Expectations of the results of the Fed meeting and the presentation of the draft Italian budget contribute to the consolidation of the EUR/USD

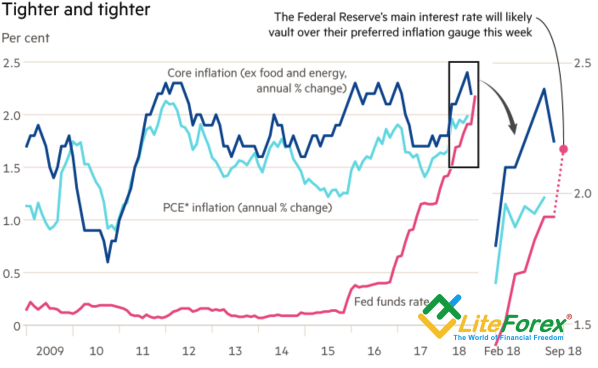

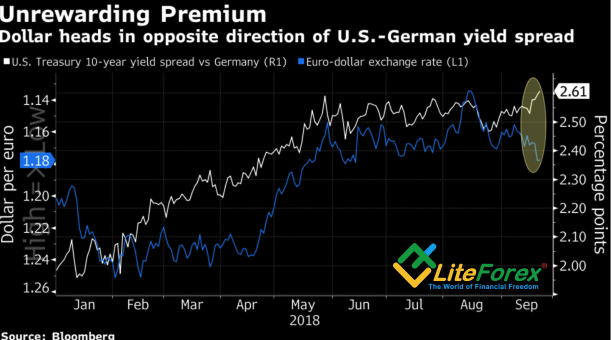

If you have just started studying fundamental analysis and hope that it will help to earn steadily in the future, the September weakening of the dollar can seriously shatter your faith. Over the past four weeks, the USD index has lost about 3% despite a strong economy, a healthy labor market, rising wages and the Fed's willingness to tighten monetary policy in September and December. The federal funds rate will exceed inflation for the first time in the last 10 years, and the last time a gap like this between the yields of US and German bonds took place in the 1980s. Then the differential of consumer prices in the two countries reached 3 pp. Now they are approximately at the same level. The EUR/USD should be traded significantly lower, but the reality turned out to be different.

Dynamics Of Inflation And Federal Funds Rate

Source: Financial Times.

Dynamics Of The EUR/USD And Bond-Yield Spread

Source: Bloomberg.

In order to stop being mad at fundamental analysis you need to understand two things. First, it is dynamic. Second, Fear and Greed rule the market. What you see in the form of macroeconomic statistics is a fait accompli. It's played. Investors believe in four acts of monetary restriction by the Fed in 2018, but do not know how the central bank will behave in 2019. CME derivatives hope for two rate hikes, FOMC forecasts say three, Goldman Sachs (NYSE:GS) expects four. If the tightening of the monetary policy by the Fed in September and December, as well as the increase in import duties by Washington and Beijing, are already priced in the quotes of dollar pairs, can greenback grow? And if it does not grow, what will happen in the minds of speculators that have increased net-longs at the USD index to multi-month highs? Exactly! Fear will reign there! Fear of losing profits. As a result, positions are closed, the EUR/USD is growing.

As for the yield differential between US and German bonds, the cost of hedging investments in dollar assets is so great that the return on purchases of Treasuries is comparable to investing in bonds of the eurozone or Japan. Why bring money to the States, if you can earn the same amount at home? As a result, the share of non-residents in the US Treasury bond market fell from 57% in 2008 to 41% in 2018.

The euro was unable to break above the base of the 18th figure against the US dollar due to weak statistics on the business activity of the eurozone, China's reluctance to negotiate with the States on trade, concerns about the Italian budget and investors' unhappiness ahead of the September FOMC meeting. And what if the Fed expresses confidence in the need for 3-4 rate increases in 2019 to prevent overheating of the economy? What if the eurosceptic government in Rome presents a draft with a deficit exceeding the EU requirements of 2-3%? Simultaneously, the weakness of the European PMI suggests that the euro does not have enough of its own trump cards, it enjoys the weakness of the opponent.

In this regard, until September 26-27, we are likely to expect consolidation of the EUR/USD around 1,165-1,185.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.