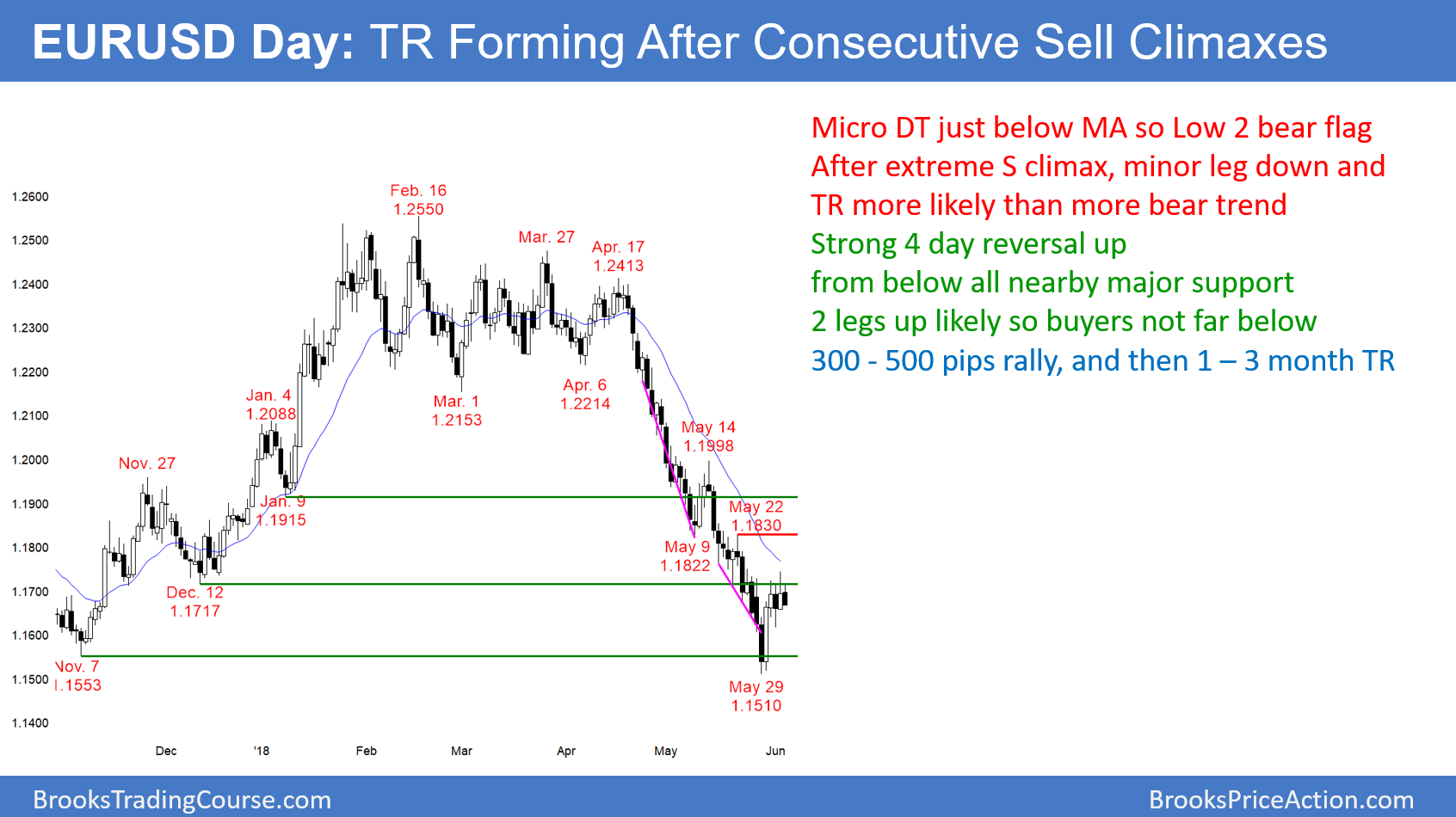

The EUR/USD daily Forex chart formed a 3 day micro double top just below the 20 day EMA. Since this came after an extreme sell climax, the odds are that there will be buyers not far below and then a 2nd leg sideways to up.

The EUR/USD daily Forex chart collapsed in consecutive parabolic wedge sell climaxes to just below weekly support last week. It then quickly rallied 200 pips. The odds are that it has begun to evolve into a trading range. Therefore, the overnight Low 2 bear flag is more likely to lead to a minor leg down. The bulls will buy the selloff, even if it falls below last week’s low.

A sell climax usually leads to at least 2 legs up. The 4 day rally is either the 1st leg up or the start of the 1st leg up. There is less than a 40% chance that this bear flag will fall for a 200 pip measured move down from below last week’s low. However, if today closes near its low, the bears will sell below today’s low for a about a 50 pip scalp. They know that there will be buyers not far below, like around a 50% pullback from the 4 day rally.

Overnight EUR/USD Forex trading

The EUR/USD 5 minute Forex chart sold off 50 pips over night and 80 pips from yesterday’s high. Since a trading range is likely, day traders will look to trade reversals for 10 – 30 pip scalps.

If today closes near its low, tomorrow will probably fall at least 20 pips below today’s low. But, the bulls will look for a reversal up from below today’s low. They expect at least a 50% retracement of the 4 day rally.

The fight today is over the close on the daily chart. The bears want the day to close near its low so that today will be a stronger sell signal bar on the daily chart. That would increase the chance of a bigger move down tomorrow.

The bulls want today to close above its open, which is only about 25 pips above the current price. If so, today will be a weak sell signal bar on the daily chart. The bulls tomorrow would be more willing to buy just below today’s low and scale in lower, instead of waiting for a 50% retracement before buying.

Trading range more likely than another leg down

Since the daily chart has been in a strong bear trend, there is always a 40% chance that there will be another leg down far below last week’s low before the trading range begins. Consequently, day traders will swing trade shorts if there is a strong bear trend on the 5 minute chart today.

A new leg down does not have to be another collapse. In fact, that is unlikely. Therefore there is only a 20% chance of a strong bear or bull trend today. It is more likely that today will be a 3rd consecutive trading range day. This is because the daily chart is evolving from a bear trend into a trading range.