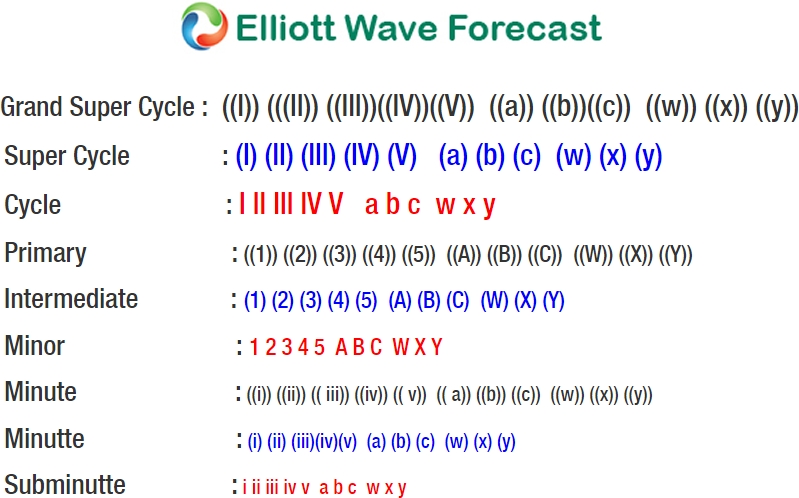

EUR/USD Short Term Elliott Wave structure suggests the decline from 9/8 peak is in progress as an expanded Flat Elliott Wave structure. From 9/8 high (1.2094), pair declined to 1.837 and ended Intermediate wave (A). Pair then bounced to 1.2034 and ended Intermediate wave (B). At present, Intermediate wave (C) remains in progress as 5 waves impulse. Minor wave 1 of (C) ended at 1.186 and Minor wave 2 of (C) ended at 1.2. Decline to 1.1716 ended Minor wave 3 of (C), and Minor wave 4 of (C) bounce ended at 1.1832.

While near term bounce stays below 1.18329, pair can extend lower in Minor wave 5 of (C) and reach as low as 1.16207. This move lower will also end cycle from 9/8 peak and complete Primary wave ((W)). Pair should then bounce in Primary wave ((X)) to correct cycle from 9/8 peak in 3, 7, or 11 swing at least. If pair breaks above 1.1832 from here, it could be in Minor wave 4 as a flat before turning lower again in Minor wave 5. As the minimum target and swing have been met, pair may have also ended Primary wave ((W)) already if it breaks above 1.1832 from here without making a new low.

EUR/USD 1 Hour Elliott Wave Chart