- EUR/USD retains neutral phase in short term.

- MACD and RSI extend bearish momentum.

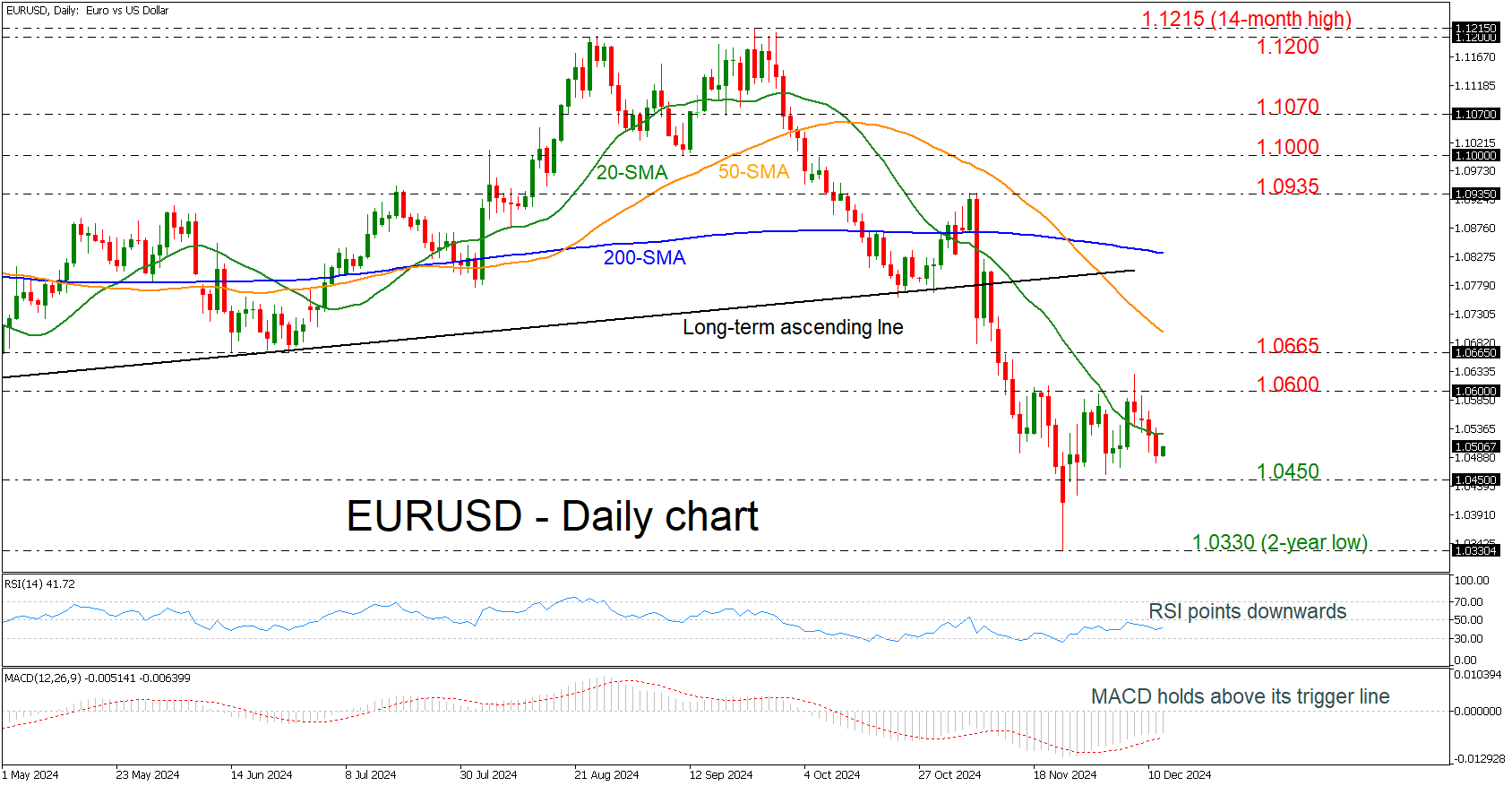

- EUR/USD has been strongly bearish since it peaked at 1.1215.

EUR/USD slides significantly after the failed attempt to surpass the 1.0600 round number and is currently challenging the 1.0500 handle. The pair has remained in a tight range of 1.0450–1.0600 over the last month, with the technical oscillators suggesting more declines. The RSI indicator is falling below the neutral threshold of 50, while the MACD is extending its negative momentum below the zero level.

More downside pressure could see traders revisiting the 1.0450 barrier ahead of the two-year low of 1.0330. Even lower, the pair may have a pause near November 2022’s low of 1.0220.

On the other hand, a climb above the 20-day simple moving average (SMA) at 1.0530 could send traders back to the 1.0600 key level again. If this time the market proves strong enough to break that area, then the next resistance could come from 1.0665.

To conclude, EUR/USD has been strongly bearish since it peaked at 1.1215, and only a rally above the 200-day SMA at 1.0830 may switch the outlook to bullish.