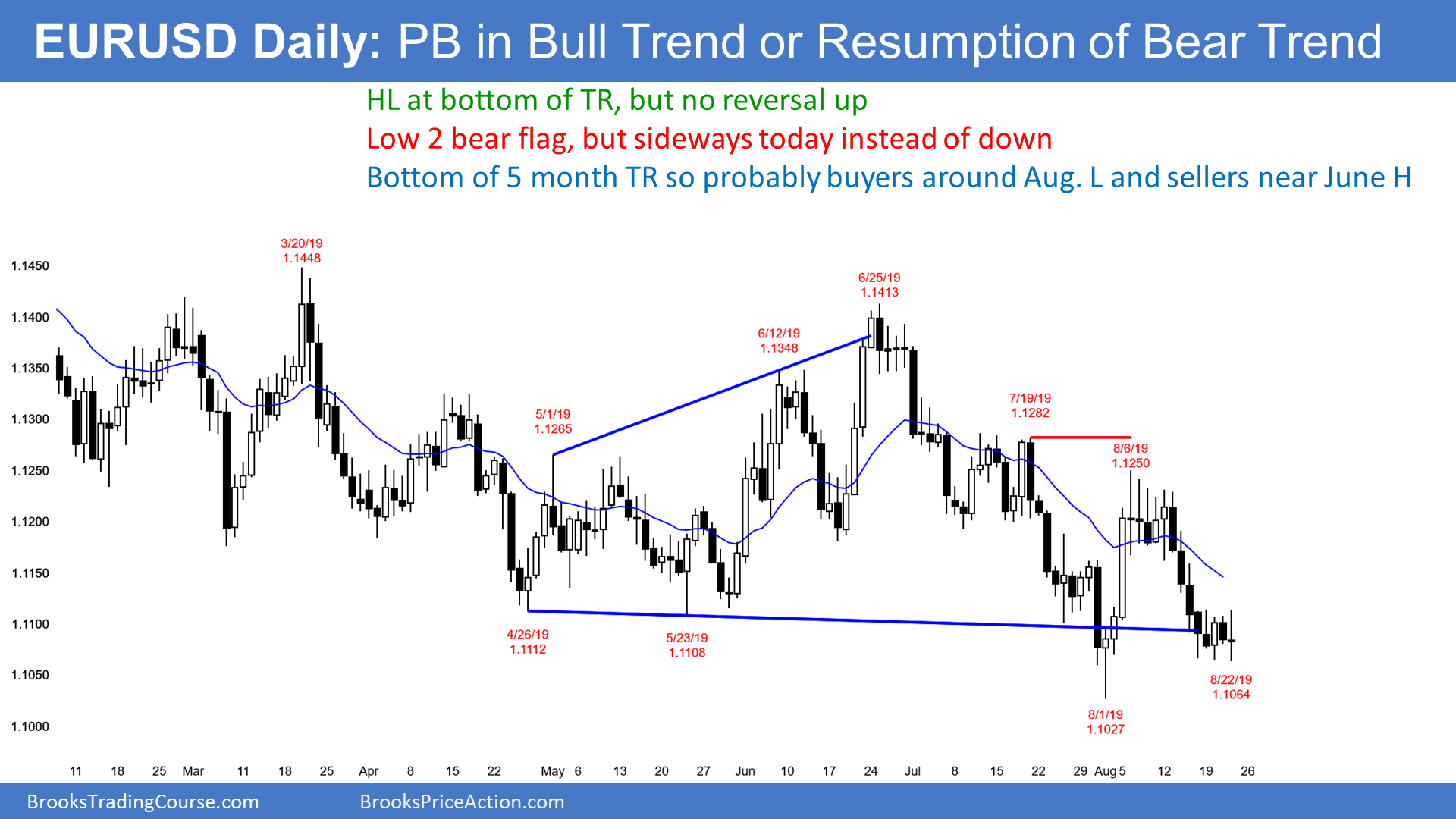

Yesterday was a bear day on the daily chart and the 2nd sell signal bar in 3 days. It was therefore a Low 2 bear flag sell setup. When today went below yesterday’s low, today triggered the sell signal. Since it also went above yesterday’s high, today is now an outside day.

Today triggered both a minor buy signal and a minor sell signal. But the range is small and it is the 5th day in a tight trading range. Traders are deciding if the 2 week selloff will lead to a new low or a higher low. The odds are 50% for each possibility.

However, since every new low over the past year reversed up for a few weeks, traders will look for a reversal up within the next couple weeks from either a higher low or from below the August low.

Overnight EUR/USD Forex trading

The EUR/USD 5 minute Forex chart rallied to above yesterday’s high and then reversed down to below yesterday’s low. It quickly revered back up to the middle third of the overnight range.

The selloff was in a tight bear channel. Today will probably not get back above the overnight high. While the bears want a trend down from the 25 pip bounce over the past hour, tight trading ranges resist breaking out. Consequently, the bears will probably not get a big move down from here. Traders are expecting a continuation of the 5 day tight trading range.

If there is going to be a trend today, down is more likely than up after the selloff from above yesterday’s high to below its low.