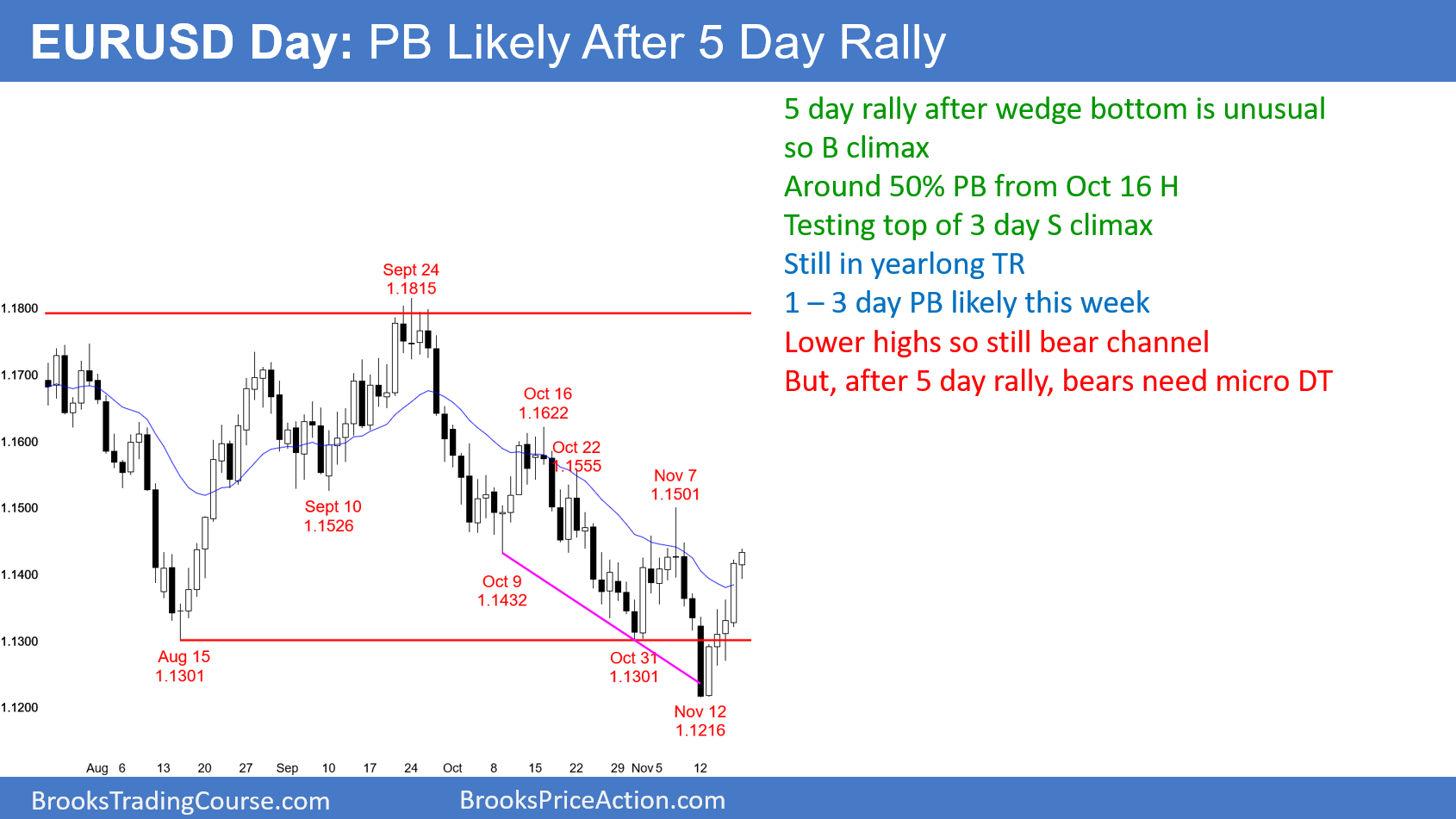

Today so far is the 5th consecutive bull trend day in a bull trend reversal up from a wedge bottom. However, it is still below the November 7 lower high and therefore in a bear channel.

Over the past year, every 5 – 6 day trend up or down pulled back for 1 – 3 days. Therefore, the current 5 day rally will probably pull back this week. However, even though it is a small buy climax, it is also a sign of strong bulls. Consequently, the bulls will buy the 1st 1 – 3 day pullback.

The bulls need to get above the November 7 lower high to make traders believe that the bear trend has ended. If the EUR/USD then sells off again, they will need a higher low at around the October 31 low for a major trend reversal buy setup. At that point, the bear trend would have evolved into a trading range.

The bulls need a strong break above the October 16 major lower high before traders will begin to believe that the rally will continue up to the February high. Even if that will happen, the 2 month bear trend will probably convert into a trading range for many months first. The bulls have to stop the bears before they can begin a bull trend. A bear trend typically has to transition into a trading range before it will evolve into a bull trend. That is what is likely over the next several months.

Weekly buy signal

I said on Friday and wrote over the weekend that last week was a big bull trend reversal bar on the weekly chart. The weekly chart has a wedge bull flag. However, I mentioned 2 problems. First, the selloff from the September 24 high is in a tight bear channel. Typically, the 1st leg up will have a pullback within the 1st few bars. Therefore, there will probably be sellers around the November 7 lower high on the daily chart. That is also around the 20 week EMA.

The 2nd problem with last week’s buy signal bar is that it is too big. A big buy signal bar means the stop is far below and the risk is therefore big. Many bulls will not take the buy signal. Instead, they will wait to buy a pullback that would allow them to use a tighter stop. This lack of bulls willing to buy around last week’s high makes a pullback likely this week.

Overnight EUR/USD Forex trading

The EUR/USD 5 minute Forex chart rallied 45 pips overnight. However, the bars were small, had prominent tails, and mostly overlapped one another. This is a weak rally and it will therefore probably lead to a trading range today. This is particularly true after an unusually protracted 5 day rally.