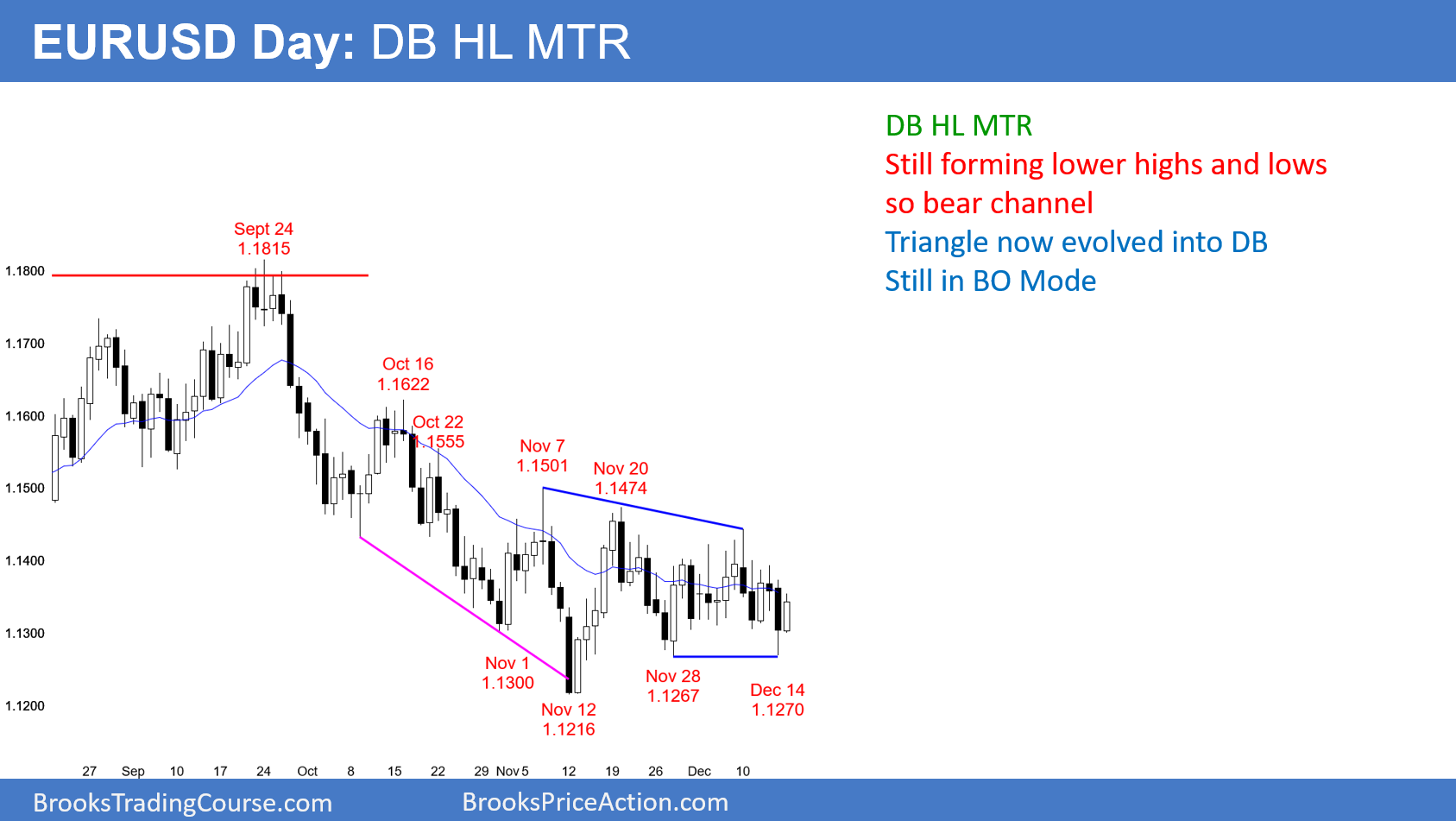

The EUR/USD daily Forex has been in a trading range for 2 months. The month-long triangle had a bull breakout and then a bear breakout. There is now a double bottom higher low major trend reversal (DB HL MTR) buy setup.

The EUR/USD daily Forex chart has been sideways for 2 months. Trading ranges resist breaking out. There is always both a bear setup and a bull setup. Most fail to lead to a breakout. Instead, the trading range keeps adding bars and forming new patterns.

The month-long triangle has evolved into a double bottom higher low major trend reversal. If today closes near the high of the day, it would be a buy signal bar for tomorrow.

A major trend reversal setup has a 40% chance of leading to a swing trade. The minimum goal is a test of the October 16 high and a 2nd leg up from the November 12 low.

But, there is a 60% chance that either the trading range or the bear channel (lower highs) will continue. Since the reward is at least twice the risk, if today closes near the day’s high, this would be a reasonable buy setup.

Overnight EUR/USD Trading

The EUR/USD rallied 50 pips overnight. Because the bulls want a good buy signal on the daily chart, they will buy 20–30 pip selloffs today. Some will hold part of their position for a test of the November 1.15 high or the October 1.16 high.

The bears want the 3-month bear channel to continue. They do not want today to become a good buy signal bar. They therefore will sell rallies and try to make today close be at least below its midpoint.

However, the overnight bull channel has been tight. As a result, the bears have not even been able to make 10-pip scalps. They need deeper pullbacks before most day traders will begin to sell.