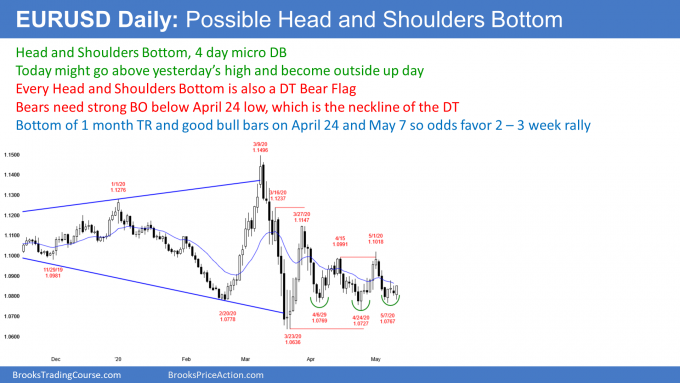

The EUR/USD Forex market on the daily chart is near the bottom of a month-long trading range. That usually leads to a reversal up. This is especially true when there are bull bars closing near their high. April 24 and May 7 are 2 examples.

Today might be another, especially if it closes above yesterday’s high. It is already an outside up bar, and a close above yesterday’s high would be an additional sign of strong bulls.

Every trading range always has both a reasonable buy and sell signal. The bears have a double top with the April 15 and May 1 highs. The May 7 low is the neckline. If the EUR/USD breaks below that price, it will trigger the double top. The bears would then look for a measured move down from there.

The bulls have a head and shoulders bottom. It will trigger if there is a rally to above the May 1 high. That double top is the neckline. If the bulls get their breakout, they will look for a measured move up.

The EUR/USD is still in a trading range

Legs in trading ranges reverse much more often than they continue into trends. The EUR/USD is now at the bottom of a month-long trading range. A reversal up for 2 – 3 weeks is more likely than a bear breakout.

But until there is a breakout, the chart is still in Breakout Mode. That means the probability can never be too far from 50-50 for the bulls or bears.

The bulls currently have about a 55% chance of a rally to the top of the range. The probability will go up if they get a couple big bull bars this week.

Overnight EUR/USD Forex trading

The 5 minute chart of the EUR/USD Forex market traded below yesterday’s low and reversed up to above yesterday’s high. Today is an outside up day, which is a sign of strong bulls. The location at the bottom of a month-long trading range is good for the bulls. Traders are wondering if today is the start of a 2 – 3 week rally.

The bulls want today to close near its high and above yesterday’s high. That would indicate buying pressure and it will attract more buyers. It would increase the chance that a rally has begun on the daily chart.

The bulls have already accomplished their goal of creating an outside up day. They do not need the EUR/USD to go any higher today. That reduces the chance of a big bull trend from here today.

But they still want today to close above yesterday’s high and near today’s high. Consequently, they will buy 20 pip selloffs today.

The bears always want the opposite of the bulls. But the overnight bull channel has been tight. That makes it very difficult for the bears to make money shorting. They need to stop the bull trend and begin a trading range.

That will probably happen at some point. If there is a 30 pip selloff, the day traders will begin to sell rallies for scalps, in addition to buying pullbacks. Until they, it will be easier to make money buying pullbacks.

An outside up day has a 20% chance of a reversal back down to below yesterday’s low. If there is a strong reversal down today, day traders will consider that possibility.