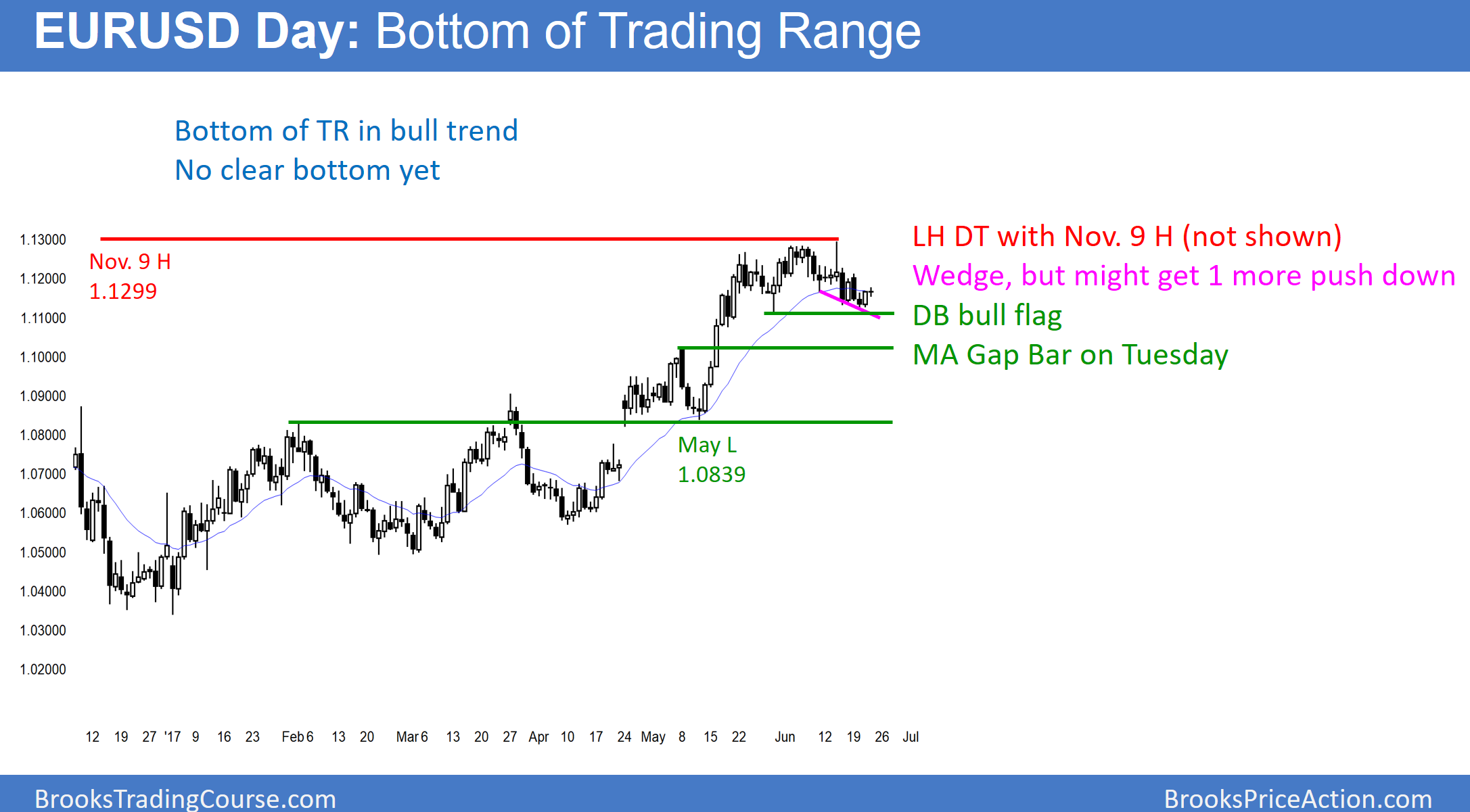

The EUR/USD daily Forex chart has been sideways for 5 weeks.

The selloff from the small wedge top now has 3 pushes down and is a wedge bull flag. Yet, the 1st leg down was strong enough to have 2 more legs. Furthermore, there is room to the bottom of the range. Hence, the odds still slightly favor one more push down before the bulls break above the November 9 major lower high.

The daily EUR/USD Forex chart is in a 5 week bull flag at the moving average. In addition, there is a gap between Tuesday’s high and the moving average. It is therefore a moving average gap bar. Consequently, the odds favor a test of the high from 2 weeks ago. Furthermore, the momentum up in May was strong enough to make a move above the November 9 major lower high likely.

Yet, last week’s reversal down was strong. It was therefore likely a spike in a spike and channel bottom. Therefore, the odds favor at least one more 50 pip move down to the bottom of the 5 week range. Because there is already a wedge bull flag pullback to the moving average, it is possible that the pullback has already ended. The bulls need a strong rally to make traders believe that the EUR/USD has resumed its bull trend.

There is always a bear case. At the moment, there is a 40% chance of a bear breakout below the 5 week range. If it is strong, the target would be a measured move down to around 1.0840. That is both the May pullback low and the top of the 5 month trading range.

Overnight EUR/USD Forex trading

The 5 minute chart has been in a 20 pip range for the past 6 hours. Consequently, day traders are continuing to look for 10 pip scalps. They are waiting for a strong breakout up or down. This might come today when the US Senate reveals its healthcare proposal.