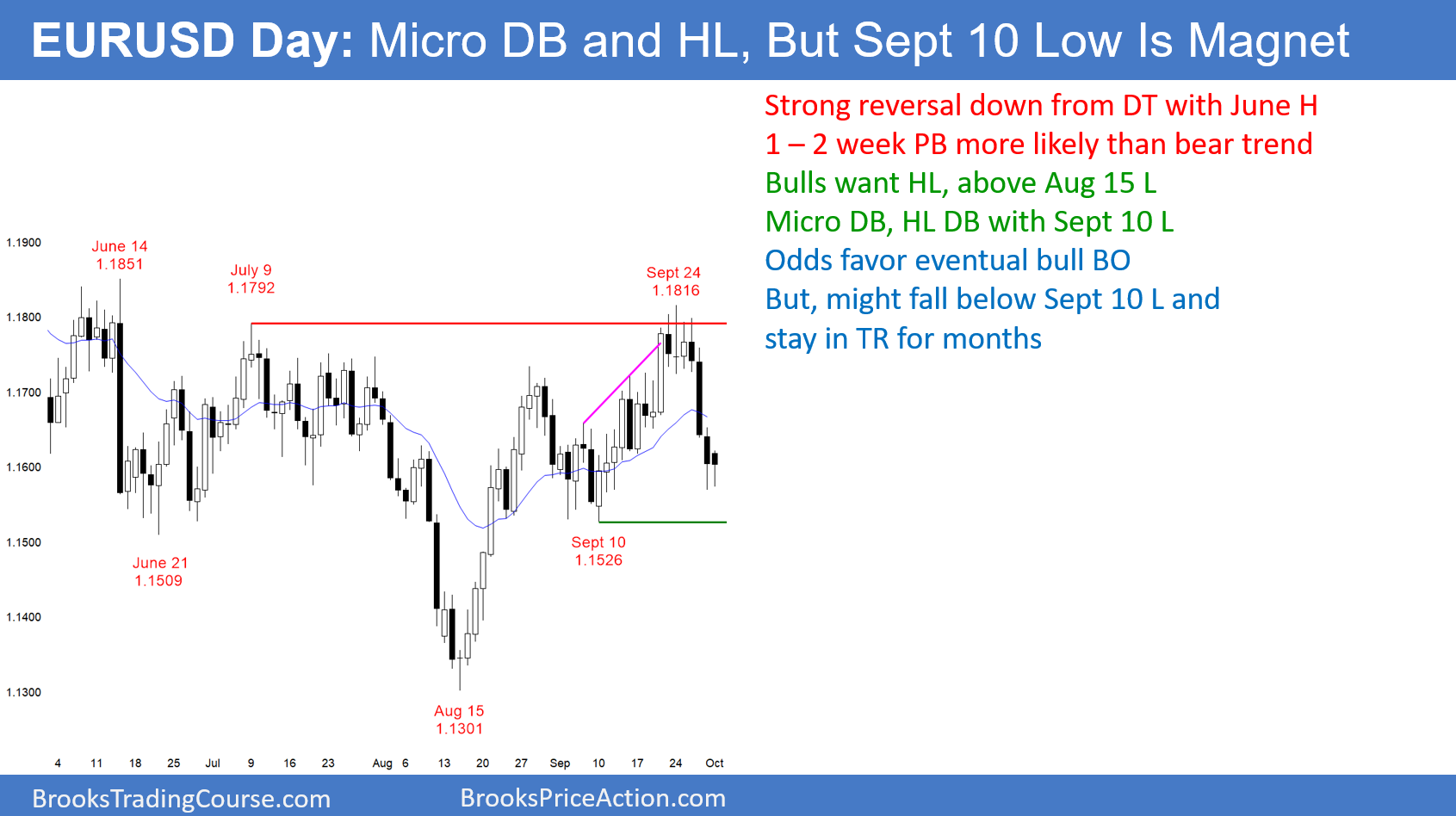

The EUR/USD daily Forex chart sold off sharply last week. But, after September’s strong reversal up, the odds favor a higher low around the September 10 low and 1.15.

While last week’s selloff from a double top on the EUR/USD daily Forex chart was strong, the bulls will probably get a higher low. The September 10 higher low and 1.15 are support, and are near the 50% pullback. Support is a magnet. Therefore, the odds favor slightly lower prices within a couple of weeks.

Since the chart is now in an early bull trend, the bulls will try for form a higher low. They would like the bull trend to resume quickly. But, the chart typically will get a 2nd leg down after last week’s buy climax at resistance. Consequently, if there is a 2 – 3 day rally this week, the bears will probably get a lower high and then a test of 1.15.

Since the daily chart is in the middle of a 5 month trading range, it could stay here for months before successfully breaking out. Therefore, traders will look for reversals after ever 1 – 2 week leg, no matter how strong.

Low 2 bear flag at 20 week EMA on weekly chart

Last week is a Low 2 sell signal bar on the weekly chart. The bulls are buying its low to prevent the weekly sell signal from triggering.

The odds favor a move below last week’s low this week, which would trigger the sell signal. But, the daily chart is in a bull trend. In addition, the 8 month selloff is probably a bull flag on the weekly chart. As a result, the reversal down on the weekly chart will probably only last 1 – 2 weeks before the 6 month trading range resumes.

Overnight EUR/USD Forex trading

The EUR/USD 5-minute Forex chart rallied 50 pips overnight from just above last week’s low. Today is forming a micro double bottom with Friday’s low. Since last week’s selloff was strong, this rally will probably form a lower high between 1.1650 and 1.17. Therefore, the bulls will take profits after any 30 – 50 pip rally and the bears will begin to sell.

The bulls would like the week to reverse last week’s selloff. Although this is possible, after a parabolic wedge top, a 2nd leg down is likely. Therefore, day traders will bet that every move up or down will not get far. They will take quick profits. Since last week was a sell climax to a support zone, the bulls will buy reversals up. With the bulls buying low and the bears selling high, this week will have a lot of trading range trading.