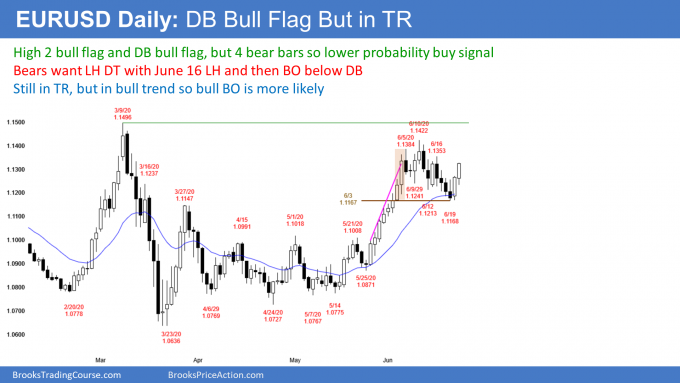

On the daily charts, the EUR/USD is reversing up from a double bottom with the June 3 buy-climax low. I have been saying that it would pull back there for the past 2 weeks.

The bulls hope the two-day rally will lead to a breakout above the three-week trading range. A measured move up would create a breakout above the March high.

If the bulls get a couple closes above that high, traders will conclude that the two-year bear trend is over. They would see the weekly and monthly charts as then being in a trading range and possibly an early bull trend.

The bears will try to get a reversal down from the the June 16 high. That would be a double top bear flag in what they hope is the start of a bear trend. At a minimum, they want a break below the June 3/June 19 double bottom and then a measured move down to the May 1 high.

The three-week late May rally was exceptionally strong, as was the March rally. Even though the EUR/USD is still in a three-week trading range, the probability still favors an upside breakout.

Traders will find out if the breakout is beginning this week, or if there will be a test of the May 1 high first. If today and tomorrow are bull days, closing on their highs, and if tomorrow closes above the June 16 high, the bulls will probably get their break above those June levels within a week or so.

5-Minute Trading

There is a small pullback bull trend forming on the five-minute chart. Day traders have only been buying. Because the pullbacks have been small, the bears have been unable to make money. That is a sign of a strong bull trend.

The day’s range is roughly the same size as that seen in recent trading, meaning there might not be much left to today’s rally.

The bulls want it to continue up to above the June 16 lower high. That is about 20 pips above the overnight high.

But this rally has had 3 legs up, which is a wedge rally. That is a type of buy climax and it typically attracts profit taking.

If the bulls begin to take profits, the pullbacks will no longer be small. The bull trend will evolve into a trading range.

The bears will start to sell rallies after they see a 30 pip pullback. However, unless there is a 40 – 50 pip selloff, many day traders will continue to only look to buy.