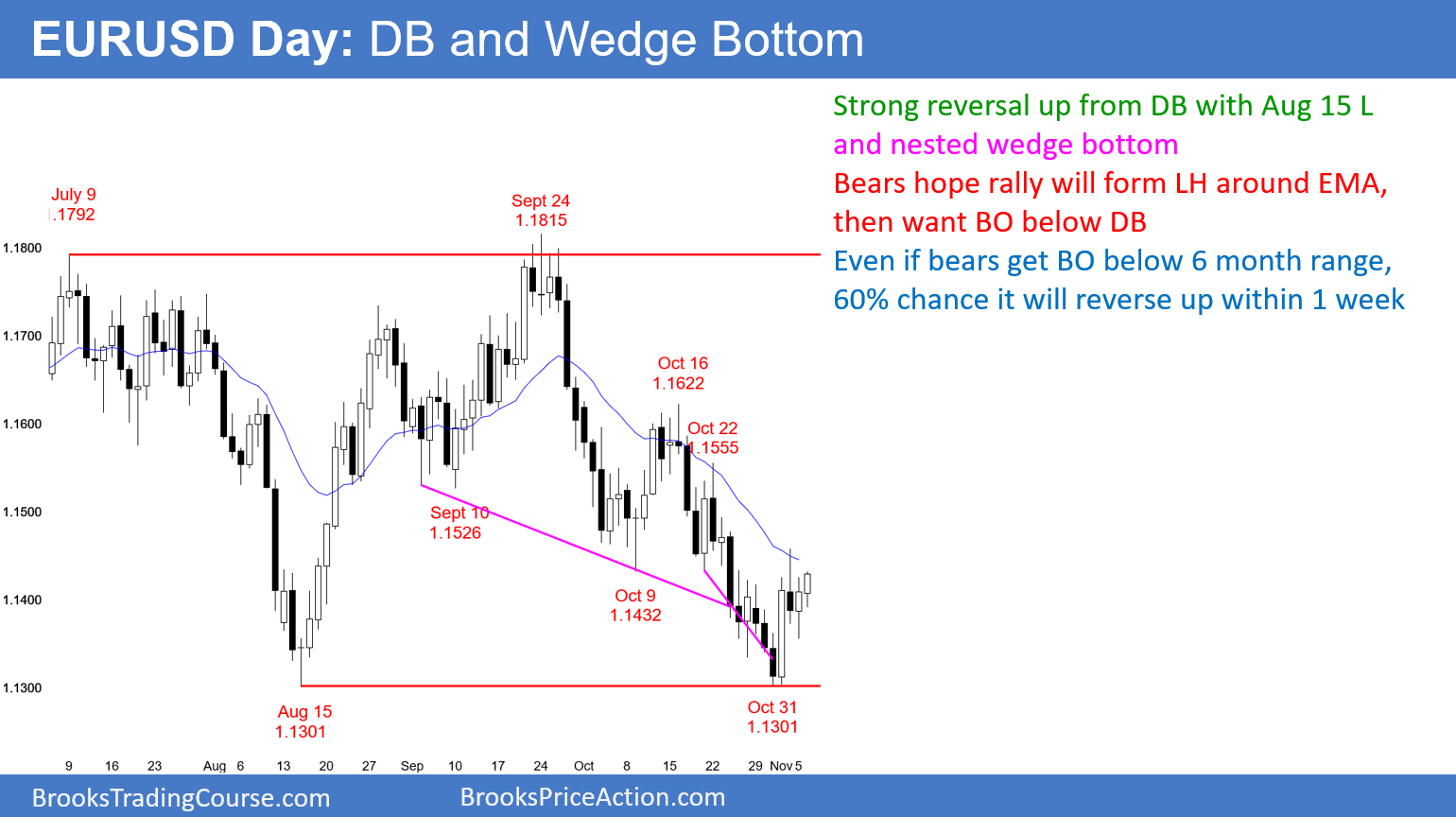

The EUR/USD daily Forex chart is reversing up from a double bottom with the August low. There is also a 3 week parabolic wedge bottom that is nested withing a 2 month wedge bottom.

The EUR/USD daily Forex chart is reversing up from a double bottom with the August 15 low. The nested wedge bottom increases the chance of a successful reversal. But, the bear channel down from the October 16 high is tight. A reversal up from a tight bear channel is typically minor. That means that it will probably turn back down within a couple of weeks.

If the bulls then get a 2nd reversal up from above the October low, they would have a major trend reversal setup. Even with that, a rally within the 6 month trading range is more likely than the start of a bull trend.

The buy signal bar of the weekly chart is only a doji. In addition, the 6 week bear channel on the weekly chart is tight. Therefore, a break above last week’s high is not a strong buy setup. As a result, the rally will probably only last a week or two. The bulls usually need a micro double bottom when a buy setup is weak. That would correspond to a double bottom on the daily chart.

Today’s election might be an important financial event. Traders will find out tonight once the polls close. Consequently, if there is going to be a big move, it will probably happen then.

Nested wedge bottom

When a market reverses up from a wedge bottom, there is usually a 2 legged rally that lasts about half as many bars as there are in the wedge. There is a small and a large wedge bottom on the daily chart. The smaller wedge lasted 3 weeks. Yesterday began a 2nd leg up. Another day or two up will satisfy the goal of two legs up from the smaller wedge.

That week-long rally might then be the 1st leg up from the bigger wedge bottom. After a test down for 3 – 5 days, the bulls would try to create another leg up, expecting it to last a couple of weeks.

Consequently, if the wedge bottoms are going to stop the October selloff, there will probably be a trading range for at least 2 more weeks. Then, the bulls will try to form a major trend reversal. The bears will try to create a big bear flag.

Overnight EUR/USD Forex trading

The EUR/USD 5 minute Forex chart has rallied 40 pips overnight. The bulls want to trigger the buy signal on the weekly chart by trading above last week’s high. That is 30 pips above today’s current high.

Traders want to see if the bottom is in on the weekly chart, or if there will be more seller’s than buyers above last week’s high. The bear case is more likely because the weekly and daily buy setups are weak. The bulls will probably need a test of last week’s low before they can begin a swing up.

The momentum up on the 5 minute chart is not especially strong. Therefore, the rally might not get above last week’s high in today’s session. Furthermore, the rally is in the 3rd leg up in an expanding triangle that began in Europe. Consequently, a reversal down today or tonight could easily fall below today’s low.

Since the rally is in a tight bull channel and last week’s high is a little higher, the odds favor sideways to up today. The bulls will buy the first 30 pip reversal down. As a result, the best the bears can get today is a bear leg in a trading range.