- The Euro’s appeal has diminished due to expectations of ECB rate cuts, fueled by softer economic data and dovish policymaker comments.

- The US Dollar is gaining strength amid Middle East tensions, potentially attracting safe-haven flows.

- EUR/USD has formed a double-top pattern at 1.1200 and is facing immediate support at 1.1000.

The Euro has lost some of its appeal over the past two weeks as softer data has increased the likelihood of an October rate cut. ECB Policymakers have struck a dovish tone as well with German Economy Minister Robert Habeck stating rate cuts are coming too slowly for his liking.

This should come as no surprise to anyone who has been following developments around the German economy over the last 12 months. Europe’s most industrialized economy which is usually a driver of growth is struggling.

Yesterday’s inflation data from the EU has ramped up rate cut expectations which means Minister Habeck may soon get his wish. This was followed by a UBS warning today that the ECB may have to drop rates to the 1-1.5% range if growth does not improve in the coming quarters. As many analysts have suggested, the ECB may pivot its focus to growth now that inflation appears out of the way.

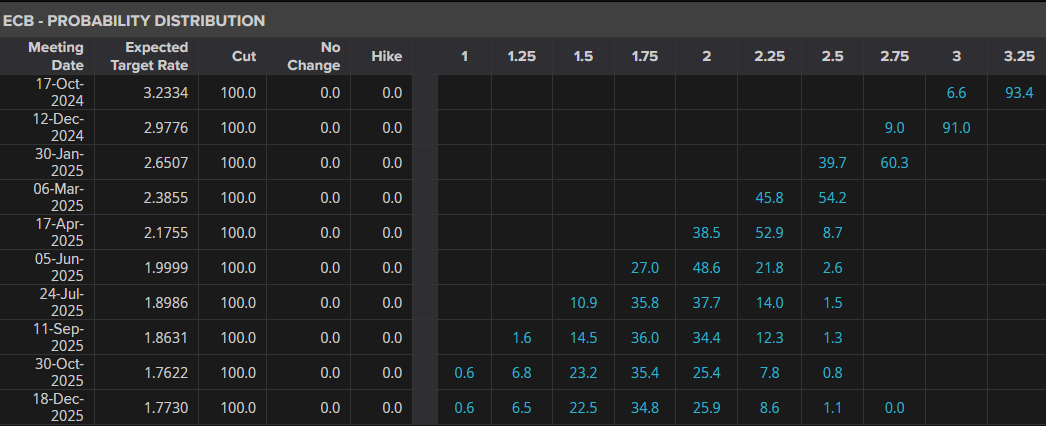

Markets are now pricing in around six consecutive rate cuts from the ECB starting in October. A 25 bps cut in October is now priced at around 93% which is a stark increase from where we were a month ago.

Source: LSEG

This could not come at a worse time for the Euro as the DXY has begun a recovery and may also benefit from some safe-haven flows. The increasing tension in the Middle East could reignite some safe haven appeal in the US Dollar and thus weigh further on EUR/USD.

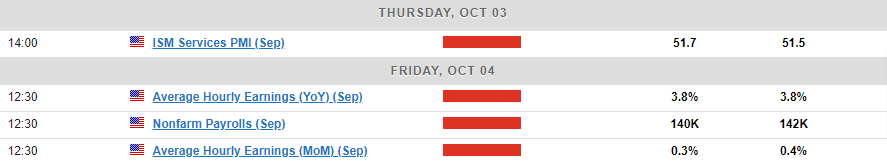

There is of course still some data ahead this week with the NFP report on Friday likely to lead to some volatility as well. Markets have shifted their focus in the US to the Labor market and thus the importance of Friday’s release. If the US unemployment rate remains steady I could see EUR/USD revisiting the 1.1000 handle and possibly lower.

Technical Analysis

EUR/USD has been on a steady move lower since forming a double top pattern at the key 1.1200 handle. The move has been swift and this leaves the door open for a potential retracement before the next leg to the downside.

Immediate support is at the 1.1000 psychological level with a break below opening up a retest of 1.0950. The 100-day MA rests at 1.09260 and would be the next hurdle to pay attention to.

Conversely, a bullish move from here first needs to gain acceptance back above the 1.1100 handle before the recent highs and double at 1.1200 become an area of focus.

The NFP report on Friday could be a catalyst for a significant move in either direction while further escalation in the Middle East could increase the US Dollars’ haven appeal and push EUR/USD below the 1.1000 handle.

Support

- 1.1000

- 1.0950

- 1.0900

Resistance

- 1.1100

- 1.1200

- 1.1300