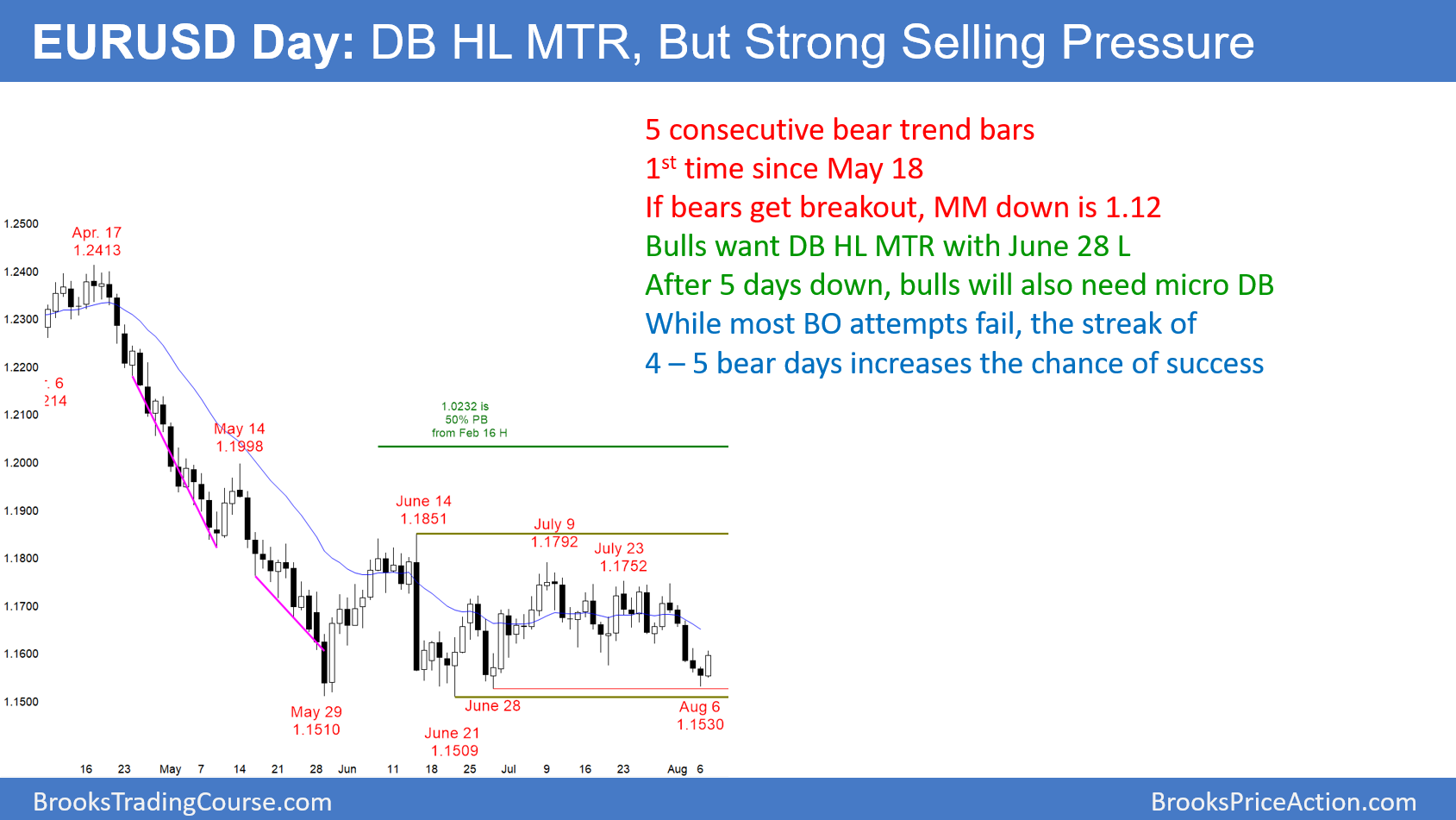

The EUR/USD daily Forex chart is reversing up from a double bottom with the June 28 low. Both bottoms are above the June 21 bottom of the bull trend reversal. Therefore, this is a double bottom higher low major trend reversal attempt. However, the 5 consecutive bear days makes a bear breakout slightly more likely.

The EUR/USD daily Forex chart yesterday formed its 5th consecutive bear day yesterday. This is the 1st time that the chart has had more than 4 consecutive trend days up or down since the trading range began on May 29. Because this selling pressure is unusual, it increases the chance that it is the start of a bear breakout.

Most breakout attempts fail, even when they are strong, like this one is. However, after 5 bear days, the bulls will probably need at least a micro double bottom over the next few days before they can erase what the bears have accomplished.

The bears will try to stop the bull reversal up from the bottom of the trading range. Typically, they would create a double top bear flag just below the 20 day EMA.

The odds are that the Emini will bounce today and maybe tomorrow. It will then form a small trading range. The range will have a small double top bear flag and a micro double bottom. The direction of the breakout of that small pattern will probably determine what the daily chart will do over the next month.

If the bulls get a strong reversal up, the 3 month trading range will continue. In addition, they will hope for a breakout above the top of the range at 1.1850. However, if the bears get consecutive closes below the June 21 low and 1.15, the chart will probably work down to around 1.12.

Overnight EUR/USD Forex trading

The EUR/USD 5 minute Forex chart rallied 50 pips in Europe overnight. But, a tight trading range is likely over the next week. Consequently, the rally will probably stall between 1.1600 and 1.1650. The legs in the upcoming tight trading range on the daily chart typically last only a day or two. Therefore, traders will look for reversals after 1 – 2 days up or down. They expect both a double top and a double bottom between 1.15 and 1.1650 over the next week.

If the rally reaches 1.17, the odds of the bear breakout below the 3 month range drop back to where they were last week. The chart would be back to neutral.