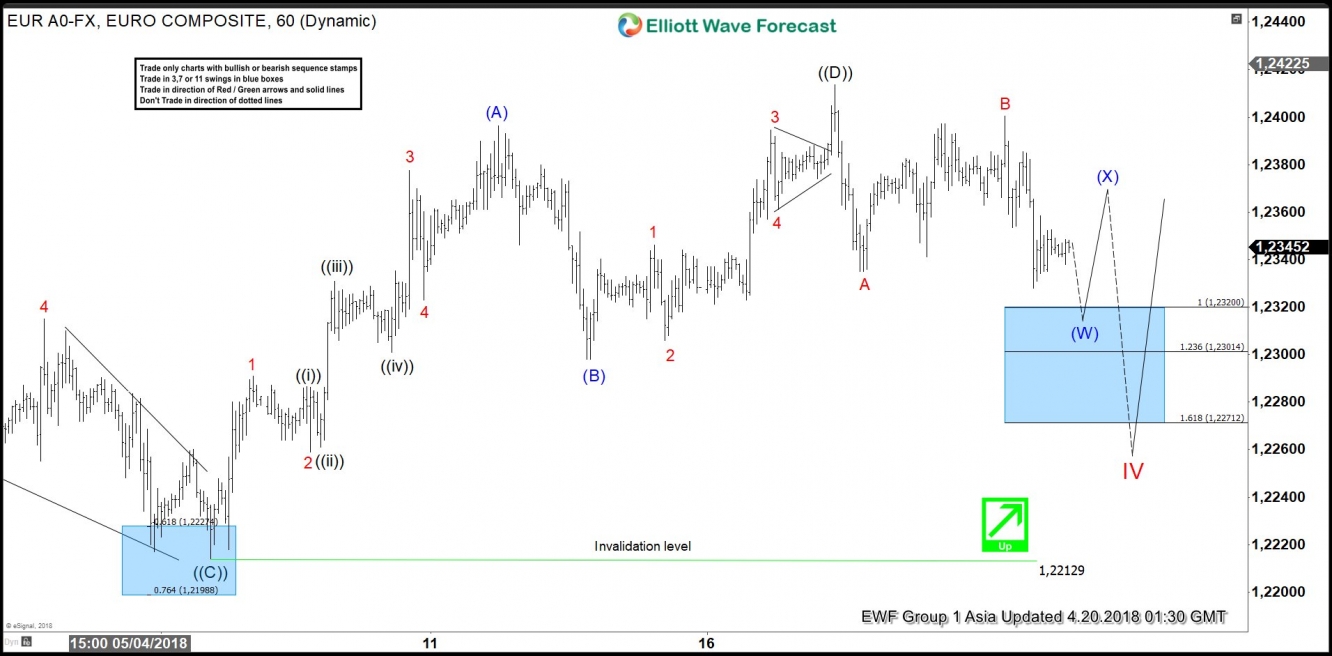

Short-term EUR/USD Elliott Wave view suggests that the pair remains in a sideways triangle range between 1.2554 and 1.2153 levels as mentioned in the previous post here. Until we break out of the range, we look for the sideways price action to continue. Triangle doesn’t have any particular trend, but it is generally a continuation pattern, thus the pair likely thrust higher to continue the previous bullish trend after the sideways action is over. If we take a look at the previous cycle from January 2017 low. The pair shows a higher high sequence thus the pair is favored to trade higher once triangle consolidation is complete. It’s important to note that the Triangle is labeled as A,B,C,D,E.

Currently, we can be in the final stage of triangle structure in Cycle degree wave IV where the decline to 1.2214 low ended Primary wave ((C)) of IV. Above from there, wave ((D)) of IV ended at 1.2414 high. The internals of primary wave ((D)) is unfolding as zigzag Elliott Wave structure where Intermediate wave (A) ended at 1.2396. Afterwards, Intermediate wave (B) pullback ended at 1.2298 low and Intermediate wave (C) of ((D)) ended at 1.2414 high. Down from there, Primary wave ((E)) of IV remains in progress as double three Elliott Wave structure looking to end Intermediate wave (W) of ((E)) in 3 swings at 1.2320-1.2301 100%-123.6% Fibonacci extension area of Minor A-B. Pair should then correct in Intermediate wave (X) of ((E)) and ideally fail below 1.2414 for another extension lower before a thrust higher is seen. We don’t like selling the pair.

EUR/USD Elliott Wave 1 Hour Chart