The EUR/USD continues falling because of concerns about the global economic outlook.

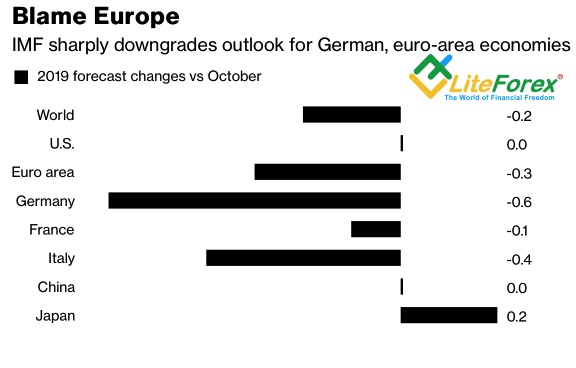

EUR/USD bears were encouraged to go ahead by the high demand for safe-haven assets amid the growing risks of global economic growth decline, as well as by the concerns about the ECB dovish rhetoric. Ahead of the World Economic Forum Annual Meeting in Davos, Switzerland, the International Monetary Fund cut down the expected global GDP growth for 2019 down to 3.5%, compared to 3.7% in October 2018. According to the authoritative organization, trade conflicts, Italy’s fiscal policy, and Brexit hold back global economic expansion. Besides, the IMF has retained the same growth forecast for the United States, which supported the U.S. dollar.

The strongest suggested decline was featured by German GDP growth rate (-0.6%, due to weak consumption and industrial production) and Italian GDP expansion (-0.4% due to high government expenditure and weak domestic demand). In general, the euro area, according to IMF, faces the most troubles among all the economic zones in the world. The GDP growth in advanced economies is likely to slow from 2.3% down to 2% in 2019 and to 1.7% in 2020. According to Christine Lagarde, the recession is not going to start soon, however, the risks of a sharper global growth decline increased.

IMF Forecast Changes

Nevertheless, there are good points in the IMF report as well. It expects the global GDP growth rate to increase up to 3.6% in 2020 and hopes that the conflicts between U.S. and China, the EU and the U.K., the EU and Italy will be successfully solved. The international organization retained the forecast for China’s economy the same, which looks rather unexpected amid a decline in Chinese economic expansion to 6.4% Y-o-Y in Q4, 2018 (the worst performance since 2009). In fact, based on an increase in industrial production and retail sales in December 2018, one may assume that the fiscal and monetary stimulus in China will have a positive effect. According to Goldman Sachs (NYSE:GS), the Chinese economy will stabilize in the second half of 2019 without mass quantitative easing and tax deductions. China’s major economic problems resulted from a decline in business investments amid trade wars and government concerns about fiscal imbalance.

Citi stresses that if trade wars and political unrest are ignored, global economies, with their strongest employment rates over the past few decades, high levels of consumption and investments, look quite strong and sound. The troubles can well be temporary and if, for example, German export starts recovering, the EUR/USD will go ahead.

After all, they first need to live through the challenge on January 24. ON this day, there will be the outcomes of the ECB meeting published; and the bad state of the euro-area economy in the second half of 2018 may get the ECB to sound dovish. Anyway, if the Governing Council retains moderate