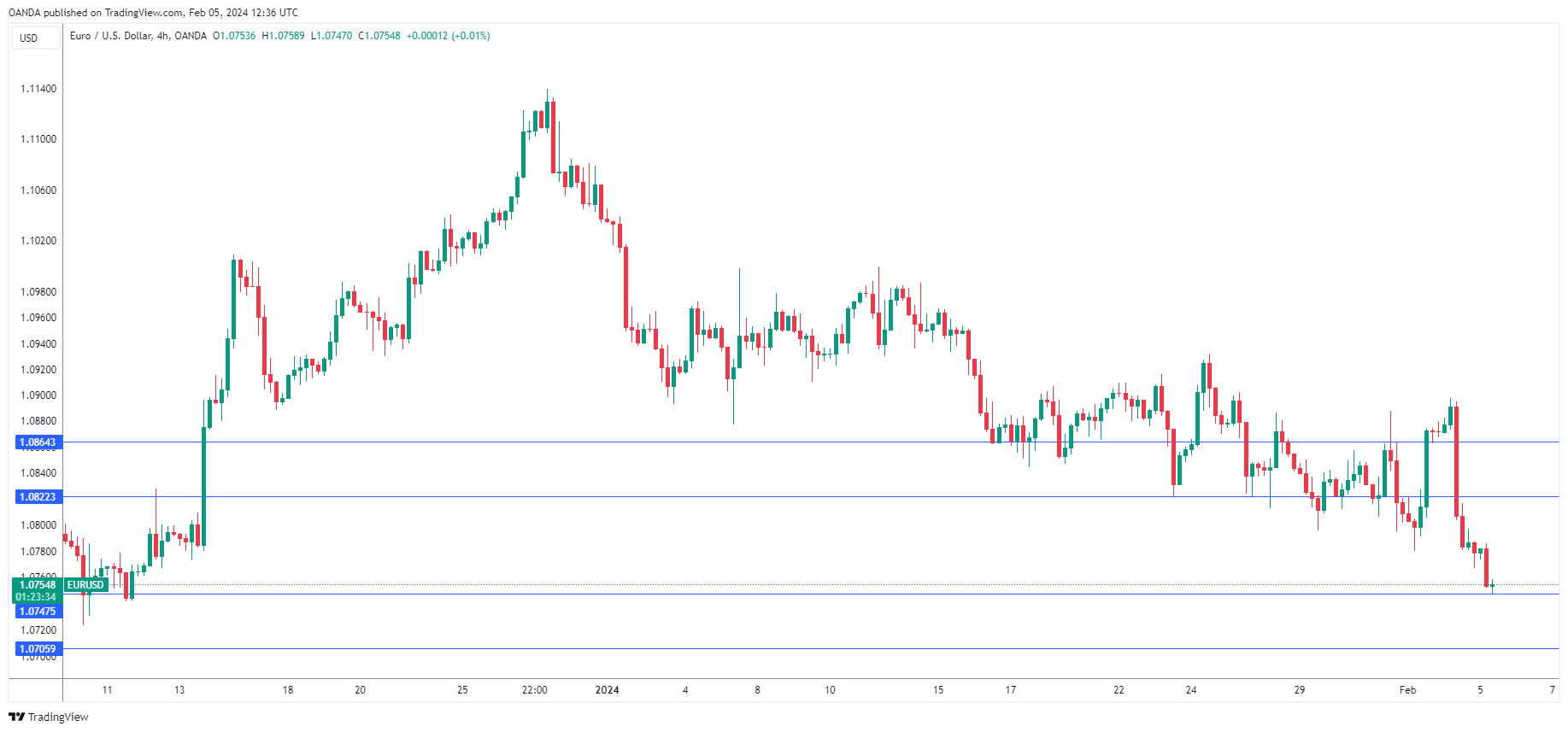

EUR/USD has extended its losses on Monday. In the European session, the euro is trading at 1.0749, down 0.34%. Earlier, the euro fell as low as 1.0747, its lowest level since December 11.

Red-Hot Nonfarm Payrolls Boosts US Dollar

The US dollar ended the week with sharp gains against the major currencies, courtesy of a sizzling nonfarm payroll report of 353,000. This beat the upwardly revised December reading of 333,000 (up from 216,000) and blew past the market estimate of 180,000. Wage growth beat expectations with a 0.6% gain m/m, up from 0.4% in December and higher than the market estimate of 0.3%.

The employment report points to a robust labor market which is helping to drive economic growth but is also contributing to inflation. At last week’s meeting, Federal Reserve Chair Powell poured call water on hopes of a March rate cut and the massive nonfarm payrolls report and strong wage growth have effectively ruled out a rate cut in March. According to the CME FedWatch tool, the Fed rate odds of a rate cut in March have dropped to 20%, compared to 47% just one week ago. The odds of a May cut stand at 64%, rising to 95% in June.

The markets were exuberant when Powell jumped on the rate-cutting bandwagon in December, but that excitement has largely dissipated, as Powell will be in no rush to lower rates with the economy continuing to churn out strong numbers.

In Europe, eurozone and German services PMIs continue to point to contraction, a sign that the eurozone and German economies are struggling. The January services PMI came in at 48.4 for the eurozone and 47.7 for Germany, both of which were lower than in December.

EUR/USD Technical

- EUR/USD tested support at 1.0747 earlier. Below there is support at 1.0705

- There is resistance at 1.0822 and 1.0864