bar closing near its low this week, especially a big bear bar, traders will look for a move back to the bottom of the range.

Overnight EUR/USD Forex trading

The 5 minute chart of the EUR/USD Forex market has had a small overnight rally with small bars. Also, the low was above yesterday’s low and the high so far is below yesterday’s high. Today is currently an inside bar.

Even though the EUR/USD is up 30 pips, the range is small. Also, yesterday reversed down. This lack of energy at the top of the 2 month trading range reduces the chance that the 2 week rally is the start of a bull trend.

But because the chart is at important resistance, day traders will be ready for either a strong breakout or a strong reversal. Given the price action of the past 2 days, they expect quiet trading. Day traders have been scalping for 10 pips while they wait for the next strong move up or down.