- The US dollar is on the retreat again, and one of the dollar-bearish catalysts is political.

- Ahead of the DNC, Kamala Harris is leading in the polls and recently outlined a potentially inflationary / deficit-driven economic agenda.

- EUR/USD saw a potentially significant breakout from a long-term consolidation pattern last week – read to see where it may head next!

Despite a barren economic calendar, the US dollar is on the retreat again to start this week. Some analysts have chalked the move up to concerns about future economic growth, and that’s certainly a possibility, but one other explanation is political in nature.

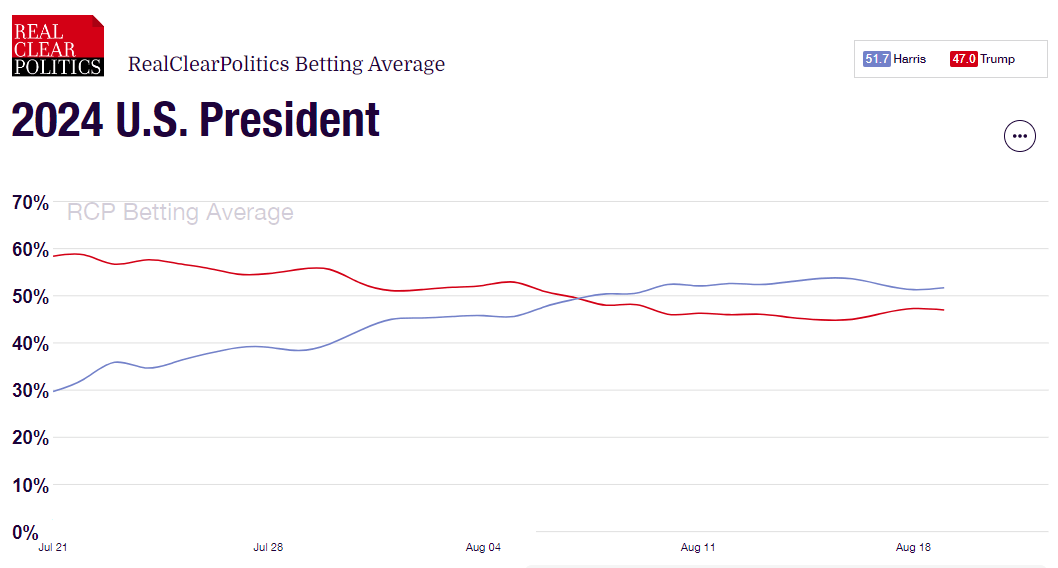

As the Democratic National Convention kicks off in Chicago this week, Democratic Presidential Candidate Kamala Harris has been enjoying a bit of a “honeymoon period” in the polls. As the RCP polling average below shows, Harris has erased a ~20 point deficit against Republican Donald Trump since President Joe Biden dropped out of the race in late July and now enjoys a 4+ point lead according to the recent polls:

Source: RealClearPolitics

Last week, Harris outlined her “populist” economic agenda, including the elimination of medical debt for millions of Americans, a ban on price gouging for groceries and food, a cap on prescription drug costs, a $25,000 subsidy for first-time homebuyers, and an expansion to the Child Tax Credit. Many observers have labeled these priorities as likely inflationary and could keep the US running historically elevated deficits if Harris is elected and implemented in full.

Even in a compressed Presidential election cycle, there will inevitably be many more twists and turns to navigate for both political aficionados and traders, but on the eve of the DNC, readers should certainly be keeping at least a loose eye on Kamala Harris’ lead in the polls and her bold economic agenda when trading the US dollar.

