Investing.com’s stocks of the week

The EUR/USD exchange rate stabilized near the middle of figure 13 amid the weak macroeconomic statistics for the USA and the euro area and uncertainty around the U.S.-China trade talks. Investors prefer to stay aside, expecting the report on the euro-area PMI and the outcomes of the ECB Governing Council meeting. Besides, a close end of European QE and easing of political risks in Italy results in higher foreign demand for the European bonds.

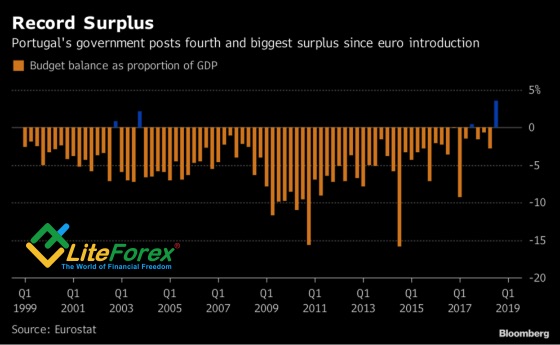

Spain received a record amount of applications to purchase € 47 billion 10-year Spanish government bonds, while the announced amount of issuance is €10 billion. Earlier, at the auctions on Italian bonds placement, demand exceeded the issued amount by 3.6 times, the demand for the Belgian debt exceeds the offer by 4.7 times, the Irish - by 4.5, the Portuguese - by 6 times. Positive changes in the economies of the euro-area peripheral countries amid their improved financial discipline limit the potentially issued amount of bonds and increase the demand for them. For example, Portugal managed to achieve a record budget surplus since the euro appeared. At the same time, investors are appealed by the factor of eased political risk, which is reflected in a narrower spread of the bond yields of Spain, Italy and other countries to their German peers.

Dynamics of changes in Portugal budget

Spanish bond yield spread to Germany

Source: Bloomberg

High demand for European bonds is an important driver for the EUR/USD growth; however, the euro bulls need improved macroeconomic statistics and signal of the ECB monetary normalization to go on a counter attack. There yet no such factors, unfortunately. Despite an improvement in German economic sentiment, reported by ZEW, investors’ assessment of the current German economy’s state has been down to its four-year low. The euro supporters are seriously concerned about the ECB’s more dovish rhetoric at the meeting on January 24, and about the signals that QE could be resumed due to a strong decline in the GDP growth rate in the second half of 2018.

Markets are also not satisfied with the outcomes of the U.S.-China trade talks. Although the U.S. president's top economic adviser Larry Kudlow says the scope of U.S.-China trade talks with is broader and deeper than ever before but a final outcome would ultimately depend on verification of Chinese commitments. According to the official, although Donald Trump is willing to strike a deal, he will stand his ground. The key event of the negotiations should be the meeting of China’s Vice Premier Liu He with U.S. Trade Representative Robert Lighthizer scheduled from Jan. 30 to 31.

Even if the EUR/USD had been closed in the red zone during five out of six previous trading days, the euro bears can’t associate their success with the strength of the U.S. economy. On the contrary, the U.S. housing market is still challenged: home sales dropped sharply down to the lowest over three years, and the home prices growth has sharply slowed down. The EUR/USD rate is likely to continue consolidating in the range of 113-1145 ahead the ECB meeting.