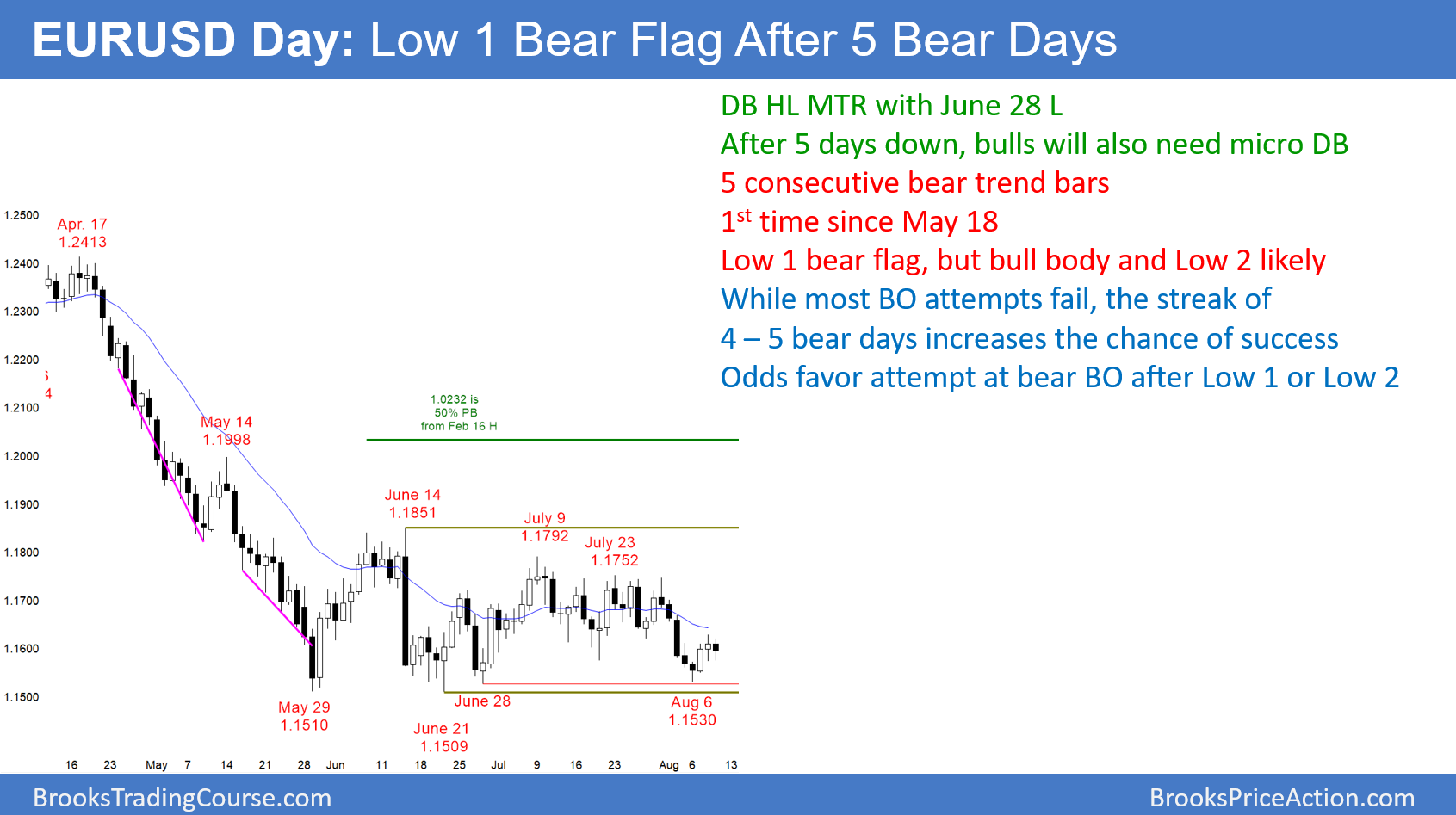

The EUR/USD daily Forex chart rallied for 2 days from a double bottom with the June 28 low. However, after 5 bear bars, the bulls will need a micro double bottom. Furthermore, the odds now favor a break below the June low after a micro double top bear flag.

The EUR/USD daily Forex chart had 5 consecutive bear trend bars. While they were not big, that is the longest streak up or down in the 3 month trading range. Charts have 2 variables, price and time. Sometimes, time is more important. This selling pressure now makes a bear breakout likely within a couple of weeks.

Yesterday is a Low 1 bear flag, but it was a bull bar and the 5 bear bars were not all big. Therefore, the bears will probably need 2 failed small rally attempts before they can get their breakout. The odds are the daily chart will trade down for a day or two and bounce from a micro double bottom. Then, the bears will try for their breakout after a micro double top (Low 2) bear flag. This means that the daily chart will probably be in a tight range for several more days.

Overnight EUR/USD Forex trading

The EUR/USD 5 minute Forex chart is in the middle of a 45 pip overnight trading range. In addition, it is probably also in the middle of a 100 pip tall tight trading range that will last several more days. Day traders will look to buy reversals up from below the prior day’s low and sell reversals down from above the prior day’s high. In addition, they will trade any small reversal on the 5 minute chart and be quick to take profits.

There is a 60% chance of a bear breakout on the daily chart and a 40% chance of a strong reversal up. Either would require a strong trend on the 5 minute chart. But, neither is likely for at least a few days.