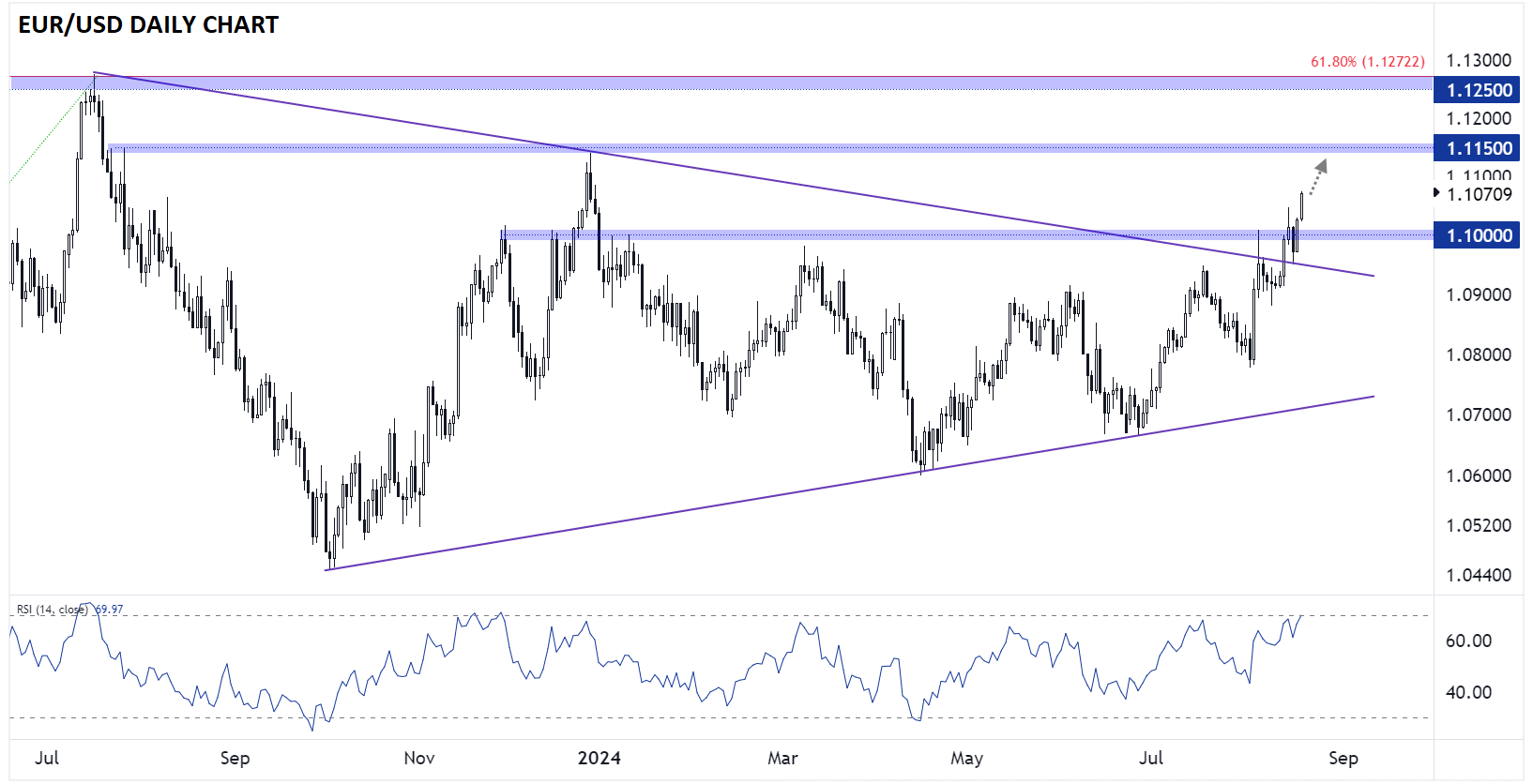

Euro Technical Analysis – EUR/USD Daily Chart

Source: TradingView, StoneX

Looking at the chart, EUR/USD saw a potentially significant breakout from a long-term consolidation pattern last week. After putting in lower highs and higher lows for more than a year, the world’s most widely-traded currency pair broke out of its broad symmetrical triangle pattern and cleared psychological resistance at 1.10 last week.

After such a long consolidation period, the bullish breakout could absolutely have further to run from here. To the topside, the next resistance level to watch is at 1.1150 (the July and December 2023 highs) and the upper-1.1200s (the 2.5-year highs set last July). Only a break back below 1.10 would call the near-term bullish bias into question.