- German Factory Orders jump 7.0%

- US nonfarm payrolls expected to dip to 200,000

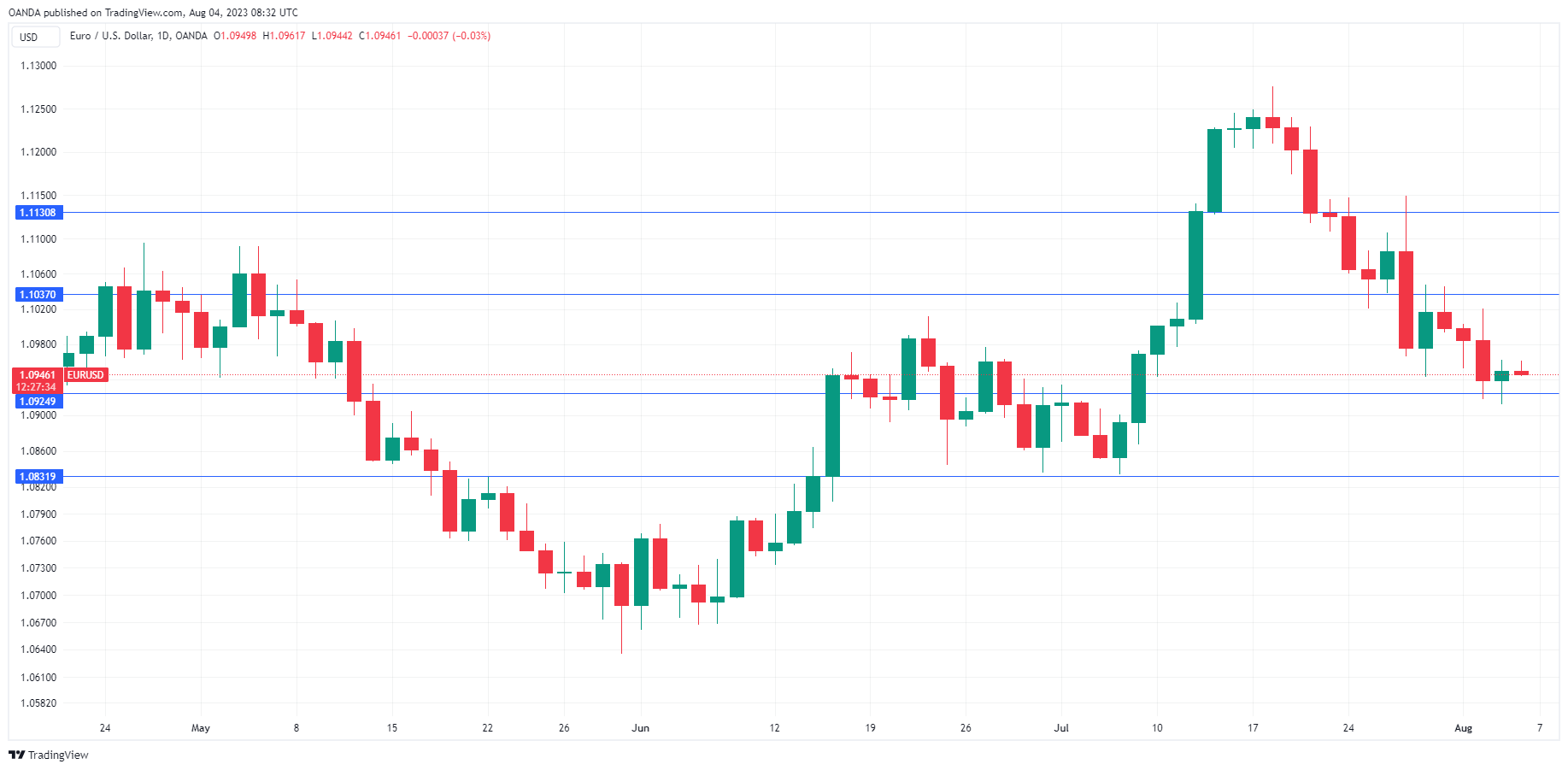

- 1.0924 remains under pressure in support. Below, there is support at 1.0831

- There is resistance at 1.1037 and 1.1130

The euro is almost unchanged on Friday, trading at 1.0952. We could see some movement in the North American session, with the release of US nonfarm payrolls.

The euro has shown sharp swings lately. EUR/USD climbed to 1.1275 on July 18th, its highest level since February 2022. It has been all downhill since then, with the euro tumbling over 300 basis points.

Soft German PMIs reflective of weak eurozone economy

It hasn’t been the best week for Germany, the largest economy in the eurozone and the bellwether of the bloc. The July PMIs pointed to deceleration in both services and manufacturing. The Services PMI remained in expansion territory but slipped from 54.1 to 52.3, its lowest level since February. Manufacturing is in terrible shape, with the PMI falling from 40.6 to 38.8, its weakest reading since May 2020. German retail sales declined 0.8% in June, down from 1.9% in May.

The week did end with some good news, as German Factory Orders jumped 7.0% m/m in June, up from 6.2% in May and blowing past the consensus estimate of -2.0%. We’ll get a look at German Industrial Production on Monday and CPI on Tuesday.

For the ECB, the weak numbers out of Germany are an indication that the central bank’s tightening cycle is working, but what comes next is a tricky question. Inflation has slowed to 5.5%, but that is much higher than the 2% target. The ECB hasn’t paused its rate hikes since the tightening cycle began in July 2022 but there is some pressure on the ECB to take a break at the September meeting in order to avoid a recession.

ECB President Lagarde is keeping mum, saying that a pause or a hike are both on the table. With no guidance from the ECB, about all investors can do is keep an eye on inflation and employment releases, which will be crucial to the ECB’s decision at the next meeting.

Markets expect soft US nonfarm payrolls

All eyes are on nonfarm payrolls, one of the most important US releases. In June, a massive ADP employment report fuelled expectations that nonfarm payrolls would also soar. In the end, nonfarm payrolls fell to 209,000, down sharply from a downwardly revised 306,000. ADP again soared this week with a reading of 324,000. We’ll have to wait and see if nonfarm payrolls come in around the consensus estimate of 200,000 or follow ADP and move sharply higher.

EUR/USD Technical