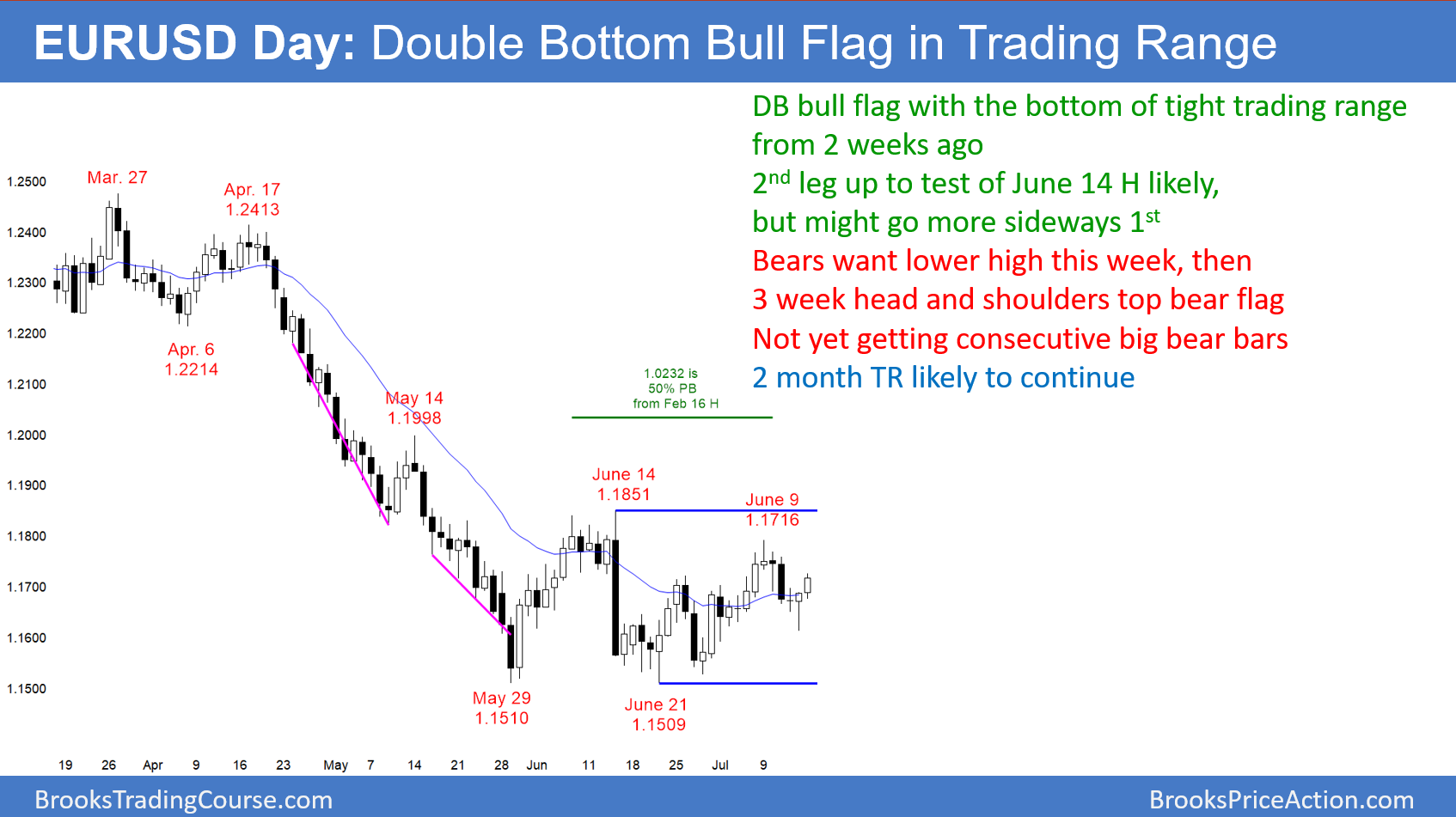

The EUR/USD daily Forex chart has been in a trading range for 2 months. Every trading range has both a bull and a bear setup. Because this trading range followed an extreme sell climax, the odds are that there will be a test of the top of the range. That is the June 14 high.

Friday was a bull reversal bar on the EUR/USD daily Forex chart. It was also a double bottom bull flag with the bear bar from 2 weeks ago. The bulls want a rally up from here.

Because the June 14 sell climax was extreme, its high is a strong magnet. This is especially true since the May selloff followed consecutive parabolic wedge sell climaxes on daily chart down to major support on the weekly chart. Therefore, the odds favor a rally to 1.1850 before a break to a new low.

Furthermore, the May 14 bear flag rallied to within 2 pips of the 1.20 Big Round Number. In addition, it was not tested. An untested important price usually gets tested. As a result, there is at least a 50% chance of the bear rally continuing up to 1.20 over the next 2 months.

If the bears begin to get consecutive big bear bars and a strong break below 1.15, then this 2 month bear flag will have ended. They will then try for a 300 pip measured move down to 1.12 over the next few months. However, the odds favor at least another 1 – 2 months of sideways to up trading before the probability will begin to shift again in favor of the bears.

Overnight EUR/USD Forex trading

After Friday’s bull reversal bar on the daily chart, the EUR/USD 5 minute Forex chart rallied 50 pips overnight. However, this rally is small and it lacked consecutive big bull trend bars on the 5 minute chart.

Day traders have been scalping, and today so far is a weak entry bar on the daily chart for the bulls. If today remains small, which is likely, the 2 week tight trading range will continue. Day traders will keep scalping longs and shorts until there is a series of big trend bars up or down on the 5 minute chart. This is true despite Friday being a good bull reversal bar at support on the daily chart.

Trading ranges have inertia. That means that there is a strong tendency to continue doing what they have been doing. The 200 pip tight trading range that began with the July 2 low will probably continue for at least a few more days. Therefore, the 100 point rally over the past 2 days will probably begin a 50 pip pullback today or tomorrow.