ECB Expected to Hold Rates at 4%

The euro is barely making a peep on Thursday, ahead of the European Central Bank’s decision later in the day. In the European session, EUR/USD is trading at 1.0894, down 0.04%.

ECB Expected to Hold Rates

The ECB is expected to follow the Federal Reserve’s pause and hold the deposit rate at 4.0% for a fourth straight time. Have ECB rates peaked? The answer seems yes, but ECB policy makers are unlikely to confirm that tightening is over, as concerns remain that inflation is not yet beaten. CPI is down to 2.6%, but core CPI is at 3.1% and service inflation is running around 4%.

Inflation is on a downtrend, but the battle to bring down inflation to the ECB’s 2% target is not over. In what sounds like a Jerome Powell sound bite, ECB members have been saying that there is no rush to lower rates. The markets have priced in 90 points in cuts for 2024, with a first cut expected in June.

The ECB will likely hold rates again today, which means that investors will be focused on the central bank’s economic outlook. The ECB is expected to revise lower its inflation forecast and ECB President Lagarde will likely address the inflation outlook in her press conference.

More of the Same From Powell on the Hill

Anyone looking for some insights about rate policy from Federal Reserve Chair Powell’s testimony on Capitol Hill on Wednesday was no doubt disappointed. Powell essentially doubled-down on a script we’ve heard before, which is that the Fed is planning to cut interest rates this year but please don’t hold your breath, as inflation is not where it needs to be and the Fed will remain cautious.

Powell did not give any hints about the timing of a rate cut except to say that the timing was not yet right. Powell said that the Fed would carefully monitor data and the economic outlook before making any moves and that the Fed had to first gain “greater confidence that inflation is moving sustainably toward 2 percent”.

Powell signaled that rates have likely peaked, saying that the Fed’s “policy rate is likely at its peak for this tightening cycle”. This means that the Fed’s rate path will probably remain in a holding pattern of “higher for longer” until the Fed sees clear evidence that inflation has been subdued. The markets have priced in three rate cuts this year, with June the likely date for the initial cut.

EUR/USD Technical

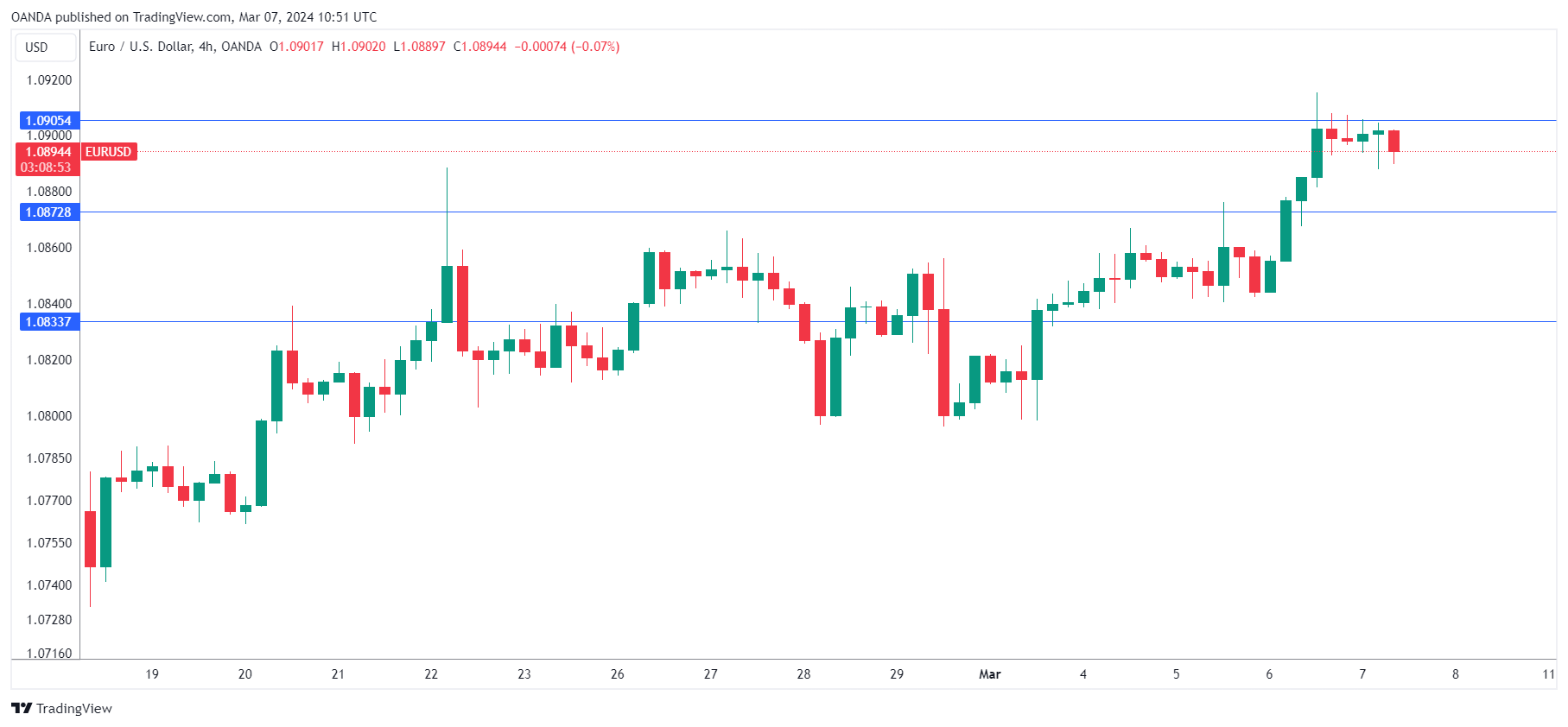

- EUR/USD is testing resistance at 1.0905. Above, there is resistance at 1.0944

- 1.0872 and 1.0833 are providing support