EUR/USD has tumbled to 1.0789, marking a near three-month low as market sentiment heavily favors the US dollar. The dollar's strength is driven by expectations of a gradual and limited interest rate cut by the US Federal Reserve and solid prospects for Donald Trump's re-election, which appears increasingly likely.

Concurrently, the Euro is under pressure due to a significant rate cut by the European Central Bank. This cut has set a clear downward trend for the EUR exchange rate, offering little room for recovery. This week, Fed officials advocated caution in monetary easing, suggesting that while a 50-basis-point cut by year-end is plausible, more aggressive cuts are unlikely.

The combination of Fed caution, rising US government bond yields, and the anticipated political stability under a potential second Trump term are contributing factors to the strengthening US dollar.

Today, the focus will be on key economic indicators, including Markit's October business activity in services and industry. Additionally, data on new home sales and the weekly unemployment benefits report will be closely monitored, especially considering their importance to the Fed's assessment of the employment landscape.

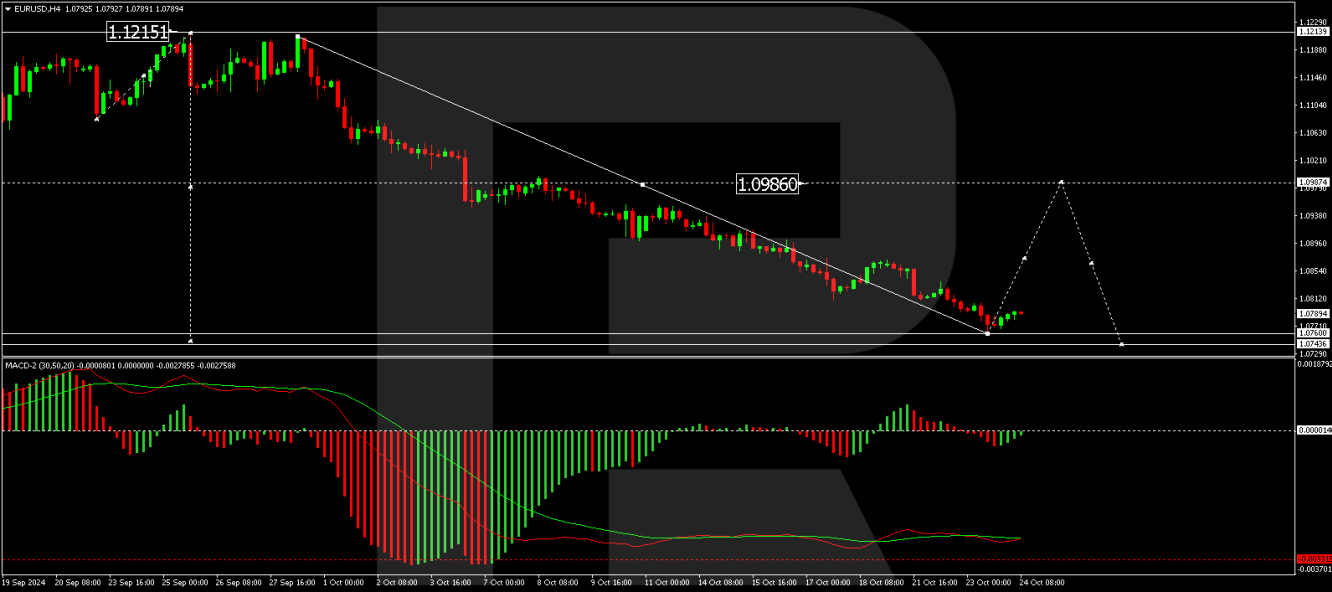

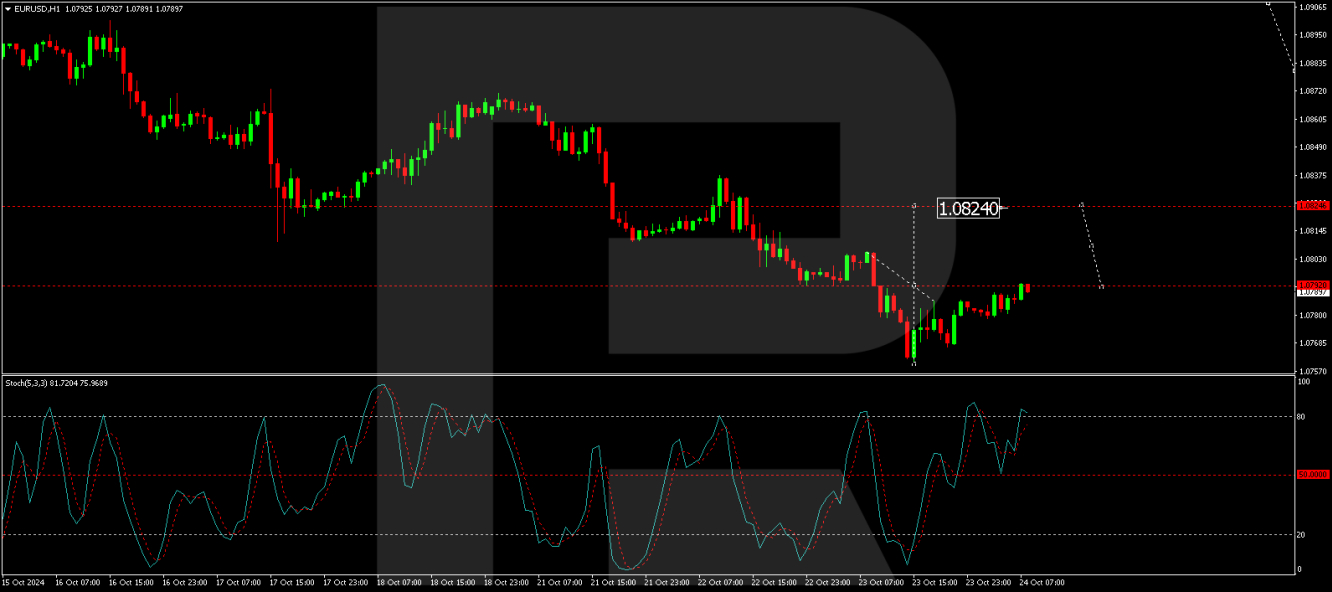

Technical analysis of EUR/USD

The EUR/USD pair has completed a downward wave to 1.0760 and is now rebounding towards 1.0880. After reaching this level, a pullback to 1.0820 is anticipated. The market may form a consolidation range at these lows, with a potential breakout upwards towards 1.0900 and possibly extending to 1.0990. The MACD indicator, currently below zero but pointing upwards, supports the possibility of a corrective rally.

On the hourly chart, EUR/USD is developing a second growth impulse towards 1.0824. Once this level is achieved, a corrective phase will be initiated, targeting 1.0790. The Stochastic oscillator, with its signal line moving towards 80 from above 50, supports this short-term bullish correction within the broader bearish context.

By RoboForex Analytical Department

Disclaimer:Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.