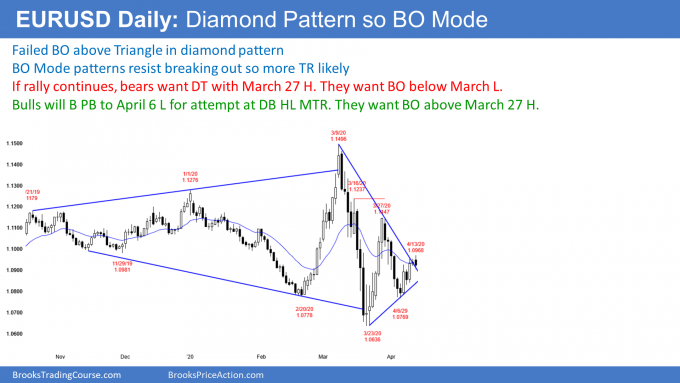

The daily chart of the EUR/USD Forex market is at the apex of a diamond pattern. That is a triangle following an expanding triangle. It broke above the bear trend line overnight. But so far, today is a bear bar. If it closes near its low, it will be a sell signal bar for tomorrow.

A breakout from a Breakout Mode pattern has a 50% chance of failing. The bears want a reversal down to below the March low. But if today is only a minor pullback and the rally continues, they will try for a double top with the March 27 high.

If the bears are successful at turning the EUR/USD down today, the bulls will try to form a double bottom with the April 6 low.

Trading ranges resist breaking into trends

A Breakout Mode pattern is a trading range. A trading range resists breaking out. Consequently, reversals are more likely than a breakout into a trend. Traders will sell reversals down and buy reversals up.

If today closes near its low, it would be a minor sell setup. If it closes near its high, it will be a continuation of the minor rally that began last week.

Last week was a buy signal bar on the weekly chart. Today triggered the buy by going above last week’s high. It is currently more likely that the EUR/USD will continue up to the March 27 high than reverse down to the April 6 low.

Overnight EUR/USD Forex trading

The 5 minute chart of the EUR/USD Forex market broke above last week’s high overnight. That triggered a weekly buy signal.

It quickly reversed down to below Friday’s low. Today is now an outside down bar on the daily chart. If it closes near its low, it will be a sell signal bar for tomorrow. But, it reversed up over the past 2 hours.

Even though the EUR/USD sold off for the past 6 hours, the bars were small. Most had prominent tails and most overlapped prior bars. The bear trend has been week.

Also, it reversed down from above last week’s high and up from below Friday’s low. These reversals and the weak bars on the 5 minute chart make a strong trend day unlikely. Traders have been scalping, looking for reversals.

Since the past 6 hours have been down, it has been easier to make money selling. But most of the bars have been sideways. Today will probably remain a small, scalping day.