Deeper political crisis in Italy encourages EUR/USD bears to storm the support at 1.146.

Strong economy - strong currency. It is the basic principle of fundamental analysis. However, its wrong use suggests that it doesn’t work.

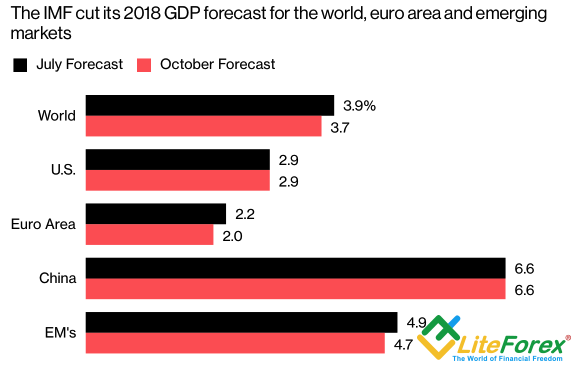

Nevertheless, it really works. The IMF has for the first time since 2016 lowered down its forecast for global economy growth to 3.7%, from 3.9%.

The expected pace of the GDP growth has remained the same for the USA, at 2.9%; for the Euro-area, it is down to 2%, from 2.2%. The growth-gap has been working to the EUR/USD bears’ advantage in the April-October period. The matter is how long its influence on the major currency pair will last.

The major reason for lower forecasts is the U.S. protectionism. According to the International Monetary Fund, the most negative scenario, including higher tariffs on the car imports, will result in a decline in the US and China’s GDP rates 0.9 bps and 1.6 bps already in 2016. Global economy will lose 0.8 bps in 2020 and will develop slower than its long-term trend during a few next years.

Source: Bloomberg

The worst problems are associated with the emerging markets, that are facing a double pressure. On the one hand, a slowdown in Chinese economy growth worsens the conditions for the goods and services exports to the largest global market; one the other hand, increased borrowing costs, resulted from the Fed monetary restrictions, inflates the demand for the U.S. dollar and results in the EM securities sales at the same time. The emerging markets’ TCHLIT MCSI 52 MSCI Emerging Markets (TA:TMCSI52), after the worst week since February, goes on declining, having renewed its 17-month low. In this environment, the growing interest in the U.S. equities is not surprising. Following impressive results in the second quarter, and a series of positive macro-economic data, hardly anybody thinks that the U.S. economy should somehow decline. Especially since Jerome Powell suggests that the U.S. economic expansion may be endless.

Euro is affected by Italian political situation. After the European commission had warned that the budget deficit of 2.4% from GDP didn’t correspond to its requirement, the League called the EU officials to be Italy’s enemies. Say, the EU has been setting down Italy’s economic development by fiscal consolidation programs for the last few years, forcing Rome into debt bondage. As a result, the gap between Italian and German bond yields continued to widen. According Morgan Stanley (NYSE:MS), the indicator may reach the critical value of 400 bps in the near future. The level was last time hit during the European debt crisis in 2012. The bank expects that in this situation the Italy’s government will have to make a compromise with the EU; the League argues that the voters don’t take spreads into consideration.

The single European currency marked the support close to $1.146; if it is broken through, the euro price is likely to move lower towards $1.136. It can result from the events in Italy and the higher U.S. inflation rate. If the Italian crisis eases for some time, the market will calm down and start consolidation, as it often happens ahead the important news release.

Share the post on the social networks and leave your comments below, it would be the best thanks :)

Stay updated of my articles by subscribing to trader blog. Fill in the form below and receive the latest articles in trader blog directly via your email.

Write your questions and comments below. I am eager to answer and explain.